Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Easing price pressures will drive yields lower

- The Fed is nearing the end of its tightening cycle

- Bonds haven’t been this attractive since 2008

Happy National Employee Appreciation Day! This lesser-known celebration was created to recognize employees for their hard work, dedication and contributions. While Labor Day is the more official holiday, it never hurts to have another day to celebrate workers, particularly in this era of the ‘Great Resignation.’ And, with the JOLTS quits rate still elevated and labor shortages persisting, U.S. companies have plenty of reasons to keep their employees happy. That’s why many companies are still holding onto staff, even though economic growth and business profits are slowing. While the U.S. economy’s resiliency may delay the onset of the recession and cause the Federal Reserve to extend its tightening cycle, it doesn’t significantly change our view that the direction of Treasury yields is lower over a 12-month horizon. Why?

- Inflation has peaked | Inflation has moved down from a peak of 9.1% last June to 6.4% in January. While elevated relative to the Fed’s 2.0% target, the trend has been moving in the right direction – until recently, that is. A slew of inflation indicators (i.e., CPI, PPI and PCE) reaccelerated last month. Even Fed Chairman Jerome Powell’s preferred metric of inflation, the so-called ‘super-core’ index, which tracks services prices less food, energy and housing, rose to 4.6%. This sent the bond market into panic mode again, sending yields across the curve sharply higher and the 2-year Treasury yield to a cycle high of ~4.9%. While disappointing, it was unrealistic to expect inflation to decline in a straight line – some bumps along the way were always expected. And although the pace of disinflation has slowed, inflation should resume its downward trend as interest rates become increasingly restrictive and the lagged impact of falling housing prices (nearly 1/3 of the Index) show up in the CPI measure in the second half of this year. Inflation is the kryptonite of the bond market, so easing price pressures bodes well for our call for lower Treasury yields.

- Nearing the end of the Fed’s tightening cycle | The recent string of stronger than expected economic releases (i.e., ISM Services, retail sales and the labor market) has led to a meaningful repricing of rate expectations, pushing the peak fed funds rate to a cycle high of 5.4%, while pricing out 50 basis points (bps) of rate cuts in the second half of the year. While the Fed may still have more work to do as the recent data has come in ‘hotter’ than expected, we do not expect 2023 to be a repeat of last year. After 450 bps of interest rate increases over the last 12 months, the Fed is a lot closer to the end of its tightening cycle today than it was a year ago. Our economist expects the Fed to deliver two additional 25 bps rate hikes, one in March and another in May, with the fed funds rate rising to a peak of 5.25%. A pause is then likely for the remainder of 2023 – that is, providing the recent bout of economic strength proves fleeting. If we’re correct and the Fed is near the end, this will be welcome news for our year-end 10-year Treasury yield forecast of ~3% as bond yields have historically declined once the Fed ends its tightening cycle.

- Growth set to remain below trend | While the global economy experienced a burst of activity, spurred by mild weather and China’s reopening, this is not the start of a major growth reacceleration. Since monetary policy operates with long and variable lags, the economy has yet to feel the full impact of the Fed’s 450 bps (with more to come) of cumulative tightening. As tighter monetary policy works its way through the economy, this will continue to restrain growth and inflation as we progress through 2023. While the tight labor market is currently underpinning growth, its strength should start to wane as more corporations look to tighten their belts as profits come under pressure. Slower job growth, combined with tighter lending standards and dwindling excess savings, should weigh on consumer spending and lead to below-trend growth in the months ahead. Given the resilience of the economy, our economist upgraded his 2023 growth forecast from 0.0% to 0.6% last month. While a stronger economy poses an upside risk to our 3.0% 10-year Treasury yield forecast, the overall macro backdrop remains favorable for bonds. Below-trend growth and declining inflation should pave the way for lower bond yields in the months ahead.

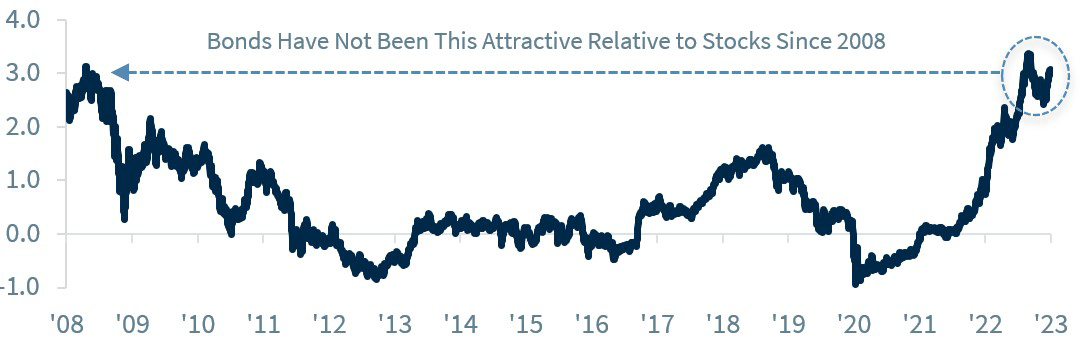

- Attractive valuations | The global interest rate reset higher last year, while painful, has altered the investment landscape for investors. Sharply higher interest rates has meant that investors no longer need to take outsized risks to generate reasonable returns from their bond allocations. After a historically poor year for bonds, fixed income now offers favorable valuations in absolute terms and on a relative basis versus other asset classes. This has led to renewed interest in the asset class, particularly now that the yield on the Bloomberg U.S. Aggregate Bond Index generates over 3.0% excess income over the S&P 500’s dividend yield. This attractive risk/reward profile is attracting retail interest, with bond funds taking in over $60 billion of net new money over the last six weeks – their longest winning streak in over two years. And with demand increasing at a time when new issuance in Treasurys, municipal bonds and corporates (i.e., investment grade and high yield) has fallen 20% or more over the last year, this is creating a favorable supply/demand dynamic that should provide an additional layer of support to the bond market.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Retirement and Longevity October 18, 2024 The 2025 Social Security cost-of-living adjustment (COLA) has...

Markets & Investing April 01, 2024 Doug Drabik discusses fixed income market conditions and offers...

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...