Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

The Treasury yield curve reflects historically low yields. The massive amount of stimulus money being injected into the economy will do little to change this anytime soon. In other words, expect low interest rates and expect them to be here for a long time. It is very tempting for some investors to reach for yield but I would suggest that this is not a time to adjust your risk profile to suit your yield desire. Always seek an investment plan that matches your risk tolerance. For many investors, a fixed income allocation is designed to protect principal with income as a secondary benefit. This discussion is not intended for the risk averse but intended to highlight an area of interest for investors suited to position for a degree of speculation with a reward of higher return.

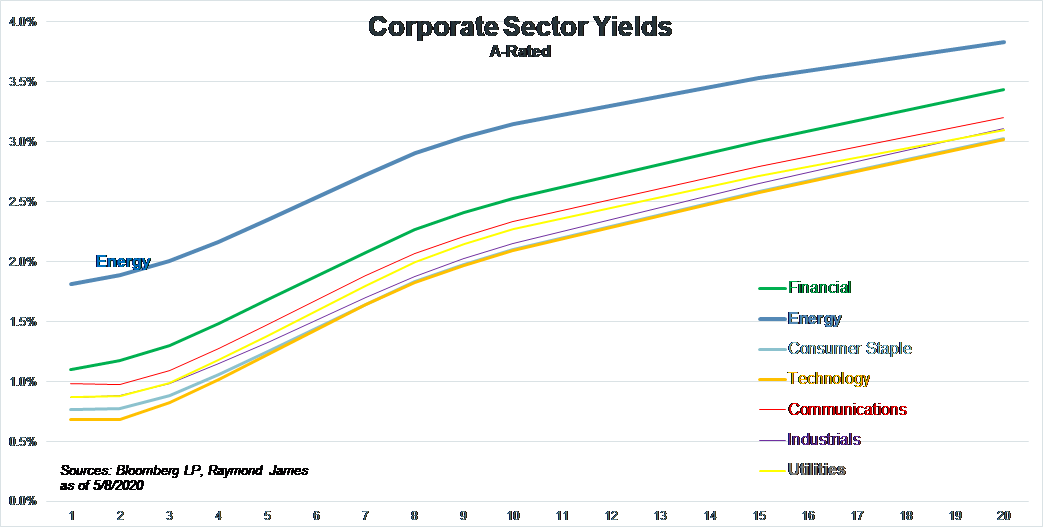

The energy sector is boasting much higher yields than other corporate sectors. This should come as no surprise as COVID-19 has contributed to withered demand. The over-supplied market is buttressed by the Saudi-Russia price war. Disarray is at an advanced level in the oil & gas sector.

A disheveled condition combined with investor uncertainty can generate opportunity. It occurs throughout various markets and time slots. Consider the political and economic turmoil prevailing in Chicago. Some investors blanket avoid all Illinois municipal debt to sidestep unwanted risks regardless of an entity’s stand-alone risk profile which might be very different than Chicago’s. A healthy-financed, well-managed and robust Illinois community may involuntarily be grouped with the warranted apprehensions tied specifically to Chicago debt.

Collateralized Mortgage Obligations (CMOs) can suffer a similar disorder when more conservatively designed tranches are compared with high-risk tranches when the only commonality is the broad sector name.

Not all oil & gas corporations carry the same risk or ability to weather a tumultuous economic downturn. The industry will likely experience consolidation and defaults resulting from current market circumstances. However, the healthy, well-positioned corporations may emerge stronger. At some point, demand for oil and gas will normalize and prices will stabilize, we just can’t predict the timing.

There is a divide between the lower-tier and the larger stronger positioned oil & gas coporations. However, the whole sector is trading with comparatively wider spreads. This means that opportunities exist to selectively choose those corporations with more flexibility, without total dependency on exploration, not solely dependent on the price of oil and suited to withstand the current market challenges.

Investors must be aware that price volatility and rating adjustments are likely during this turmoil. For those that are positioned and suited to explore these opportunities, we will work closely with the trading desk to identify these prospects.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...