Chief Economist Scott Brown discusses current economic conditions.

The CPI rose more than expected in April, adding to inflation worries. The University of Michigan’s Consumer Sentiment index dipped in the mid-March reading, reflecting growing concerns about inflation and potential rate hikes. Yet, Fed officials, while acknowledging risks, have remained calm.

The Consumer Price Index rose 0.8% (+4.2% y/y) in April. The index for used motor vehicles jumped 10.0% (+21.0% y/y), accounting for more than a third of the increase. Motor vehicle production ground to a halt a year ago and sales to rental car agencies dried up during the pandemic. As a consequence, retail agencies had fewer vehicles to sell into the used car market this spring. The semiconductor shortage has crimped auto production recently, although the price index for new vehicles has risen only moderately (+0.5% in April, +2.0% y/y). The important point is that used vehicle prices are not going to rise sharply month after month.

The increase in year-over-year inflation reflected two other factors. Inflation figures were very low a year ago (the CPI rose 0.3% y/y in April 2020). Such “base effects” will last a little longer (the CPI rose 0.1% y/y in May 2020 and +0.6% y/y in June 2020), but they will fade in the months ahead. The other factor is restart inflation pressures as the economy recovers.

Supply chains take a while to get going in every recovery. However, given the nature of the pandemic and the expected speed of the economic rebound, these pressures will be more pronounced than typical. However, supply chain issues will work themselves out over time. February’s bad weather disrupted supply chains, but we’ve already seen a recovery from that. Freight costs have risen, but should stabilize and begin to moderate.

Labor issues will be a factor in the near term. There were going to be frictional challenges in matching millions of unemployed workers to available jobs. A lot of that is informational. Unemployed workers may not know where the jobs are and firms may not know where to find workers – and there may be regional issues (too many unemployed here, too many job vacancies there).

Some have cited aid to the unemployed as a deterrent to taking a job, which makes sense. Why work if you are getting more by staying unemployed? However, most want a permanent job that pays well. Extended unemployment benefits allow workers a longer time to search for a good job. If you want workers, you can pay them more. Several states have begun to reign in extended unemployment benefits. At the federal level, extended unemployment benefits are set to end on Labor Day, just as schools and daycare centers re-open, leading to an increase in (mostly) female labor force participation.

Fed Governor Lael Brainard gave a good summary of the central bank’s views. “There are a variety of reasons to expect an increase in inflation associated with reopening that is largely transitory,”, she noted, highlighting supply-chain bottlenecks, shipping delays, and container shortages. “If past experience is any guide, production will rise to meet the level of goods demand before too long,” she added. Supply–demand imbalances in the in-person services sector “are expected to be resolved within a few quarters with progress on virus control and the return of in-person schooling.” She emphasized that “a persistent material increase in inflation would require not just that wages or prices increase for a period after reopening, but also a broad expectation that they will continue to increase at a persistently higher pace.”

Consumer expectations of inflation are on the rise. In the University of Michigan’s consumer sentiment survey through mid-May, the expected inflation rate for the next year rose to 4.6% (from 3.4% in April), while the expected rate for the next five years rose to 3.1% (from 2.7%). Two-thirds of those surveyed expect the Fed to raise short-term interest rates within a year. Inflation compensation, or breakeven inflation (the TIPS spread) has moved up. However, consumer inflation expectations are fickle, the last time inflation expectations were this high was in 2007. How’d that turn out? The key is whether the increase will be sustained. Similarly, inflation compensation is not the same as inflation expectations (as there in an inflation-uncertainty premium in TIPS).

Brainard indicated that increased household savings will be depleted over time and fiscal policy will turn to a headwind in the months ahead. Even if inflation expectations become unanchored, “we have the tools and the experience to gently guide inflation back to our target – no one should doubt our commitment to do so.” Fed Governor Waller said that “the takeaway is that we need to see several more months of data before we get a clear picture of whether we have made substantial progress towards our dual mandate goals – now is the time we need to be patient, steely-eyed central bankers, and not be head-faked by temporary data surprises.”

Recent Economic Data

The Consumer Price Index rose 0.8% in April (+4.2% y/y), up 0.9% ex-food and energy (+3.0% y/y). The index for used motor vehicles rose 10.0% accounting for more than a third of the April increase. Ex-food, energy, and used cars, the CPI rose 0.7% (+2.0% y/y, vs. -0.8% y/y in April 2020).

The Producer Price Index rose 0.6% in April (+6.2% y/y), up 0.7% ex-food, energy, and trade services (+4.6% y/y).

The Import Price Index rose 0.7% in April (+10.;6% y/y), but with an ongoing sharp split between industrial supplies and materials (up 50.7% y/y) and moderate gains in finished goods (consumer goods +0.8% y/y).

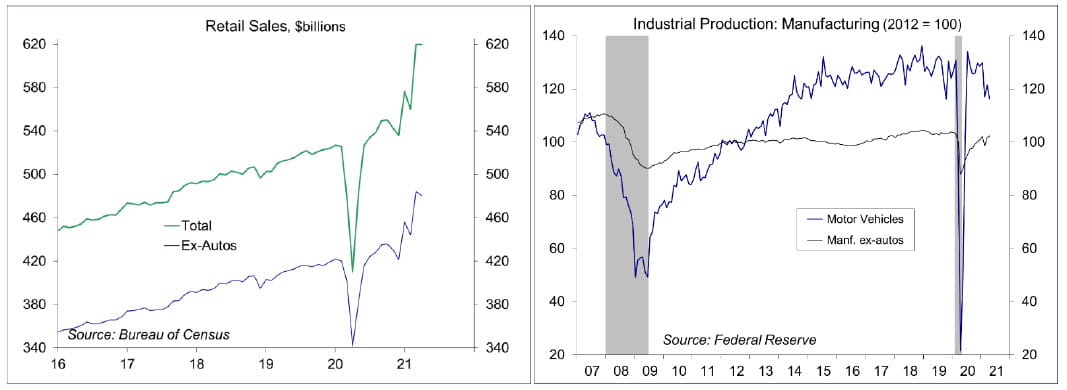

Retail sales were essentially unchanged in April (+51.2% y/y), which isn’t bad following the 10.7% surge in March (revised from +9.7%). Ex-autos, sales fell 0.8% (+40.6% y/y). Ex-autos, gasoline, and building materials, sales fell 0.8% (+38.1% y/y), with sales at restaurants and bars up 3.0% (vs. +13.5% in March, up 116.8% y/y).

Industrial production rose 0.7% in April (+16.5% y/y), with manufacturing output up 0.4% (+23.3% y/y). Motor vehicle production fell 4.3% (+439.7% y/y, not a typo, production had ground to a halt a year ago), restrained by the semiconductor shortage.

The Job Opening and Labor Turnover Survey data for March showed job openings rising to a record 8.12 million in March (7.29 million for the private sector). Hiring and quit rates were relatively high.

Gauging the Recovery

The New York Fed’s Weekly Economic Index edged down to +11.45% for the week ending May 8, down from

+11.98% a week earlier (revised from +12.23%), signifying strength relative to the weak data of a year ago. The WEI is scaled to year-over-year GDP growth (GDP was down 9.0% y/y in 2Q20).

Breakeven inflation (the spread between inflation-adjusted and fixed-rate Treasuries, not quite the same as inflation expectations) continues to suggest a moderately higher inflation outlook for the next five years. The 5-10-year outlook has crept further above the Fed’s long-term goal of 2% (worth keeping an eye on).

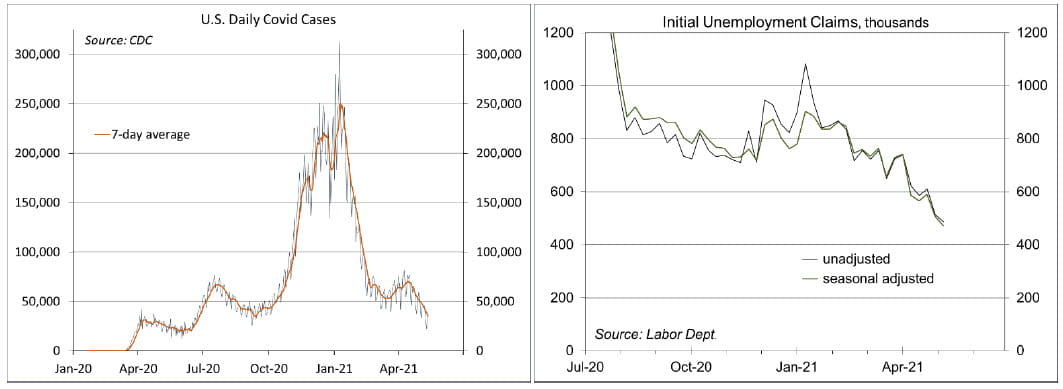

Not enough people are getting vaccinated, making it unlikely that the U.S. will reach herd immunity, but the number of new cases is trending lower and restrictions are easing.

Jobless claims fell by 92,000, to 498,000 (a pandemic low), in the week ending May 1. Claims are trending lower, but are still much higher than pre-pandemic levels (a little over 200,000).

The University of Michigan’s Consumer Sentiment Index fell to 82.8 in the mid-month assessment for May (the survey covered April 28 to May 12), vs. 88.3 in April and 84.9 in March. The increase reflected growing concerns about inflation. The expected inflation rate for the next year rose to 4.6% (from 3.4% in April), while the expected rate for the next five years rose to 3.1% (from 2.7%). Two-thirds of those surveyed expect the Fed to raise short-term interest rates within a year.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...