Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

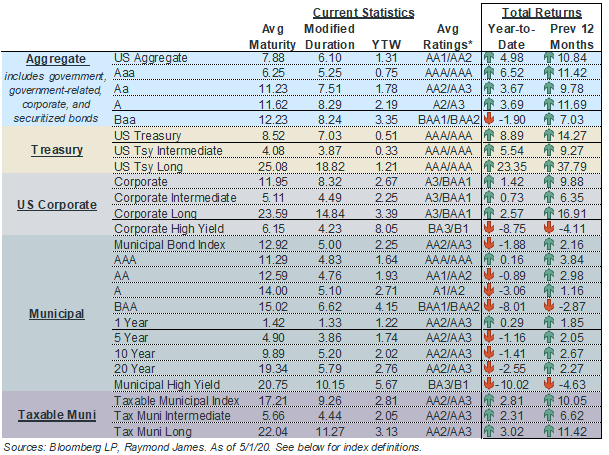

We are now one-third of the way through 2020. The first four months of the year has been one of the most volatile periods that the financial markets have ever seen. It is easy to get caught up in the day-to-day fluctuations of the market, so this week we take a step back and look at the ground we have covered year-to-date across the fixed income landscape. Note the wide variance in returns among the different products. This is a good reminder that while Treasury yields and returns get most of the headlines, they are not necessarily a good representation for how actual fixed income allocations are performing, as many investors do not hold their fixed income allocation in US Treasuries.

Aggregate

A majority of the US Aggregate index is made up of extremely high quality bonds, as evidenced by the average rating in the high AA range. The flight to quality so far in 2020 has driven prices higher/yields lower for these high-quality bonds (think Treasuries, agencies, and agency-backed securitized bonds). Higher prices mean positive total returns, as the overall Aggregate index is up ~5% year-to-date. It is interesting to note the differences as you look at the various ratings categories that make up the index. The risk-off trade is clearly portrayed when you look at the difference between returns for the AAA category (+6.5%) and the Baa category (-1.9%).

Treasury

A combination of the risk-off trade and the extraordinary measures that the Federal Reserve has taken so far this year have driven Treasury yields to historically low levels. Falling yields mean rising prices, so the sharp move lower in Treasury yields has led to strong total returns. For investors in Treasuries, duration has been your friend, as the long-dated Treasury index has returned over 23% year-to-date.

US Corporate

Investment-grade corporates have experienced the risk-off trade. Demand has increased in high quality (A-rated) corporates, in part due to risk-averse investors shying away from lower quality Baa credits. This has led to positive total returns in higher quality corporates and slightly negative total returns in lower quality corporates, which balances out to the positive returns for the overall corporate index (Bloomberg does not break out corporate indexes by rating category). Widening spreads have worked in conjunction with sharply lower Treasury rates muting net total returns. As would be expected in times of economic crisis, high-yield bonds have been under stress resulting in considerably higher yields and lower prices, netting a negative return of 8.75% so far this year.

Municipal

Municipal bonds had an extremely volatile month of March, but in comparing yields today to the start of the year, we see they haven’t moved all that much. The 5, 10, 20, and 30 year benchmark AAA yields are all within 15 basis points of Jan 1st levels. Looking at the breakdowns by rating, it is clear that municipals are not moving uniformly. The current economic situation is having a dramatic effect on some credits and sectors while affecting others very little. In addition to this, there has been a strong flight to quality and out of riskier credits in the municipal space just like in other fixed income sectors. The divergence between ultra-high-quality and lower investment grade bonds is evident in the numbers, as returns for AAA rated municipals are roughly flat for the year, while the Baa category is down 8%. Below-investment-grade credits have fared slightly worse, losing 10% so far this year.

Taxable Municipals

As a generally highly rated asset class (average rating of the index is mid-AA), taxable municipals have benefitted from investors seeking high-quality investments where a tax-exempt product might not make sense either due to the type of account or tax situation of the investor. This has driven prices higher for the year leading to positive total returns.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...