Chief Economist Eugenio J. Alemán discusses current economic conditions.

- Chinese RMB is not convertible

- Chinese capital account has not been liberalized

- Non-Chinese holders of RMB cannot buy Chinese assets

- S. dollar is not losing its reserve currency status, it represents about 60%

- Chinese government negotiates bilateral swap lines to guarantee convertibility

- Canadian dollar, which represents ~2% of reserve currencies is still a reserve currency

- China is the second largest economy, but the RMB only represents about for 3%, the euro is 20%

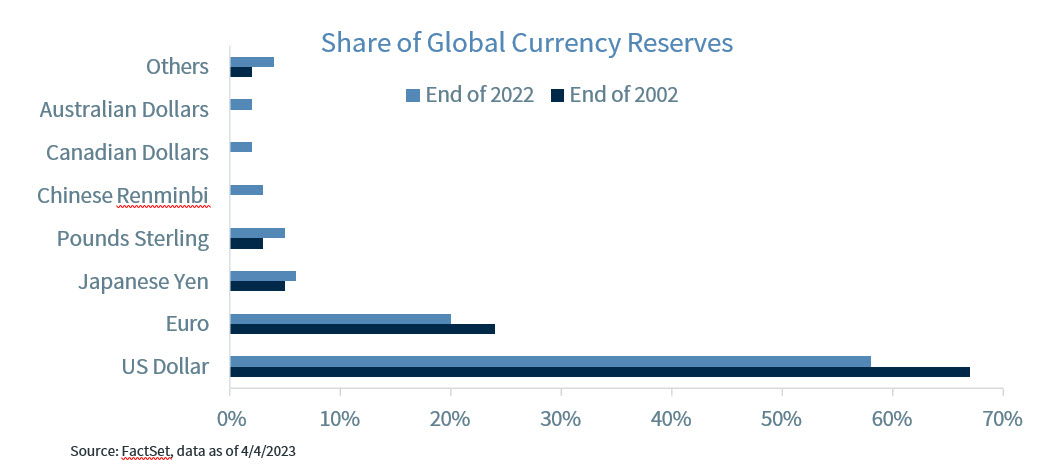

The dominance of the U.S. dollar has been challenged for decades and it is not a breaking story despite all the attention it has received of late. In fact, a quick web search results in articles going back decades talking about this topic. Our thoughts are very simple: the U.S. dollar will not lose its reserve currency status. The currency fluctuates in value, and it could weaken in the coming months and years, but as of today, the currency is still used in most transactions worldwide, accounting for ~60% of international banking claims and liabilities. Additionally, the U.S. dollar is used (bought or sold) in ~88% of global currency transactions, and ~60% of globally disclosed foreign exchange reserves are held in dollars. While these numbers have changed over the last two decades, the dominance of the U.S. dollar has remained relatively stable, and it will take a long time for this to change, if it ever does.

In light of the many questions received regarding the recent agreements between China and other countries to conduct international transactions in Chinese renminbi or yuan (henceforth RMB), we thought it prudent to address the issue.

We are not going to try to gauge whether the Chinese RMB is going to supplant the U.S. dollar as the premier reserve currency as nobody knows what will happen in the future. What we are going to do is try to explain why the RMB today is NOT one of the most important reserve currencies, despite China being the second largest economy in the world. And this will help us understand why the supremacy of the U.S. dollar is not at stake today nor will it be in the future. Furthermore, it is important to note that even if the U.S. dollar loses its principal role as the premier reserve currency, which is a big “if,” that doesn’t mean that the U.S. currency cannot remain an important reserve currency as the yen, the pound sterling, and other currencies have.

One of the most important issues we have heard clients discuss is whether this is bad news for the U.S. dollar and for the U.S. market. The simple and fast answer is that it is not. The fact of the matter is that the participation of the Chinese currency in international transactions and as a reserve currency should be much larger than it is today. So, the question is, why is it that the Chinese currency’s representation in international transactions and as a reserve currency is so low?

Again, but from an economic perspective, the question that everyone should be asking is why is it that China, having become the second largest economy of the world, has such an underrepresentation in terms of its currency in international markets? The US dollar (59%) and the euro (20%) are the two preferred currencies in the world in terms of central bank reserves, according to a recent report by the U.S. Congressional Research Service1. The RMB only represents 3% of central bank reserves in the world.

The most important reason the Chinese RMB is not a highly traded/held currency across the global economy is that the country’s capital account is not open, or in economic parlance, it hasn’t been ‘liberalized.’ What does this mean? It means that if you hold RMB, you are not free to use your RMB to buy Chinese assets in China. You can buy dinner if you are in China, but you cannot buy a factory (an asset). Or: the RMB is not fully convertible.

“If you hold a non-convertible currency, that means that you cannot exchange it freely at the going exchange rate.”

Let’s look at an example from recent history to make the point. We remember that back in the early 1990s a Japanese billionaire bought the land under the Empire State Building in New York City, and this was a shock for politicians as well as Americans in general. How could Japanese investors buy a symbol of U.S. power? However, because of large trade surpluses that had been accumulating since the 1960s, the Japanese had been accumulating U.S. dollars. In the early 1990s, one of those Japanese billionaires decided to buy the land under the Empire State Building and that became a serious political issue at the time.

Japanese individuals could buy U.S. assets because the U.S. capital account is ‘liberalized,’ that is, there are no restrictions on acquiring U.S. assets if you have the correct number of U.S. dollars to do so. 2 That is, the dollar is fully convertible. However, that is not the case in China. The Chinese capital account is not fully ‘liberalized’ so if a foreigner holds RMBs, he/she cannot go and buy Chinese assets freely.

Because of the problems with capital flows, or the lack of liberalization of these capital flows, the Chinese government has to enter into bilateral swap deals with other countries in order to guarantee payments. This is what has been happening over the last several years. What you hear or read in the newspapers is nothing but an attempt by the Chinese government to extend the use of the RMB as a reserve currency.

According to the conclusion from an article by the Atlantic Council, “the use of the RMB to settle bilateral trade and investment transactions between China and another country fits well into the Chinese approach to internationalization of the RMB via a multitude of BSLs (Bilateral Swap Lines) subject to China’s discretion and control – instead of China liberalizing its capital account and allowing the RMB to be fully convertible i.e., freely usable by anyone in the world. The likely purpose of the efforts mentioned above is not to replace the role of the USD in global finance, but realistically to develop an alternative payment system to be used by countries which have made a political decision to do so, especially among the sanctioned countries.”3

In a November 2022 working paper from the Banque de France, Barry Eichengreen et. al, concluded that even if China does not fully liberalize its capital account, it could increase the penetration of the Chinese RMB in the international market through trade links. They said that “Historically, currencies first acquired a role in trade invoicing and settlement before also assuming reserve currency status. The RMB can similarly acquire a more important international reserve currency role via China’s trade links.” They further argue that the “ability to accumulate RMB-denominated reserves is not the same as willingness to hold them”. For the latter, offshore RMB markets and central bank swap lines are key. The People’s Bank of China (PBoC) has negotiated bilateral currency swap agreements with at least 39 central banks, totaling some RMB 3.7 trillion ($550 bn).

“Although they are not permanent lines available in unlimited amounts, swap lines engender confidence that RMB can be obtained from the Chinese central bank. The offshore market reassures central bank reserve managers and other investors that they can convert RMB into dollars at reasonably stable and predictable prices. Just as the London gold market was a safety valve for dollar holders in the 1960s, the offshore RMB market in Hong Kong is a safety valve for RMB holders today.”4 That is, this process could help the Chinese increase the importance of the RMB as a reserve currency. However, Eichengreen et. al also indicate that “Stability and predictability further require the Chinese authorities to regulate the RMB/USD exchange rate. And regulating the exchange rate in turn requires those authorities to hold dollar reserves. This observation suggests that an enhanced role for the RMB as a reserve currency will not automatically eliminate that of the dollar. Rather, China will have to hold dollar reserves for other countries to willingly hold RMB reserves.”

“… even if the Chinese government can increase the penetration of the RMB, it will be a complement to other currencies like the US dollar, and not a substitute…”

“The two reserve currencies will be complements, not substitutes. Holding dollars may have disadvantages for China, insofar as this creates mutual dependence with the U.S. But this peculiar relationship between the world’s two largest economies is the only way for China to make the RMB a significant reserve currency without embarking on full capital account liberalisation.” Basically, the reason why central banks and investors do not hold RMB is because they cannot easily purchase or sell them in international markets. These swap lines are intended to increase the importance of the RMB as an important reserve currency. However, it is probably highly unlikely that the RMB will challenge the supremacy of the U.S. dollar or even the euro any time soon. Furthermore, this paper indicates that even if the Chinese government can increase the penetration of the RMB, it will be a complement to other currencies like the U.S. dollar, and not a substitute for it.

For the Chinese communist party, the idea of fully liberalizing its capital account is probably something it is not completely comfortable with. That is, once you liberalize your capital account, you are at the mercy of international capital flows and market forces. This means that the Chinese communist party would lose its grip on the economy. As an example, the current collapse of the Chinese housing market would have made more noise and would have represented a much larger crisis if the capital account had been completely liberalized. That is, China has been able to keep better control over the collapse of the housing market than the U.S. and other European countries were able to do during the Great Recession. This is another reason why we don’t believe the Chinese RMB will challenge U.S. dollar preeminence any time soon, despite the recent noise regarding the agreements with other countries in the world.

Again, the U.S. dollar is a freely trading currency while the Chinese RMB is not. The Chinese government determines the value of its currency, and nobody knows what the actual value of its currency is in the free market. The Chinese government does not allow the free movement of capital, so it is impossible to know what the value of its currency is. What surprises us about all this noise regarding other countries ‘ditching’ the U.S. dollar is that the value of the U.S. dollar has remained unperturbed even as all these stories continue to appear. If you look at the graph above, if there are investors “ditching” the U.S. dollar, then we need to explain why the U.S. dollar continues to gain value in the global economy. That is, if what these experts are saying is true, the U.S. dollar should have nosedived. But that hasn’t happened, and, in fact, the U.S. dollar appreciated and has only recently started to weaken somewhat, perhaps because of differences in interest rates between the different countries rather than because some countries are ‘ditching’ the U.S. dollar.

“The Chinese government determines the value of its currency, and nobody knows what the actual value of its currency is in the free market.”

A New Reserve Currency?

The European Central Bank launched the euro on January 1, 1999 in an effort to promote economic growth and cohesion among the countries of the European community. The new currency strengthened significantly through the early 2000s, reaching $1.58 per euro in 2008. However, the euro has weakened by over 30% since then, reaching parity earlier this year, and currently trading at $1.09 per euro. There are a variety of reasons why the euro has been weakening for over a decade, including multiple debt crises, slow economic growth, quantitative easing, and political uncertainty, and the lack of a fiscal union, just to mention some potential reasons. But it is also true that all countries within the European community are fundamentally different, not just economically, but culturally as well. In fact, language barriers aside, the economic disparity between the strongest and weakest country is extremely significant. Why is this important? Because the concept of the European Union and the euro is a much better version of what some are saying China, India, Brazil, South Africa, and Russia are presumably trying to create. However, from what we know, there is nothing being created here. The BRICS is a loose – very loose – grouping of countries with very disparate objectives and views of what the road ahead for them should be.

China is clearly the leader of these countries, as it has invested heavily over the years. However, China has a non-convertible currency, a communist regime, very inefficient state-controlled industries, as well as an aging and declining population. India is the sixth largest economy in the world and therefore would be the second most important country in this partnership. However, India has plenty of issues itself, including significant corruption, income inequality, still-developing infrastructure, as well as a caste system that hinders its economic development.

The economies of the last three countries have been experiencing either stagnant or declining growth for years. Brazil and South Africa are huge commodity and natural resource exporters, but they are both plagued with political instability, high unemployment, and many other challenges. The last member of the group is Russia, and while some of the European countries are still energy dependent on Russia, we would argue that the long-term prospects for the country’s economy aren’t very promising.

Therefore, we do not believe that a manipulated, non-convertible Chinese currency, can compete with the U.S. dollar. This is not because the U.S. currency is perfect, but simply because, at least for now, the U.S. dollar is still the top dog in a weak pack. Maybe the Chinese could get their act together and become the currency of choice in the very, very long run, who knows. What we do know is that “in the long run, we are all dead.”

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the U.S. Bureau of Labor Statistics. Currencies investing is generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation. A value above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to consume. The opposite applies to values under 100.

Leading Economic Index: The Conference Board Leading Economic Index is an American economic leading indicator intended to forecast future economic activity. It is calculated by The Conference Board, a non- governmental organization, which determines the value of the index from the values of ten key variables

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

GDP Price Index: A measure of inflation in the prices of goods and services produced in the United States. The gross domestic product price index includes the prices of U.S. goods and services exported to other countries. The prices that Americans pay for imports aren’t part of this index.

FHFA House Price Index: The FHFA House Price Index is the nation’s only collection of public, freely available house price indexes that measure changes in single-family home values based on data from all 50 states and over 400 American cities that extend back to the mid-1970s.

Expectations Index: The Expectations Index is a component of the Consumer Confidence Index® (CCI), which is published each month by the Conference Board. The CCI reflects consumers’ short-term—that is, six- month—outlook for, and sentiment about, the performance of the overall economy as it affects them.

Present Situation Index: The Present Situation Index is an indicator of consumer sentiment about current business and job market conditions. Combined with the Expectations Index, the Present Situation Index makes up the monthly Consumer Confidence Index.

Pending Home Sales Index: The Pending Home Sales Index (PHS), a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.

DISCLOSURES

Import Price Index: The import price index measure price changes in goods or services purchased from abroad by

U.S. residents (imports) and sold to foreign buyers (exports). The indexes are updated once a month by the Bureau of Labor Statistics (BLS) International Price Program (IPP).

ISM New Orders Index: ISM New Order Index shows the number of new orders from customers of manufacturing firms reported by survey respondents compared to the previous month.ISM Employment Index: The ISM Manufacturing Employment Index is a component of the Manufacturing Purchasing Managers Index and reflects employment changes from industrial companies.

ISM Inventories Index: The ISM manufacturing index is a composite index that gives equal weighting to new orders, production, employment, supplier deliveries, and inventories.

ISM Production Index: The ISM manufacturing index or PMI measures the change in production levels across the

U.S. economy from month to month.

ISM Services PMI Index: The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) (also known as the ISM Services PMI) report on Business, a composite index is calculated as an indicator of the overall economic condition for the non-manufacturing sector.

Source: FactSet, data as of 12/29/2022

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...