Chief Economist Scott Brown discusses current economic conditions.

Economic data reports are generally backward-looking. There’s a lot of noise, reflecting statistical uncertainty and seasonal adjustment difficulties. Reports for March 2020 present a greater challenge. Social distancing was sporadic, with some states locking things down sooner than others. One should always take a given piece of economic data with a grain of salt, but this is especially so now. Yet, it’s pretty clear that the economy began to contract in March and that second quarter figures will be much worse. For the markets, the bigger question is how long it will take the economy to recover and when that will start.

“There will be growth in the spring.” – Chance the Gardener (Being There)

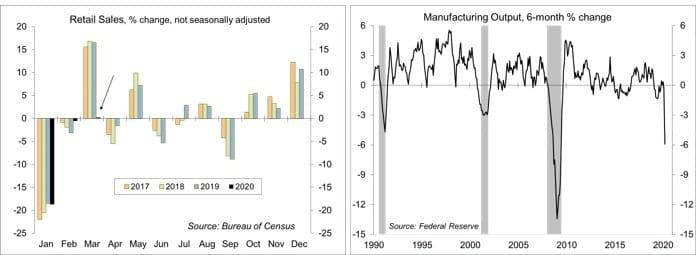

Not this year. March is an important month for retailers. A year ago, prior to seasonal adjustment, retail sales rose 16.5%. This year, they edged up 0.2%. That’s a huge shortfall. The Bureau of Census tweaked the seasonal adjustment in the March report, which yielded an 8.7% seasonally adjusted decline. Restaurants, department stores, clothing stores, gas stations, and auto dealers suffered badly, while grocery stores, online shopping, and (implicitly) wholesale clubs thrived. The decrease in retail sales was enough to throw the first quarter into negative territory, a

-9.2% annual rate relative to 4Q19. Chance may have been wrong about growth in the spring, but he has one prescient observation for the current environment – “I like to watch.”

COVID-19 also affected the collection of industrial production data. The Fed reported a 5.4% decline in March. Manufacturing output fell 6.3%, led by a 28.0% decline in motor vehicles. Factory output fell at a 7.1% annual rate in 1Q20, a recessionary decline – and April figures will be even worse.

Housing starts fell 22.3% in March. Single-family permits, which are reported more accurately, fell 12.0%, offsetting strong gains in January and February. Residential construction may still add a little to first quarter GDP growth.

The Conference Board’s Index of Leading Economic Indicators posted its largest decline on record in March.

Jobless claims remain the best real-time economic indicator. Claims slowed to “only” 5.245 million in the week ending April 11, with a total of

22.0 million in the last four weeks. That’s inflated a bit by the seasonal adjustment (20.1 million unadjusted, which is more than 12% of the labor force), but many laid-off workers couldn’t file. The broadening of eligibility (part of the CARES Act) should keep claims elevated in the near term. Using micro data from ADP, the Fed estimates that the economy lost 18 million jobs through April 4.

The advance estimate of 1Q20 GDP will be reported on April 29. While much of the component data is suspect, we should see a negative growth figure. The jobless claims data are consistent with a much worse decline in 2Q19.

A second half recovery for the economy depends on the unwinding of social distancing, which should be coordinated and gradual, but could be haphazard and self-defeating. There’s always hope. (M20-3048022)

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...