Chief Economist Scott Brown discusses current economic conditions.

The shift in the Fed’s monetary policy framework was simultaneously a big deal and not much at all. In Chair Powell’s own words, the changes “add up to a robust updating of our monetary policy framework.” However, “to an extent, these revisions reflect the way we have been conducting policy in recent years.”

In November 2018, the Fed announced that it would review of its monetary policy strategies, tools, and communication practices. “With labor market conditions close to maximum employment and inflation near our 2% objective, now is a good time to take stock of how we formulate, conduct, and communicate monetary policy,” said Fed Chair Powell at the time. In 2019, the Fed held 14 “Fed Listens” events (plus one this year, in the midst of the COVID-19 pandemic), engaging with low-income and minority residents, workforce development organizations and community colleges, labor unions, small businesses, retirees, and others, and held a research conference in June of that year. The Federal Open Market Committee began discussing what it had learned in July of last year. Completion of the review was put off to this year and the pandemic delayed it further.

Importantly, the Fed’s review comes amid some significant changes. The economy’s long-term potential growth rate has declined, reflecting slower growth in the labor force, and interest rates are correspondingly lower. The level of the federal funds rate consistent with maximum employment and price stability over the longer run has declined relative to its historical average. As a consequence, the federal funds rate is likely to be constrained by its effective lower bound more frequently than in the past. Given the proximity to the effective lower bound, the Fed believes that downward risks to employment and inflation have increased.

As part of its efforts to improve its communications, the Fed began issuing an annual “Statement on Long-Term Goals and Monetary Policy Strategy” in January 2012, with a reaffirmation each January thereafter. With the results of its policy review pending, it skipped this January, but has now issued a revised statement (which will be reviewed each January, with a thorough public reassessment conducted about every five years).

In its revised statement, the Fed has moved to flexible average inflation targeting. Policymakers will shoot for an average inflation rate of 2% (as measured by the PCE Price Index) over time, but not in a mechanical or mathematical way. Judgement will remain the key factor behind policy decisions. A period of inflation below 2%, would be followed by a period of inflation above 2%. This will help to reaffirm 2% as a goal, rather than a ceiling. This is important because a ceiling would lower inflation expectations, which are a key driver of actual inflation and sub-2% expectations leave the Fed less scope to support the economy in a downturn.

The Fed also altered its employment objective, now “a broad-based and inclusive goal that is not directly measurable and changes over time.” One of the key takeaways from the Fed Listens events was that low unemployment has been especially beneficial to low- and medium- income communities. According to Powell, “one of the clear messages we heard was that the strong labor market that prevailed before the pandemic was generating employment opportunities for many mericans who in the past had not found jobs readily available.” Additionally, the Fed has lost faith that there is much of a trade-off between low unemployment and inflation. The Phillips Curve is apparently flatter than in the past, making shortfalls in unemployment less inflationary.

For those who have followed the Fed closely in recent years, this isn’t a change from how the central bank views things. The Fed has simply formalized it, providing a clearer break from past views.

The revised statement, as well as Powell’s speech to the Kansas City Fed’s Monetary Policy Symposium, consolidated changes in the Fed’s thinking, but left out a number of things. First, the Fed and other central banks have had ongoing difficulty hitting inflation goals. What will the Fed do to boost inflation above the 2% target? There’s always helicopter money, I guess. Second, Powell did not discuss forward guidance, defying the expectations of many Fed watchers, who had anticipated an outcome-based trigger for rate increases. Importantly, the Fed is still emphasizing judgement (there has been a multi-decade debate on rules vs. discretion in monetary policy, and discretion remains well out in front). Powell did not discuss the balance sheet, which is now viewed as just one more tool in the monetary policy kit. In its statement, the Fed noted that “the Committee is prepared to use its full range of tools to achieve its maximum employment and price stability goals.”

Prior to the pandemic, the three previous recessions came at the end of financial bubbles (the S&L crisis, the dot-com boom, and housing), rather than in bouts of higher inflation. Powell did not speak to possible financial risks associated with aggressive monetary policy easing. Maybe that will come in the next five-year review.

Statement on Longer-Run Goals and Monetary Policy Strategy

Adopted effective January 24, 2012; as amended effective January 29, 2019 August 27, 2020

- The Federal Open Market Committee (FOMC) is firmly committed to fulfilling its statutory mandate from the Congress of promoting maximum employment, stable prices, and moderate long-term interest rates. The Committee seeks to explain its monetary policy decisions to the public as clearly as possible. Such clarity facilitates well-informed decision- making by households and businesses, reduces economic and financial uncertainty, increases the effectiveness of monetary policy, and enhances transparency and accountability, which are essential in a democratic

- Employment, inflation, employment, and long-term interest rates fluctuate over time in response to economic and financial disturbances. Monetary policy plays an important role in stabilizing the economy in response to these disturbances. The Committee’s primary means of adjusting the stance of monetary policy is through changes in the target range for the federal funds rate. The Committee judges that the level of the federal funds rate consistent with maximum employment and price stability over the longer run has declined relative to its historical average. Therefore, the federal funds rate is likely to be constrained by its effective lower bound more frequently than in the past. Owing in part to the proximity of interest rates to the effective lower bound, the Committee judges that downward risks to employment and inflation have increased. The Committee is prepared to use its full range of tools to achieve its maximum employment and price stability goals. Moreover, monetary policy actions tend to influence economic activity and prices with a lag. Therefore, the Committee’s policy decisions reflect its longer-run goals, its medium-term outlook, and its assessments of the balance of risks, including risks to the financialsystem that could impede the attainment of the Committee’s goals.

- The maximum level of employment is a broad-based and inclusive goal that is not directly measurable and changes over time owing largely determined by to nonmonetary factors that affect the structure and dynamics of the labor market. These factors may change over time and may not be directly measurable. Consequently, it would not be appropriate to specify a fixed goal for employment; rather, the Committee’s policy decisions must be informed by assessments of the shortfalls of employment from its maximum level of employment, recognizing that such assessments are necessarily uncertain and subject to revision. The Committee considers a wide range of indicators in making these assessments. Information about Committee participants’ estimates of the longer-run normal rates of output growth and unemployment is published four times per year in the FOMC’s Summary of Economic Projections. For example, in the most recent projections, the median of FOMC participants’ estimates of the longer-run normal rate of unemployment was 4.4 percent.

- The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate. The Committee would be concerned if inflation were running persistently above or below this objective. Communicating this symmetric inflation goal clearly to the public helps keep judges that longer-term inflation expectations firmly that are well anchored, thereby at 2 percent fostering price stability and moderate long-term interest rates and enhancing enhance the Committee’s ability to promote maximum employment in the face of significant economic disturbances. In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.

- Monetary policy actions tend to influence economic activity, employment, and prices with a lag. In setting monetary policy, the Committee seeks over time to mitigate shortfalls of employment from the Committee’s assessment of its maximum level and deviations of inflation from its longer-run goal and deviations of employment from the Committee’s assessments of its maximum level. Moreover, sustainably achieving maximum employment and price stability depends on a stable financial system. Therefore, the Committee’s policy decisions reflect its longer-run goals, its medium-term outlook, and its assessments of the balance of risks, including risks to the financial system that could impede the attainment of the Committee’s goals.

- These The Committee’s employment and inflation objectives are generally complementary. However, under circumstances in which the Committee judges that the objectives are not complementary, it follows a balanced approach in promoting them, taking takes into account the magnitude of the employment shortfalls and inflation deviations and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate.

- The Committee intends to reaffirm review these principles and to make adjustments as appropriate at its annual organizational meeting each January, and to undertake roughly every five years a thorough public review of its monetary policy strategy, tools, and communication practices.

Recent Economic Data

Real GDP fell at a 31.7% annual rate in the 2nd estimate for 2Q20, vs. -32.9% in the advance estimate. Component revisions were relatively small. Consumer spending fell at a 34.1% pace (vs. -34.6% in the advance estimate). Business fixed investment fell 26.0% (vs. -27.0%). Profits of domestic financial corporations increased $39.5 billion in the second quarter, in contrast to a decrease of $42.2 billion in the first quarter. Profits of domestic nonfinancial corporations decreased $170.1 billion, compared with a decrease of $190.5 billion. Rest-of-the-world profits decreased $96.2 billion, compared with a decrease of $43.5 billion.

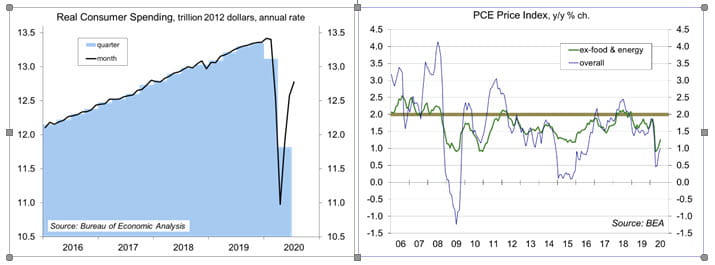

Personal income rose 0.4% in the initial estimate for July (+8.2% y/y), as a 1.4% gain in wages and salaries (- 1.1% y/y) offset a 7.2% decline in unemployment benefits (+4833% y/y). Personal spending rose 1.9% (-2.8% y/y). Adjusted for inflation, spending rose 1.6% (-3.8% y/y). If real spending for August and September holds steady at the July level, it would rise at a 36.6% annual rate in 3Q20 (vs. -34.1% in 2Q20 and -6.9% in 1Q20).

The PCE Price Index ex-food & energy rose 0.3% in July (+1.0% y/y), up 0.3% ex-food & energy (+1.3% y/y).

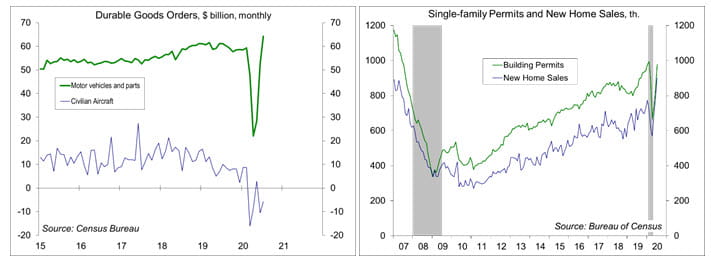

Durable goods orders jumped 11.2% in July, as a 21.9% increase in orders for motor vehicles more than offset nearly $5 billion in aircraft order cancellations. Ex-transportation, orders rose 2.4%. Orders for nondefense capital goods ex-aircraft rose 1.9% (with shipments up 2.4%, down 1.9% from a year earlier).

New home sales jumped 13.9% (±20.0%) in the initial estimate for July, up 36.3% from a year ago (±27.4%). While these figures are reported with a huge degree of statistical uncertainty, strength was similar to other housing market indicators (existing home sales rose 24.7% in July, single-family building permits rose 16.3%).

Gauging the Recovery

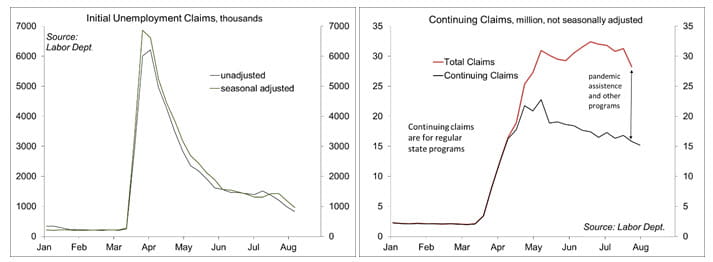

Jobless claims fell to 1,006,000 in the week ending August 22. Seasonal adjustment is multiplicative, amplifying the adjusted figures in August and September (when unadjusted claims are at seasonal lows). Unadjusted claims fell to 822,000, still very high by historical standards. The Labor Department announced that it will move to additive seasonal adjustment in September, which will reduce the adjusted figure, making it incomparable to previous figures (historical figures won’t be revised).

The New York Fed’s Weekly Economic Index rose to -4.91% for the week of August 22, up from -6.16% in the previous week and a low of -11.45% at the end of April. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

The University of Michigan’s Consumer Sentiment Index edged up to 74.1 in the full-month assessment for August (the survey covered July 29 to August 24), vs. 72.8 at mid-month and 72.5 in July. The report noted that “half of all consumers anticipated the economy would improve in the year ahead, but 62% judged that the overall conditions in the economy could be best described as unfavorable.” The Conference Board’s Consumer Confidence Index fell to 84.8 in the initial estimate for August (vs. 91.7 in July, 98.3 in June, and a prior low of 85.7 in April), reflecting deterioration in job market perceptions and business conditions. The report noted that “both business and employment conditions had deteriorated over the past month.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...