Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

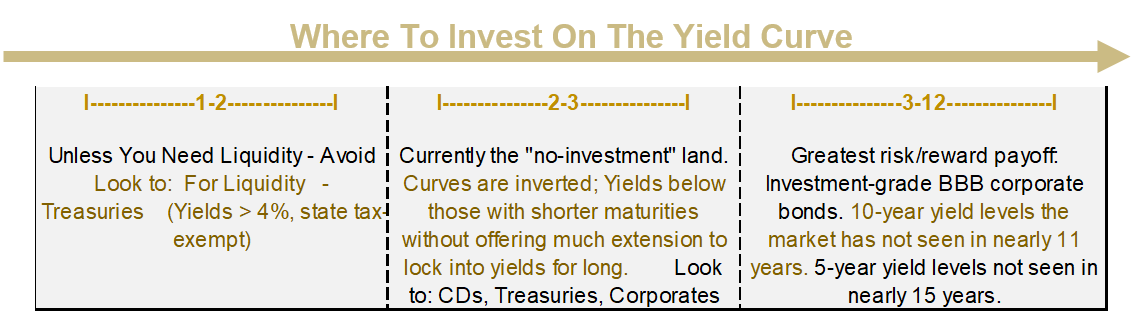

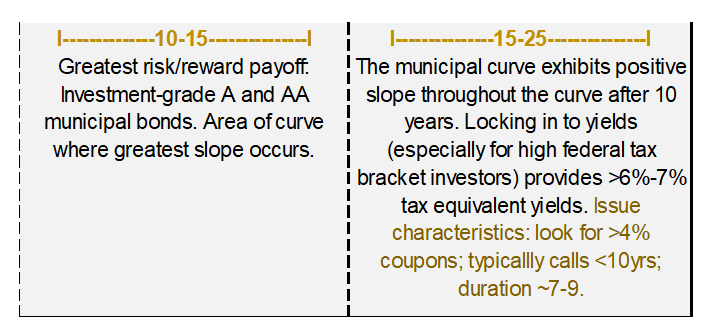

Not all curves look the same. Let’s compare several fixed income yield curves and the time ranges that may provide value. We often hear investors talk

about “timing” the market, waiting for a Fed move or hovering in anticipation of some event they “know” will happen. Fixed income allocation

involves long term planning for many investors. Buy and hold practice means that interim price movement, geopolitical events, central bank action or political

tremblings have little or no effect on a fixed income holding’s income, cash flow or time when the face value is returned to the investor. This is why

bonds can meet the primary purpose of protecting principal. Right now, there’s more. That’s right. In addition to helping preserve capital, fixed income

is providing income levels not seen in well over a decade. This timeline and graph demonstrate where value exists on the curve. Seize the fixed income opportunity

while it still exists!

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...