Rob Tayloe discusses fixed income market conditions and offers insight for bond investors.

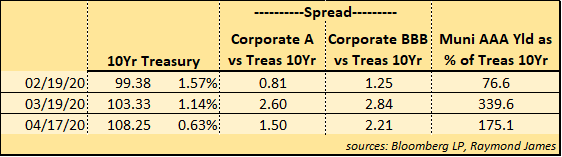

We have seen demand for Treasuries increase dramatically. Since February 19 the 10-year Treasury yield has tumbled from 1.57% to 0.63%. This reflects an appreciation in price from $99.38 to $108.25.

Spread products (corporate and municipal bonds) have experienced similar volatility, but absolute yields have remained near pre-virus levels. Corporate A-rated bonds were spread 81bp versus the 10-year Treasury (+81/10yr Treasury) on February 19. They are now spread +144/10yr Treasury. Similarly, 10yr BBB-rated corporate bonds went from +125/10yr (2/19) to +221/10yr (4/17). The AAA-rated municipal bond yields as a percent of Treasuries has moved from 77% (February 19) to 175% (April 17).

Widening spreads on the corporate and municipal curves have more than offset the strong demand for Treasuries that has dropped Treasury rates. This divergence has created an opportunity within these sectors for investors to take advantage of.

First and foremost, it is imperative for clients to stick to their game plan. For example, know your risk tolerance and do not reach for yield in a bond that you would otherwise be uncomfortable owning.

On the corporate side for conservative investors, stick to “brands and balance sheets”. This guidance is coming directly from our corporate trading desk. It is sensible to stick to high quality issuers with secure financials. You have heard us advocate “know what you own.” It is imperative for investors to be comfortable with every position in their portfolio and have it align with their risk tolerance, especially in turbulent markets like we are experiencing.

A measure of Municipal bond relative value is the yield as a percent to their corresponding Treasuries. For example, 5-year municipal bonds have historically traded around 75% of the 5 year Treasury. They normally have traded 85-90% between 5-15 years and closer to 100% beyond 15 years. The 5-year AAA municipal bond curve is currently 260% of the 5 year Treasury, 186% of 10-year and 162% of the 30-year.

The general flat Treasury curve and enormous Fed monetary stimulus packages suggest interest rates could remain low and for a long time. Investors seeking the benefits of higher income may find them in the volatile and dislocated corporate and municipal markets. Many of the larger issuers, those that have the liquidity and flexibility to endure this economic slowdown, are targeted opportunities.

Raymond James has a vast team of experts to assist in building portfolios or reviewing current positions. Ask your advisor if you are interested in a review of your current portfolio or would like to see a proposal of opportunities in the current fixed income landscape.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...