Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

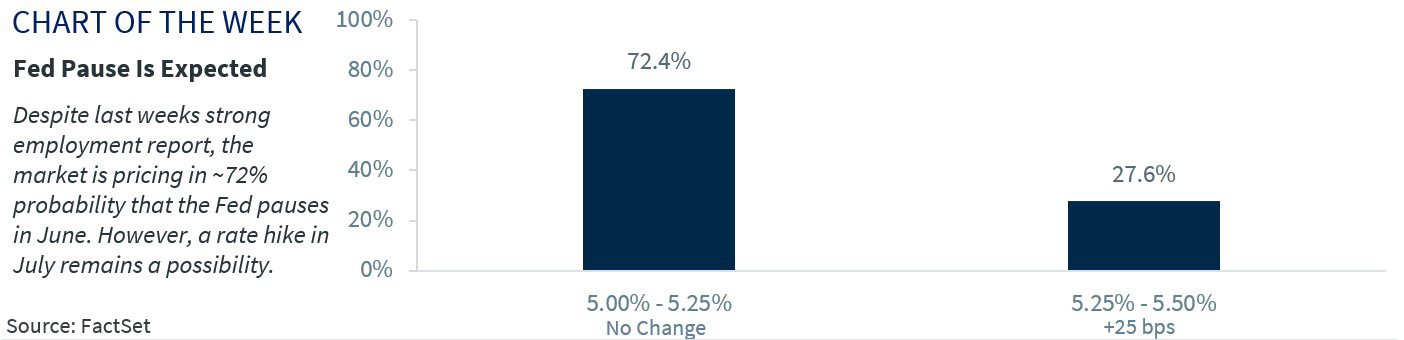

- The Fed is expected to pause in June

- Economy is slowly inching toward a recession

- Fed rate cycle likely to turn in 2024

Welcome to the Basketball Finals! As we head into Game Four tonight, the Eastern and Western conference champs are battling to win this year’s Championship. Watching the game and following the stats is entertaining, but die-hard fans tune into the post-game press conferences to gain valuable insights about the game, the team’s challenges and potential adjustments that need to be made going forward. The same can be said with the Federal Reserve (Fed). Investors tune into the Fed’s post-meeting press conferences for insights on the economy, interest rates and the direction of policy. Hearing it provides more context than reading the official statement. And with the financial markets and the economy at an inflection point, the Fed’s meeting next week should shed light on where they see things heading. With market concerns oscillating between fears of an economic slowdown (i.e., no more hikes) and inflation remaining elevated (i.e., more hikes), the Fed’s updated economic projections and dot plots couldn’t come at a more critical juncture.

- What ‘Nuggets’ will we hear from the Fed? | The Fed’s two-day policy meeting next week is going to present another challenging decision for policymakers. Why? Well for starters, there does not appear to be a clear consensus at the Fed. For much of last year the Fed was united about the need to lift rates into restrictive territory. But after ten consecutive rate increases, we are starting to see some diverging opinions. Some Fed officials are still leaning in favor of further rate hikes, particularly given the Teflon jobs numbers and elevated inflation. While other prefer to wait for additional data in the wake of long and variable lags of monetary policy. Below we summarize what we expect from the Fed next week:

- Interest rate decision never a ‘slam dunk’ | We know that the Fed doesn’t like to surprise the market. And given that the market is pricing in a ~72% probability that interest rates will remain unchanged, it’s reasonable to assume the Fed will stay on hold next week. However, the market believes a Fed rate hike at the July meeting is a real possibility. Surprise rate hikes from the Australian and Canadian central banks this week gave the markets a few jitters, particularly as their rate actions suggested that the global rate tightening cycle may not be over yet. We do not think these moves will have any bearing on the Fed’s rate decision next week, as Fed officials appear to be leaning in favor of a pause. In fact, that’s precisely what our economist thinks.

- Dot plots and projections unlikely to bring more ‘Heat’ | Fed officials penciled in 5.1% as the peak fed funds rate with the median dot moving down to 4.3% in 2024 in their March projections. Since that meeting, the data on inflation, jobs and the banking sector have delivered mixed messages. Inflation is headed lower, but at a slow pace. Job growth is decelerating but remains strong. Wage growth is slowing, but from elevated levels. The acute banking stress has receded, but loan demand remains weak and credit conditions continue to tighten. All in, this signals that restrictive policy is working its way through the economy, albeit at a slow pace. However, the big question facing the markets is whether Fed officials will signal that they are comfortable that the current level of interest rates will be enough to bring inflation back under control, particularly given the ongoing strength in the jobs market. With seven out of eighteen FOMC members penciling in a terminal rate above 5.25% in March, it would only take a few policymakers to shift their outlook for the 2023 median dot to move higher. While this presents an upside risk to our fed funds forecast, our economist does not think further rate hikes will be necessary. The Fed’s restrictive policy is already cooling growth and inflation, without inflicting severe damage on the economy. And assuming the damage is contained (mild recession at worst, soft landing at best), this would be good news for both stocks and bonds.

- Powell will play both ‘offense’ and ‘defense’ | Fed Chair Jerome Powell will have an opportunity to expand on the Fed’s rate decision in the post-meeting press conference. We expect him to strike a balance between leaving the door open for further tightening given how far inflation remains away from the Fed’s 2.0% target and the economy’s ongoing resilience, while also reiterating that the Fed is nearing the end of its tightening cycle but will remain data dependent. Powell will likely field questions on whether he believes a soft landing is achievable (there have been very few instances when the Fed was able to deliver a soft landing), particularly since his view differs from Fed staffers who are forecasting a recession. Powell will also need to provide answers on whether he believes the significant rate cuts (i.e., ~150 bps of rate cuts by year-end 2024) priced in for next year by the market are appropriate and how receding bank stress is impacting their rate outlook (Powell previously mentioned that the credit tightening from the bank stress was akin to one or two 25 bps rate hikes).

- Bottom Line | While the Fed wants to retain optionality on further hikes and affirm rate cuts are not on the horizon for this year, we anticipate that slowing economic momentum and easing inflation pressures will lead to the beginning of an easing cycle in 2024.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...