Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

From corporate bonds to brokered CDs to municipal bonds, there are good values to be found across the fixed income landscape. While product choice is always an important decision, current fixed income market dynamics mean that investors may want to take time to consider the ideal product for their individual situation. Typically, in a “normal” market, higher tax bracket investors don’t have to give product choice a second thought as tax-exempt municipal bonds are going to provide the best value given their tax advantages. Recently, due to supply imbalances and very strong demand for municipal bonds on the short end of the yield curve, prices have been driven so high that even with their tax advantages, many investors may be better off from an after-tax yield perspective by purchasing a taxable product, such as corporate bonds, for shorter maturity investments.

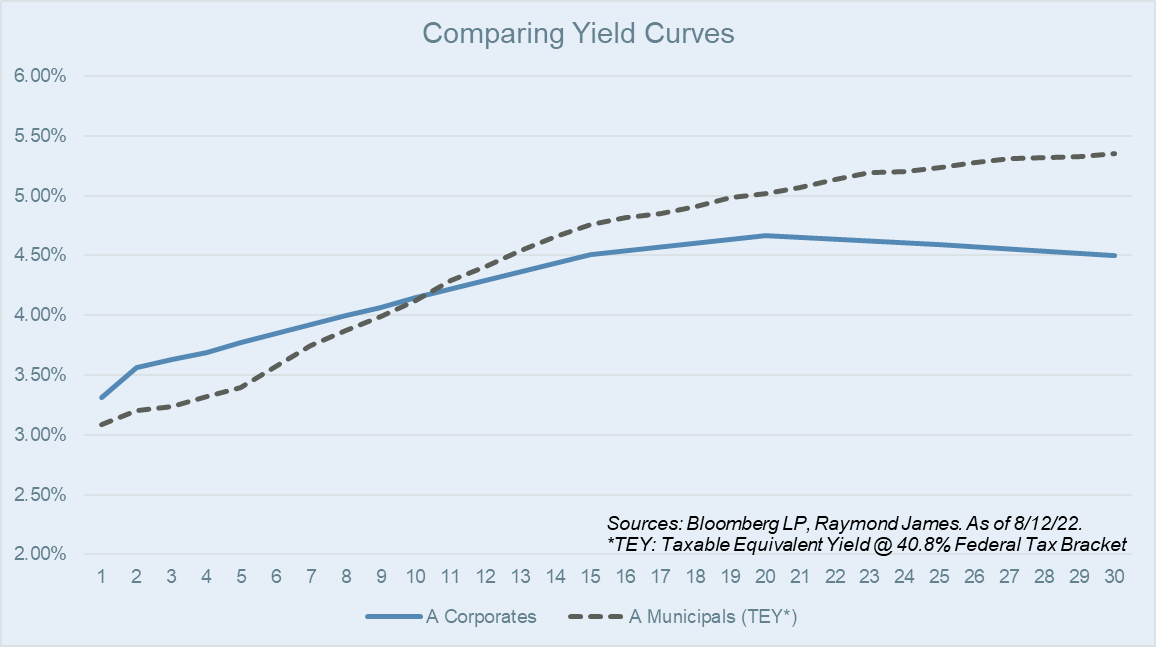

The yield curves below highlight these current market dynamics. The solid blue line is the A-rated corporate bond curve. The dashed gray line is the A-rated municipal bond curve displaying the taxable equivalent yield for someone in a 40.8% federal tax bracket (37% + 3.8% Net Investment Income Tax). As you can see, even factoring in the top tax bracket into the calculation, A-rated corporate bonds offer a yield advantage on the short end of the yield curve.

What does this mean for investors considering a short-term municipal portfolio? Perhaps consider a taxable bond portfolio. Corporate bonds are illustrated above, but taxable municipals, brokered CDs, and Treasuries could all present opportunities depending on investor needs. For many investors, extending out further on the curve might also be appropriate. As the graph shows, intermediate and long term municipals still present the traditional taxable equivalent yield advantage that high tax bracket investors are familiar with. With longer term municipal yields at some of the most attractive levels in years, now could be a good opportunity to lock in yields for a longer amount of time by extending out on the curve.

Would you rather earn $500,000 and not have to pay any taxes, or would you rather earn $1,000,000 and pay $300,000 in taxes? Many investors may want to avoid paying taxes at all costs, but at the end of the day, it is the income that you take home that matters, not how much you pay in taxes. The current relationship between tax-exempt municipal yields and corporate bond yields is a good reminder that markets are dynamic and constantly changing. As we never know what things are going to look like in the future, all we can do is look at the current investment environment and try to make informed decisions. In the current market, an informed decision involves potentially looking outside of your typical asset class and considering the entire landscape of investment options available before making any investment decisions.

Raymond James does not provide tax advice, please consult a tax professional prior to making any investment decisions.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...