Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Being an investor and trying to compare various investment vehicles can be a tall task given the mountains of information, statistics, and data points that are available. One of the most common points of confusion that investors have in the fixed income world is comparing yields on individual bonds with those of bond funds. This confusion is understandable, as these two different products typically quote different types of yields.

The standard yield quoted for an individual bond is its yield-to-worst (YTW), which is the lower of either the yield-to-call or yield-to-maturity. It is essentially the worst case scenario for what an investor can expect to earn annually by purchasing a bond and holding until redemption (barring a default). The standard yield quoted for most bond funds is its distribution yield, which is a measure of how much cash flow the fund distributes (generally a combination of income earned and return of principal). Neither yield is right or wrong to quote, but they measure two different things, so comparing the YTW of a bond to the distribution yield of a bond fund is an apples-to-oranges comparison.

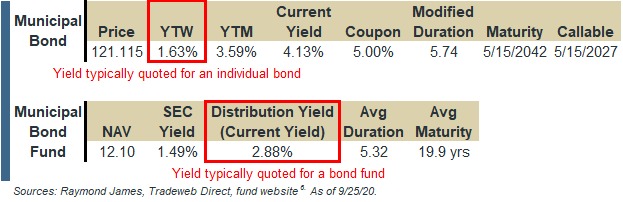

Take the illustration below for example, which shows various yields and statistics for a high-quality municipal bond and a popular municipal bond fund. These products have similar characteristics, as far as duration, maturity, and credit quality. In taking a quick glance at the quoted yields, it might appear that the fund offers tremendous value and a much higher yield if you were comparing the 2.88% yield on the fund versus the 1.63% yield of the bond. This takeaway would be incorrect, as the 2.88% is a distribution yield, whereas the 1.63% is a YTW. Although, a more accurate comparison is possible with a basic understanding of the various yields quoted.

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

Bond funds have what is called an SEC yield, which (as you can guess by the name) was developed by the SEC and is the closest comparison a bond fund has to a YTW. Comparing the SEC yield to the YTW is a more useful analysis if trying to compare the yield quoted on a bond to the YTWs of the bonds in the fund. Conversely, if cash flow is more important to you, a more helpful comparison might be to compare the distribution yield of the fund with the current yield of the bond (easily calculated by dividing the coupon by the current price).

Investors often ask how a high-quality municipal bond fund they are looking at is able to offer a higher yield than the high-quality municipal bonds that they see available. Does the fund have access to some magical pool of high-quality bonds yielding twice that of the individual bonds that are available to the investing public? No. They are likely purchasing very similar bonds but quoting a distribution yield rather than a yield-to-worst.

None of the various types of yield are necessarily right/wrong or better/worse, but they measure different things. Understanding what each one is telling you will allow for a proper analysis in determining an appropriate investment. You might have to dig a little bit or ask a few more questions when trying to find the appropriate statistics to compare, but performing an informed and appropriate analysis is a crucial step in determining what investments do or don’t belong in your portfolio.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...