Chief Economist Scott Brown discusses current economic conditions.

Following the strong performance in the first half of the year, economic growth was bound to moderate in the second half. Growth is still expected to be strong by historical standards. Yet, it may be disappointing for some investors.

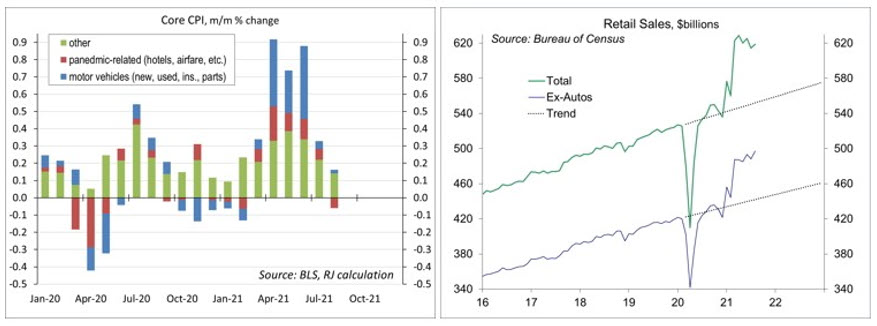

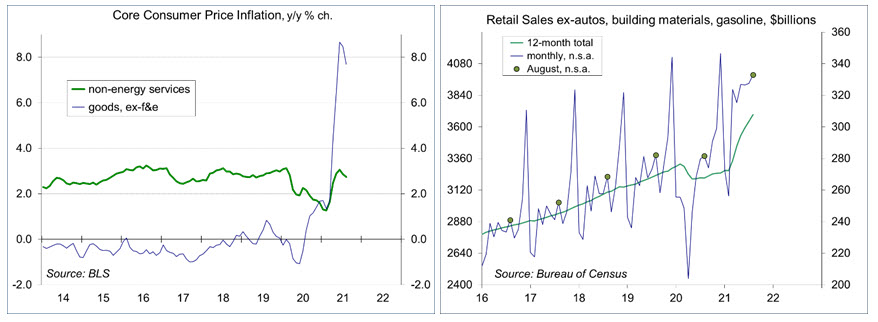

Team Transitory scored a win (but not a complete victory) with the latest CPI report. The Consumer Price Index rose less than expected in August (+0.3%, up just 0.1% ex-food and energy). The price index for new vehicles remains elevated (up 1.4% in August and a 6.7% rise in the last three months), but prices that were running hot a few months ago (used cars, vehicle rentals, car insurance, airfares) retreated. The report on import prices showed a drop in prices of raw materials. Supply chain difficulties (semiconductor shortage, ocean freight and domestic transportation issues) will likely continue into 2022, providing limited relief in the prices of goods. Inflation in consumer services has remained moderate.

With spending on consumer services constrained, spending on goods surged in the pandemic. As spending on services recovers, spending on goods should moderate, but there’s little evidence of that so far. Retail sales fell 1.6% over the last four months, but that reflects the impact of the semiconductor shortage on vehicle production. Auto dealership sales are down 14.1% since April. Ex-autos, retail sales are still more than 12% above the pre-pandemic trend. There are ongoing concerns about COVID, and the Delta variant in particular, but we may be seeing a more long-lasting shift in consumer behavior. One of the consumer themes of the last decade was that people were becoming more interested in “experiences” than in “stuff.” That theme is likely to return, but it may be a few years.

Any economic forecast of GDP should have growth eventually moving toward a long-term sustainable pace. Simply put, potential GDP growth should be the growth in the labor force (the working-age population is growing at 0.5%) plus productivity growth (reasonably put at 1.0-1.5%). The results in a 1.5-2.0% long-term growth rate. Of course, there is considerable uncertainty about labor force participation (including a potential grey wave of early retirements). Productivity growth could be improved through technology (including robotics and artificial intelligence) or through a shift towards tasks with higher output per worker (and away from lower output per worker). In the current environment, plenty of slack remains in the job market, but matching unemployed workers to available jobs takes time. The Delta variant has dampened the near-term growth outlook, but that is likely to be temporary. Motor vehicles will subtract from 3Q21 GDP growth, but we should see increased inventories (adding to GDP) in the months ahead.

The Fed will release revised projections of growth, unemployment, and inflation this week (now out to 2024). Fed officials’ median forecast of 2021 GDP growth is widely expected to fall from the 7.0% projection made in June. We’ll get a new dot plot (which shows officials’ expectations of the appropriate year-end federal funds target rate). Fed officials, including Chair Powell are not happy with the dot plot and we may see some changes at some point. The dot plot provides useful information, but is broadly misinterpreted by financial market participants – it signals general expectations, not a plan.

Recent Economic Data

The Consumer Price Index rose 0.3% in August (+5.3% y/y), up 0.1% (+4.0% y/y) ex-food & energy. Consumer goods ex-food, energy, and used cars rose 0.7%, up 3.9% y/y (vs. +0.1% for the 12 months ending August 2020). The price index for mon-energy services was flat (+2.7% y/y, vs. +2.1% y/y in August 2020).

In contrast to expectations of a decline, retail sales rose more than expected in August (+0.7% overall, +1.8% ex-autos), although figures for July were revised lower (-1.8% overall, -1.0% ex-autos). Core retail sales (which exclude autos, building materials, and gasoline) rose 2.1% (median forecast: -0.1%), also with a downward revisions to July. Sales at restaurants and bars were flat (-2.8% before seasonal adjustment) — up 10.2% from two years ago. Non-store retailers (includes internet and mail order) rebounded 5.3%, following -4.6% in July (up 36.0% from two years ago).

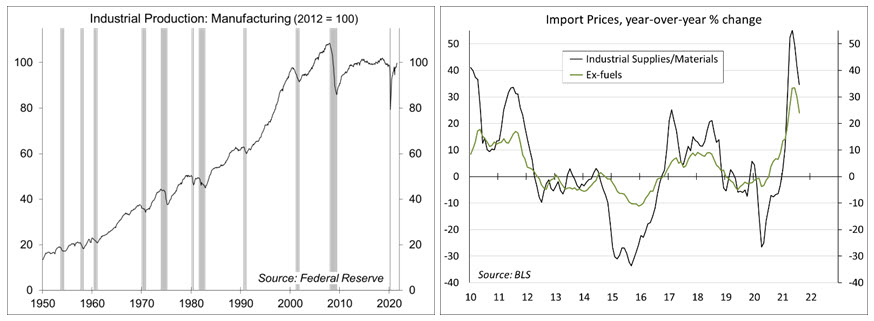

Industrial production rose 0.4% in August (+5.9% y/y), reflecting a minor drag from the effect of Hurricane Ida. Manufacturing output rose 0.1% (+6.2% y/y). The semiconductor shortage is still a factor in motor vehicle output (down 4.9% y/y and 7.3% lower than August 2019). Ex-autos, factory output rose 0.2% (up 6.2% y/y and +0.8% above the level of two years ago).

Import prices fell 0.3% in August (+9.0% y/y), down 0.2% (+5.2% y/y) ex-food & fuels. Ex-fuels, the price index for imported industrial supplies and materials fell 1.3% (+34.6% y/y). The price indices for imported finished goods (capital equipment +1.9% y/y, autos +2.0% y/y, and consumer goods +1.0% y/y) remained moderate.

Gauging the Recovery

The New York Fed’s Weekly Economic Index fell to +7.84% for the week ending September 11, vs. +8.36% a week earlier. The WEI is scaled to y/y GDP growth (- 2.9% y/y in 3Q20).

Breakeven inflation rates (the spread between inflation-adjusted and fixed-rate Treasuries, not quite the same as inflation expectations, but close enough) continue to suggest a moderately higher near-term inflation outlook. The 5- to 10-year outlook remains consistent with the Fed’s long-term goal of 2%.

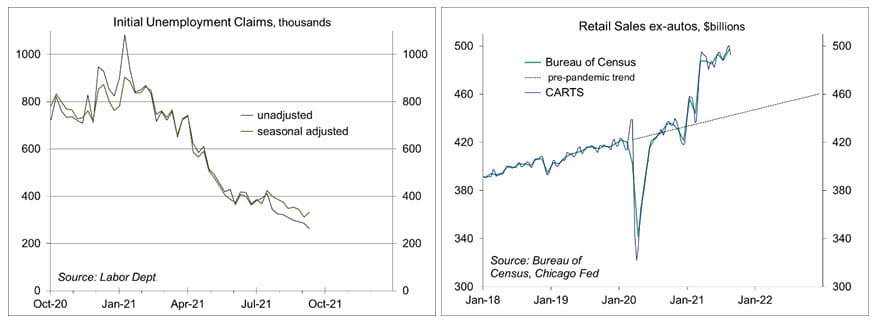

Jobless claims rose by 20,000, to 332,000 in the week ending September 11. Seasonal adjustment can add uncertainty in September (in the transition from the summer travel season to the start of the school year), but the decline (since August) likely reflects the end of extended unemployment benefits. Claims had remained elevated in recent months (by historical standards) reflecting people moving into and out of short-term jobs.

In the fourth week in August, the Chicago Fed Advance Retail Trade Summary (CARTS) index (a composite of multiple retail gauges) showed a 1.6% decrease in retail sales (ex-autos), following a 0.2% rise in the previous week. August retail sales (ex-autos) were projected to have risen 1.3% from July.

The University of Michigan’s Consumer Sentiment Index fell to 70.3 in the mid-month assessment for September (the survey covered August 25 to September 15), vs. 70.3 in July and 81.2 in July. Expectations sank to 65.1, from 79.0, reflecting concerns about the Delta surge.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...