Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

As investors, we are programmed to think total return, even if we don’t recognize that we’re thinking like this. Total return includes interest/dividends as well as capital gains (price appreciation) realized over the holding period of an investment. It can seem uncomplicated with a stock – buy low and sell high. The capital gain often represents the majority of the stock’s growth, gain or total return. It actually is less complicated with individual bonds mostly because many investors don’t buy them with expectations of huge price gains or losses. Many times, individual bonds are held in a portfolio because when held to maturity (barring default), a bond’s income and cash flow are known and they don’t fluctuate even if the market is volatile or inflation is escalating or consumers are active or the Fed is shifting policy. The first day of ownership is identical to the last day of ownership as the cash flow and income earned is a constant (fixed) throughout. Individual bond holders also know the exact time when their bond’s face value will be returned to them – again regardless of all outside influences.

Is there anything that can spoil this uncertainty? Yes, two events. One is that the bond defaults. This is an unlikely event when purchasing high quality investment grade bonds. According to Moody’s, the average one year default rate of a Baa-rated corporate bond is 0.0015 (0.15%) and 0.00% for a Aa-rated municipal bond. The other event that can change known results for individual bonds is selling them before their maturity date. At this point, the market value, which could be higher or lower than the purchase price, would affect the bond’s return.

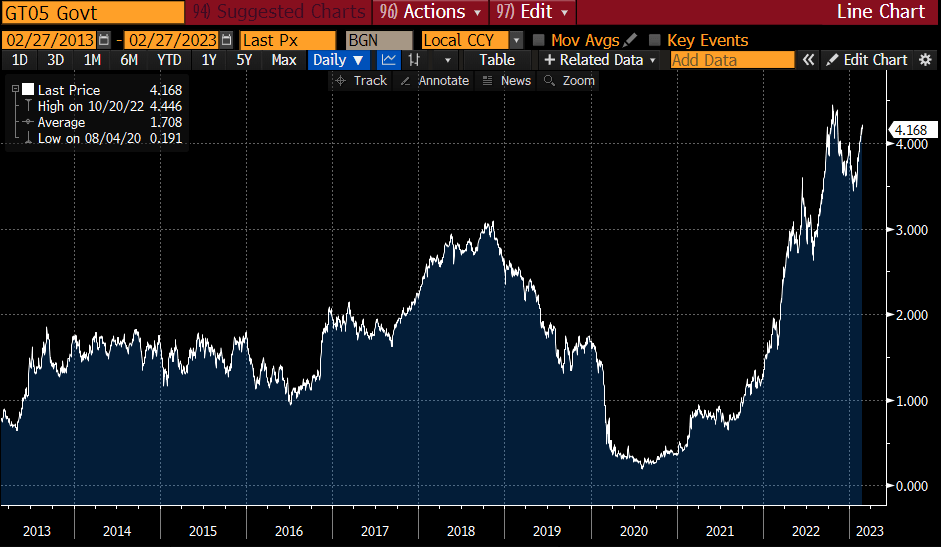

Five year Treasury yields are shown in the graph for the last ten years. It is clear that yields are elevated from the 1.71% average (last 4.17%). The bond market is providing investors with an opportunity to lock into these higher yields. Still higher yields exist among CDs, agencies, corporate bonds and municipal bonds. These yields can compete with those achieved historically by riskier growth assets over long periods of time.

The known individual bond characteristics provide balance for investors and a way to protect principal, especially significant during times of turmoil when growth assets such as stocks and home values are met with volatile markets. The protective qualities alone deliver individual bond value so when yields are high (as depicted in the graph), investors benefit from delivered higher income. Fixed income allocation is long term and therefore trying to time market entry can prove to be very difficult. Yields (income) are currently relatively high versus the low yield environment experienced for years. Lock into these yields for as long as your risk profile and goals allow. Short term investments will mandate reinvestment in a short period when rates may be higher or lower. Lock in to yield levels for longer and eliminate this reinvestment risk. You will know (fix) your cash flow and income levels for years to come.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...