Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

There is no shortage of opinions regarding economic data and forecasting. The sensational point of view captures audiences, so it is likely that we will continue to read extreme opinions and hear about dramatic possibilities. Although the story sells better if it is different this time, several key indicators are pointing to a repeated economic pattern. The past is not a guarantee of how the future will play out but understanding historic events and consequences may offer a fair clue as to what we might expect.

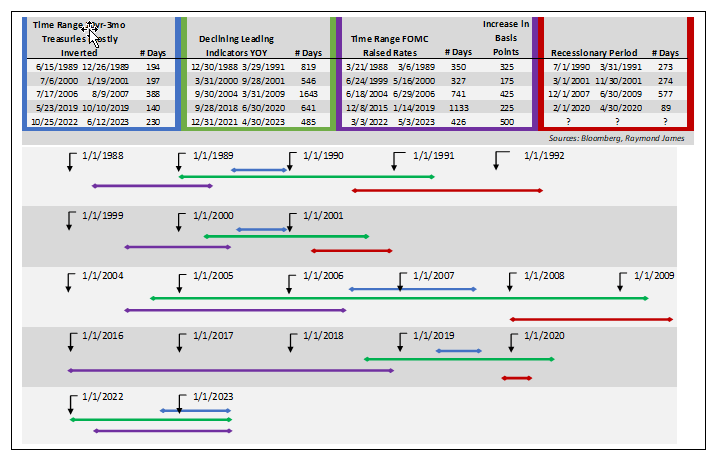

Three indicators have unfolded in a similar fashion in previous recessionary periods. Regardless of whether we fall into a recession or not, even a slowdown in economic activity is likely to bring interest rates down. This is important in recognizing how long rates may stay elevated and how long investors can take advantage of these rates by locking into desirable income.

The following data is put into a timeline to give some perspective on the length of time and occurrence of events during each economic cycle. The data takeaways are highlighted on the next page.

- Each recession was preceded by an inverted curve (3mo T-Bill rate higher versus 10yr Treasury rate).

- The longest inversion happened prior to the deepest recession.

- We are currently in the 2nd longest inversion period over the last 30 years.

- Leading economic indicators (LEI) are economic variables that tend to move before changes occur in the overall economy. In each of the last four cycles, LEIs were well into decline before the recession hit and continued to decline through at least the start of a recession.

- Current LEIs have been in decline for more than a year.

- The Federal Open Market Committee (FOMC) tightened rates preceding each recession.

- The FOMC has raised (tightened) Fed Funds a very divisive 500 basis points in a very short period of time. The current debate is determining whether they are done raising rates or not.

None of this suggests that the future is predictable but it is intended to show how data has typically played out in the past. It is up to you to decide whether it is different this time. If the data holds this pattern, the current elevated interest rate environment will likely remain only until the Fed is done tightening and the yield curve starts to normalize. We can say with certainty that locking into today’s yields provides some of the best income opportunities seen in over a decade.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...