Chief Economist Scott Brown discusses current economic conditions.

With state economies opening up, activity is expected to pick up the final two months of 2Q20. Real-time indicators show improvement. However, the figures for April are consistent with a sharp contraction in 2Q20, which won’t come close to being offset by May and June.

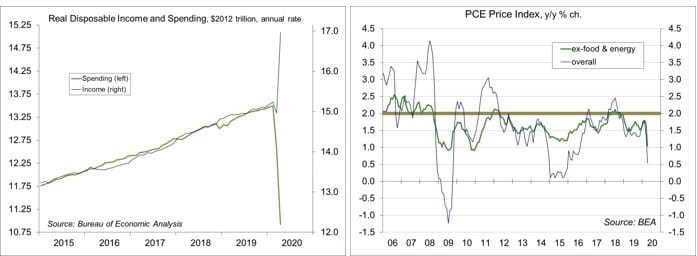

Personal income is the main driver of consumer spending. The two trend together over time. However, the April figures were bizarre. Income rose unexpectedly, up 10.5% (+11.5% y/y). Private-sector wages and salaries plunged 8.9%, following a 4.1% decline in March (-9.9% y/y). The drop in labor income was more than offset by an 89.6% rise in transfer payments, which include “recovery rebate” checks and unemployment insurance benefits. Because Tax Day was delayed to July 15, tax payments fell 7.4%, leaving disposable income up 12.9% (up 13.4% adjusting for inflation). The Bureau of Census figures are reported at an annual rate, as if short-term effects continued for a full year, amplifying monthly quirks. Still, with spending curtailed by social distancing, savings have gone up (a 33.0% rate in April, although that is misleading). Credit card bills are generally smaller. Individual bank deposits are generally rising. In theory, savings should provide fuel for an increase in consumer spending in the second half of the year.

Personal spending plunged 13.6% in April, following a 6.9% decline in March (-17.2% y/y). The monthly-to-quarterly arithmetic can generate some strange results. If inflation-adjusted spending for May and June were to simply hold at April levels, real consumer spending (about 70% of Gross Domestic Product) would fall at a 53% annual rate in 2Q20. We are likely to see a partial rebound in the final two months of the quarter, which would limit the 2Q20 decline to about a -40% annual rate, still incredibly steep. However, improvement in May and June would also lift the 3Q20 growth figure to somewhere between +15% to +25% (annual rate). Such a rise in spending would be unprecedented, but it would still leave GDP far below where it was at the end of last year.

The report on personal income and spending also includes inflation data. The PCE Price Index is the Fed’s key inflation measure. The Fed has a target rate of 2%, which it has struggled to reach over the last decade. No surprise, the PCE Price Index fell 0.5% in April, up just 0.4% year-over- year. Ex-food and energy, the index fell 0.4% (+0.9% y/y). Lower energy prices were a factor in April, but we also saw declines in hotel rental fees, airfares, and clothing. With the unemployment rate expected to remain elevated, labor cost increases ought to be moderate. Excess productive capacity should put downward pressure on prices. Inflation is likely to remain below the Fed’s 2% target through 2021.

Durable goods orders fell more than expected in the initial estimate for April (-17.2%, following a 16.6% decline in March). However, most of the March and April declines were cancellations of aircraft orders. Ex-transportation, orders fell 7.4% (following -1.7% in April), less than expected. Orders for nondefense capital goods ex-aircraft, a rough proxy for business fixed investment, fell 5.8% (vs. -1.2% in March). That suggests a moderate decline in 2Q20, much less than anticipated and a milder decline than what we see in consumer spending. That could reflect business optimism about an eventual recovery – or it could be a sharper decline later on.

Gauging the Recovery

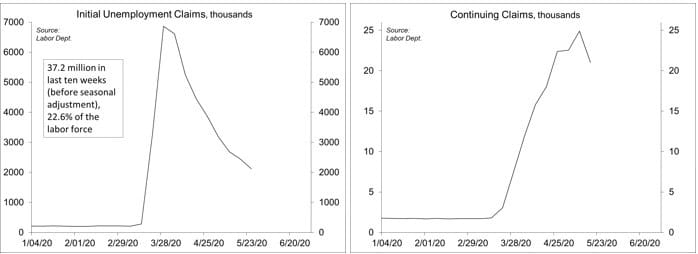

Jobless Claims fell to 2.123 million in the week ending May 23, still very high. Continuing Claims fell by 3.86 million in the week ending May 16, to 21.052 million, but the figures do not include pandemic assistance (total continuing claims were 30.957 million for the week ending May 9). (M20-3106819)

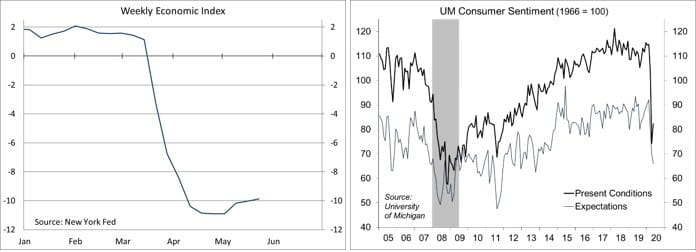

The New York Fed’s Weekly Economic Index rose to -9.87 for the week of May 23, up from -10.03 in the previous week and a low of -10.90 set a few weeks ago. The rebound was driven by an increase in retail sales, the drop in continuing jobless claims, and modest rises in steel production, rail traffic, and tax withholdings. The WEI is scaled to four-quarter GDP growth.

The University of Michigan’s Consumer Sentiment Index rose to 72.3 in the full-reading for May. Expectations remained weak. The report noted that “the CARES relief checks and higher unemployment payments have helped to stem economic hardship, but those programs have not acted to stimulate discretionary spending due to uncertainty about the future course of the pandemic.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...