Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Appropriate asset allocation and diversification are cornerstones of any financial plan. In the same way that it is not in the best interest of your financial future to have 100% of your equity allocation in a single stock, you do not want 100% of your assets in a single asset class. Each asset class performs differently in different market environments and generally perform different roles within a portfolio. An effective allocation hopefully balances the features of various asset classes in a way that allows them complement each other. There is no one-size-fits-all allocation. An investor in their 20s might target 20% in fixed income and 80% in equities, while the investor entering retirement might have the opposite ratio. Whatever your allocation is, sticking to it is critical and could determine the future and longevity of your financial well-being.

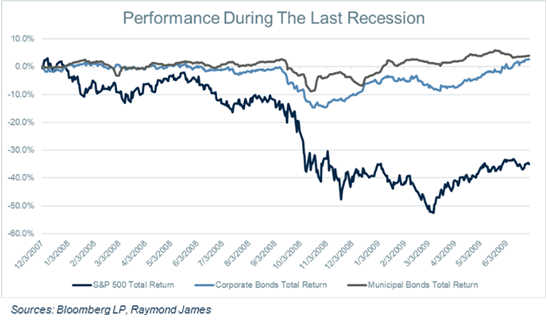

Fixed income is generally the ballast of a portfolio. It is meant to provide stability through consistent cash flow and income. It is easy in times of strong equity performance and/or low interest rate environments to be tempted to shift money that should be allocated to fixed income into other asset classes in an attempt to either ride the equity wave higher or search for yield. This strategy works until it doesn’t. As long as things are going well and equities keep going up, things are going to be fine. Unfortunately, as we know, recessions do happen, and when things turn south, these over-allocations get exposed and can be extremely harmful to an investment portfolio. It has been over 10 years since we were last in a recession, so hopefully, the graph to the right serves as a reminder for what can happen when things go bad and why we have money invested across various asset classes.

During the recession from December of 2007 to June of 2009, the S&P 500 had a total return of negative 35%, while corporate bonds and municipal bonds posted total returns of positive 3-4%. This is the role that fixed income plays in a portfolio. It is meant to provide consistency in the face of volatility, delivering downside protection in the face of a market downturn. Less emphasis on return on principal, but instead, return of principal when equities lose 35% of their value. When you are tempted to shift “fixed income dollars” into another asset class, don’t just consider the potential upside scenario, consider the downside and why they are earmarked as “fixed income dollars” to begin with.

The moral of the story is to stick to your allocation. A young investor might be able to afford an 80% equity allocation, because they have an investment time horizon measured in decades, so weathering the storm is much more manageable. On the other hand, a retiree that is currently living off of their investment portfolio could take a significant hit to their financial well-being if they have to sell equities at a 35% loss in order to fund their lifestyle during a downturn. Fixed income serves a very distinct purpose in a portfolio. Substituting other assets classes in place of fixed income, for any reason, could have dire consequences to an investment portfolio. It works until it doesn’t.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...