Chief Economist Scott Brown discusses current economic conditions.

The first of three presidential debates is set for the evening of September 29. The topics, chosen by the Chris Wallace, the moderator, will be the Trump and Biden records, the Supreme Court, COVID-19, the economy, racial tensions, and election integrity. We may hear a little about fiscal policy, but any discussion of the federal debt will likely be deferred to one of the other debates (if at all).

The federal budget deficit is the difference between tax receipts and spending. As FY20 comes to an end, tax revenues are expected to total about $3.3 trillion, while outlays are seen at double that, $6.6 trillion, leaving a deficit of $3.3 trillion. That’s a substantial increase from FY19’s $984 billion, reflecting the pandemic (a loss in tax revenue and a large increase in spending). The deficit is expected to fall as the pandemic recedes, but is expected to remain above $1 trillion over the next ten years. Despite the added borrowing, the government’s interest payments are now projected to be little more than before the pandemic (as interest rates are projected to remain low).

The federal debt is simply the accumulation of past deficits, currently about $26.8 trillion. Some of that debt ($5.9 trillion) is what the government owes itself though Social Security and Medicare trust funds and some federal retirement programs (people have been paying into these funds, but the government has borrowed against that). The rest is debt held by the public ($20.9 trillion). The proper way to think about the debt is as a percentage of GDP. This percentage is now at 100%, a level last seen at the end of World War II. The impact of the 2008-09 financial crisis and the current pandemic is similar to the two world wars, revenues fall and spending increases. The bigger problem is what lies ahead.

The demographics aren’t in our favor. The retirement of the baby-boom generation will boost spending while slower growth in the working-age population will limit revenues. Medicare is a bigger problem because healthcare inflation adds to the demographic strains. As the government makes good on the trust fund obligations, debt that the government owes itself will become debt held by the public. Foreign investors could lose faith in the U.S., weakening the dollar, but every other country faces similar pressures.

The government is nothing like a household. We don’t have to pay off the debt. We just have to make interest payments and roll over maturing debt, which is currently not a problem. The federal budget deficit was on an unsustainable trajectory ahead of the pandemic. Sustainability can be achieved by having debt grow no faster than GDP. This can be accomplished by tax changes (increases in rates or the elimination of deductions), retirement reforms (that is, cuts), increased borrowing, or some combination. However, in the near term, fiscal support will play a critical role in the economic recovery. There will be plenty of time to worry about the deficit later.

Lawmakers would be wise to consider the advice of St. Augustine, who wrote “Da mihi castitatem et continentiam, sed noli modo,” which translates as “Grant me chastity and purity, but not yet.”

Recent Economic Data

Both new and existing home sales reached their highest levels since 2006. Lower mortgage rates and what is perceived to be a longer-term shift to working from home continued to fuel demand. Existing home sales rose 2.4% in August, up 10.5% from a year ago (still down 3.2% year-to-date).

New home sales rose 4.8% (+43.2% y/y), with a 13.4% jump in the South. These figures are often erratic and the seasonal adjustment may have exaggerated August strength, but the housing sector is strong.

Durable goods orders rose 0.4% in the initial estimate for August. Aircraft order cancellations totaled $2.8 billion vs. -$16.5 billion over the two previous months. Motor vehicle orders fell 4.0%, reflecting a seasonal quirk that overstated the gain in July. Ex-transportation, orders rose 0.4%, mixed across industries, and 0.4% above the February level. Orders for nondefense capital goods ex-aircraft rose 1.8%, with shipments on track for a +30% annual rate in 3Q20 (vs. -19.7% in 2Q20).

The Chicago Fed’s National Activity Index, a composite of 85 economic indicators, fell to +0.79 in August, vs. +2.45 in July and +5.84 in June. The three-month average was +3.05. The report noted that the figures remained consistent with above-trend growth, but slower in the near term.

Gauging the Recovery

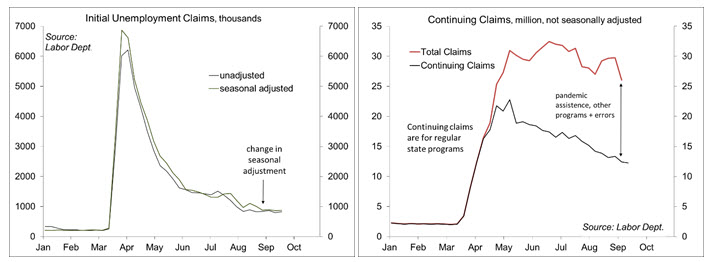

Jobless claims, a leading economic indicator, totaled 870,000 in the week ending September 19. The four- week average (under the new arithmetic seasonal adjustment) was 878,250 – still an extremely high trend (although less horrific than in March and April). Continuing claims (for regular state unemployment insurance programs), a coincident economic indicator, fell by 167,000 (week ending September 12) to 12.580 million. Total persons claiming UI benefits (all programs) fell by 3.7 million in the week ending September 5 to 26.045 million (not seasonally adjusted) – that total appears to be overstated due to reporting issues and widespread fraud.

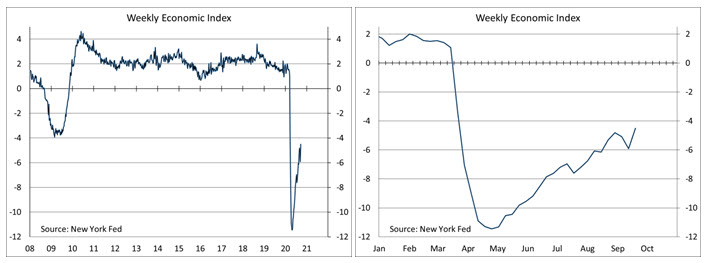

The New York Fed’s Weekly Economic Index rose to -4.50% for the week of September 17, up from -5.91% a week earlier and a low of -11.45% at the end of April, consistent with a moderation in the pace of the recovery. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously). Note that the weekly figures are subject to revision.

The University of Michigan’s Consumer Sentiment Index rose to 78.9 in the mid-month assessment for September (the survey covered August 26 to September 14), vs. 74.1 in July. The report noted that “while the recent gain was consistent with an unchanged flat trend, the data indicated that the election has begun to have an impact on expectations about future economic prospects.” The September gains were primarily in the outlook for the economy, “and it was Democrats that posted gains in economic prospects while optimism about the economy weakened among Republicans.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...