Drew O’neil discusses fixed income market conditions and offers insight for bond investors.

June Consumer Price Index (CPI) data was released last week and came in at 9.1% year-over-year. This was the first +9% print since 1981 and exceeded the consensus forecast of 8.8%. Needless to say, inflation fears, expectations, and projections are major driving forces in the market. Yet, even though the market is fixated on inflation and analyzing every detail that comes with it, the 9.1% level of inflation is not driving yields to 1981 levels (the 10-year Treasury was well north of 10% the last time we saw inflation like this). Yes, Treasury yields are higher relative to the past few years, but definitely not high by historical measures. Why not? As always is the case, there is no single determining factor, but the forward looking nature of the markets appears to be a large driver.

Market participants are generally not solely looking at the current state of the economy, they are looking into what they think the future is going to look like and positioning accordingly. When it comes to inflation and its effect on interest rates, the forward-looking view of the market can be as influential as the current inflation levels. With this in mind, it is not likely that inflation is going to push yields significantly higher unless/until forward looking inflation expectations move higher (not just a little higher, but significantly higher, i.e. early 1980s interest rate levels). Even if inflation continues to run at 9%, if the market continually thinks that inflation is going to fall back to 2-3% in the next few years, intermediate and longer-term yields might reflect the 2-3% expectation and likely not the 9% current levels.

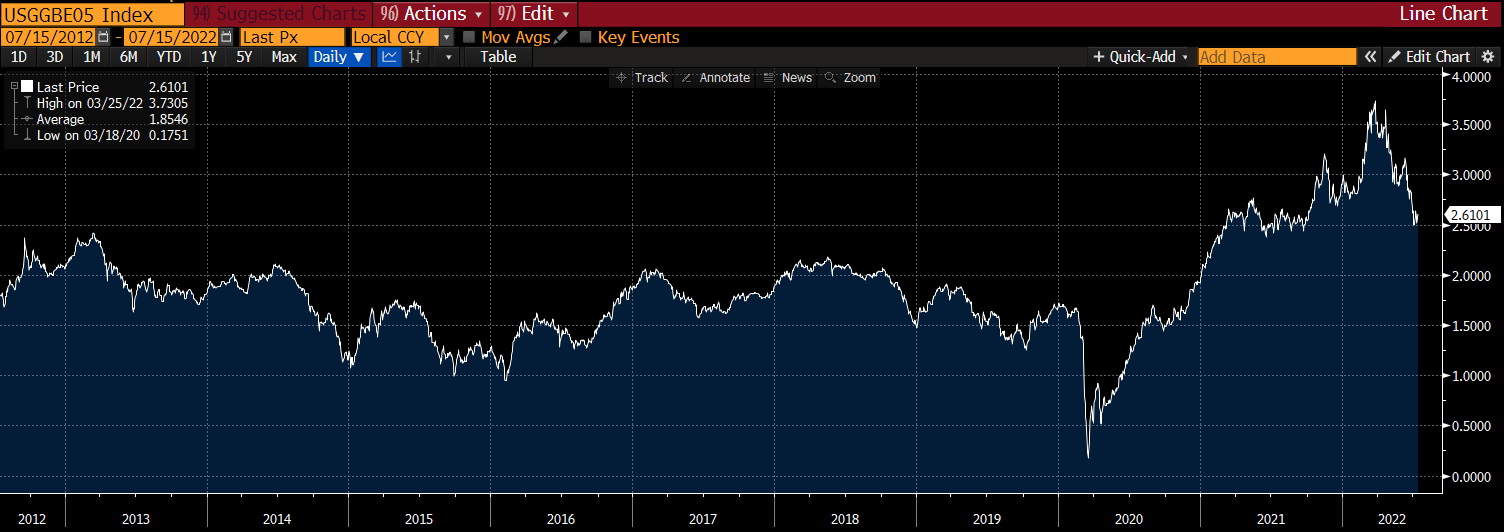

A good gauge for market expectations of what inflation is going to be is the breakeven inflation rate, which is the difference between inflation protected Treasuries (TIPS) and nominal Treasury yields for a given maturity. The graph below shows the 5-year breakeven yield going back 10 years. The current level is ~2.61%, which means that the market is expecting inflation to average 2.61% over the next 5 years. Yes, this is higher than it has been for much of the past 10 years, but it is clear that the market doesn’t expect 9% inflation to be a perpetual problem. Also note that it has come down rather sharply since peaking in late March at 3.73%.

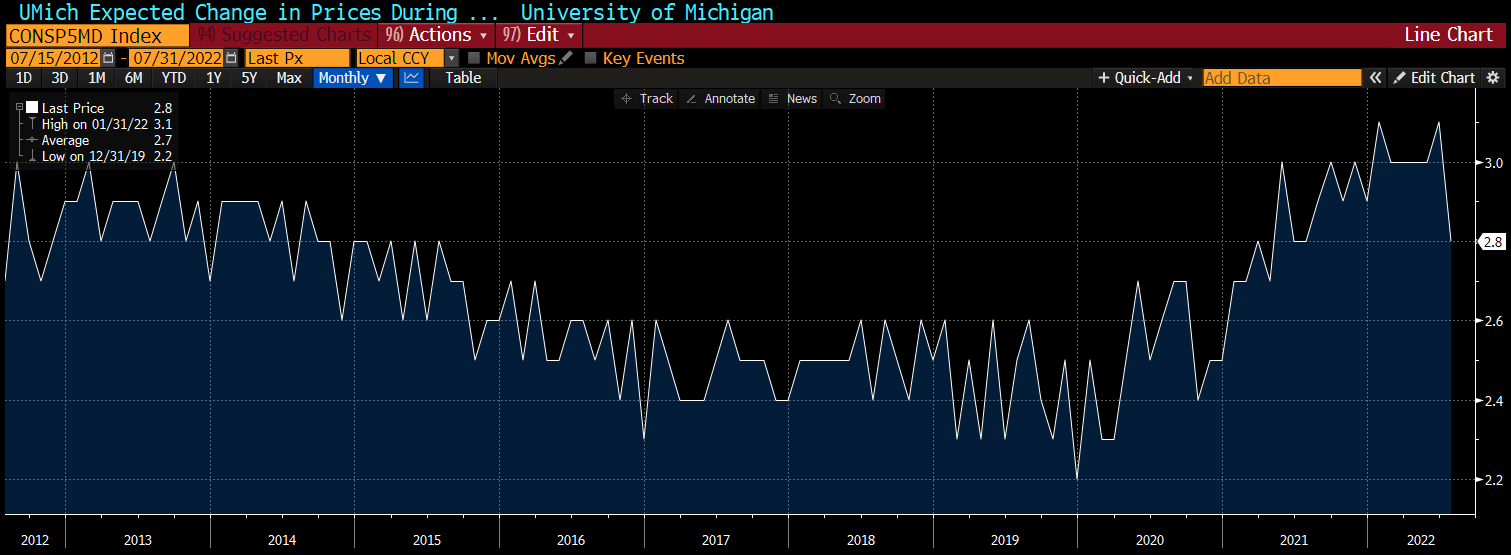

Another good indicator of future inflation expectations comes from the University of Michigan Surveys Of Consumers, which was released on Friday. One of the data points in the survey asks consumers what their expectations are for inflation over the next 5 to 10 years. Their response came in at 2.8%, which is its lowest point since last June and only slightly higher than its average over the past 10 years (2.7%). This is another data point that might explain why the 10-year Treasury is not at 9%… longer term expectations for inflation are only slightly elevated.

All of this is not to say that inflation isn’t going to remain elevated and interest rates aren’t heading higher, but rather this commentary is trying to shine some light on the disconnect that might appear to be taking place with the inflation versus interest rate market. Forward looking estimates and positioning based on a longer term thesis are what drives markets. Bear in mind that the market’s view of the future can and does sometimes change dramatically and quickly. So, if these outlooks do change, and suddenly breakeven rates and/or consumer outlook shifts into thinking that inflation is going to remain at current levels, not for months or quarters, but for years and years, expect interest rate markets to react accordingly. For now, intermediate and long term expectations for inflation remain slightly elevated and that has pushed interest rates higher and created a great buying opportunity for many investors with money to put to work in fixed income. Will rates move higher? Maybe. They also might move lower. Remember: TIME IN THE MARKET > TIMING THE MARKET.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...