Chief Economist Eugenio J. Alemán discusses current economic conditions.

The risks to our forecast and to the US economy increased considerably after the latest statement from the FOMC with its updated projections for the path of interest rates. As an example, the March 2022 projection for the federal funds rate for 2022 was 1.9%, which was still below what is currently called the ‘neutral’ level for the federal funds rate. However, in this new projection, the FOMC estimates the “projected appropriate policy path” to be 3.4% for 2022, which is a highly restrictive level. Furthermore, for 2023, the path for the federal funds rate changed from 2.8% during its March projection, which was slightly restrictive, to 3.8% for this new projection, which is highly restrictive.

Thus, we are changing our forecast for the US economy and now estimate that the US economy will probably face a shallow recession during 2023. That is, the probability of a recession in 2023 has increased to 60%. The timing of this recession will depend on how fast the Federal Reserve (Fed) increases the federal funds rate during the rest of this year but at this time, our estimation is for a recession to hit the US economy during the second and third quarter of 2023. Our new forecast for US economic growth in 2022 is 2.1% while our forecast for 2023 is now 0.5%. Thus, we expect this to be a shallow recession. That is, we don’t expect the recession in 2023 to be deep or long lasting so the economy should be growing again by the end of 2023.

Why Are We Making This Recession Call?

Two factors are contributing to our view. First, the Fed is not in control, currently, of the factors pushing inflation higher from the cost side, i.e., supply chain issues, Ukraine-Russia war, etc., so the only thing it can do is slowdown consumer demand in order to rein in inflation and inflation expectations.

Second, the only way it can slow consumer demand today is by slowing employment growth and wage growth even at the risk of pushing the economy into a recession. And, the only instrument in its control to do that is increasing interest rates. Some argue that this is the same as using a ‘sledgehammer’ to hammer in a tack, as higher interest rates affect highly sensitive sectors of the economy, like the housing market. This may be true, but the Fed cannot risk a continuous increase in inflation expectations or what it sees as expectations becoming unanchored.

Can the US Economy Avoid a Recession in 2023?

Yes, there is still a smaller probability (40%) where we see the US economy avoiding a recession in 2023. But the stakes are high currently. The Fed needs to see inflation, and particularly, longer-term inflation expectations, abate. Thus, the path of inflation during the second half of this year is the key for determining whether we can avoid a recession in 2023. If inflation starts to slow down in the second half of the year, then the Fed tightening campaign may also slow down and in the end the Fed may not need to go as high as what their “projected appropriate policy path” is today.

The Federal Reserve: Trying to Beat Inflationary Expectations

The race is on for the Fed to try to control inflationary expectations, so they don’t become entrenched (see our Weekly Economics for June 10, 2022). Consumers and businesses hold the key to whether this latest inflationary episode abates or lingers for a longer time, as happened back in the 1970s and early 1980s.

The concept of expectations seems a bit flimsy, to say the least. However, it is not. It is of utmost importance and the Fed knows this. If consumers and business expectations agree with what the Fed sees for the future, the Fed’s job becomes easier. However, if that is not the case, the Fed may have to push the economy into a deep recession in order to conquer those expectations the hard way. And the social and economic costs of doing that are great. Thus, the Fed will try to do whatever it takes for inflationary expectations to remain anchored.

Today, inflationary expectations are riding high, just as inflation is, and American businesses and consumers feel the pain of higher prices in all the things they do.

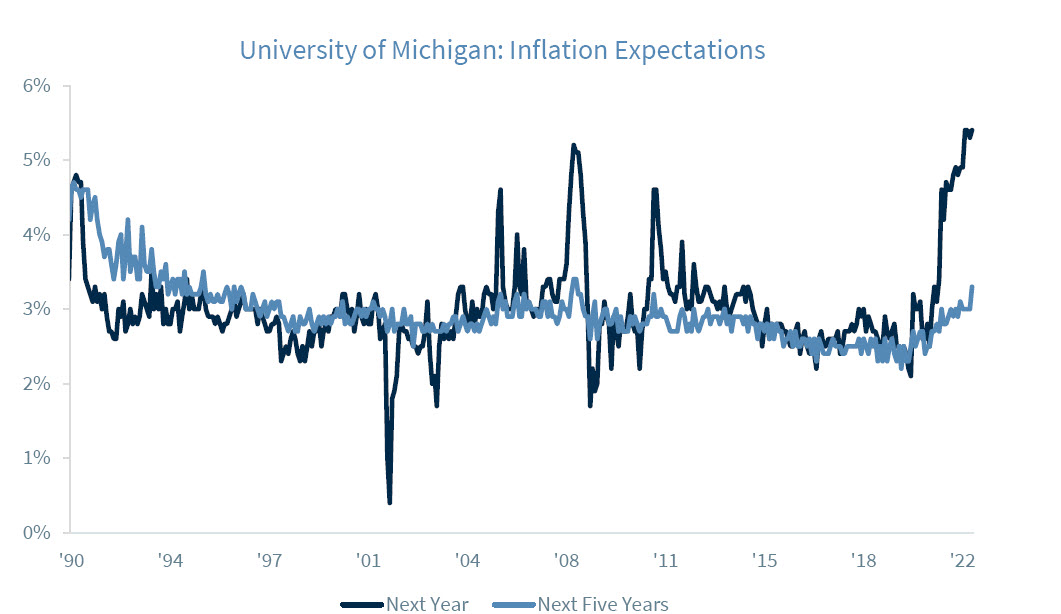

According to the University of Michigan Inflation Expectation Index, one year ahead inflation expectations have increased considerably, as shown in the graph below.

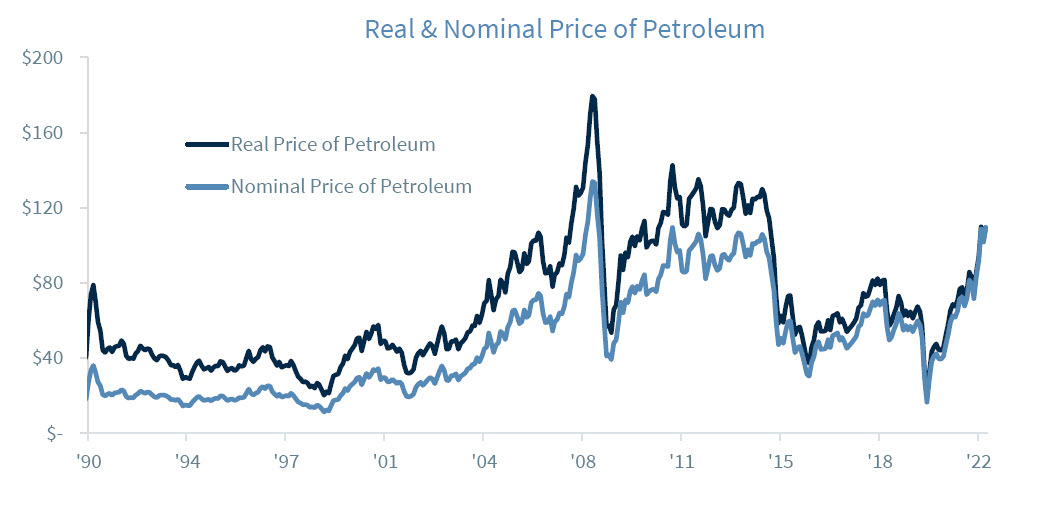

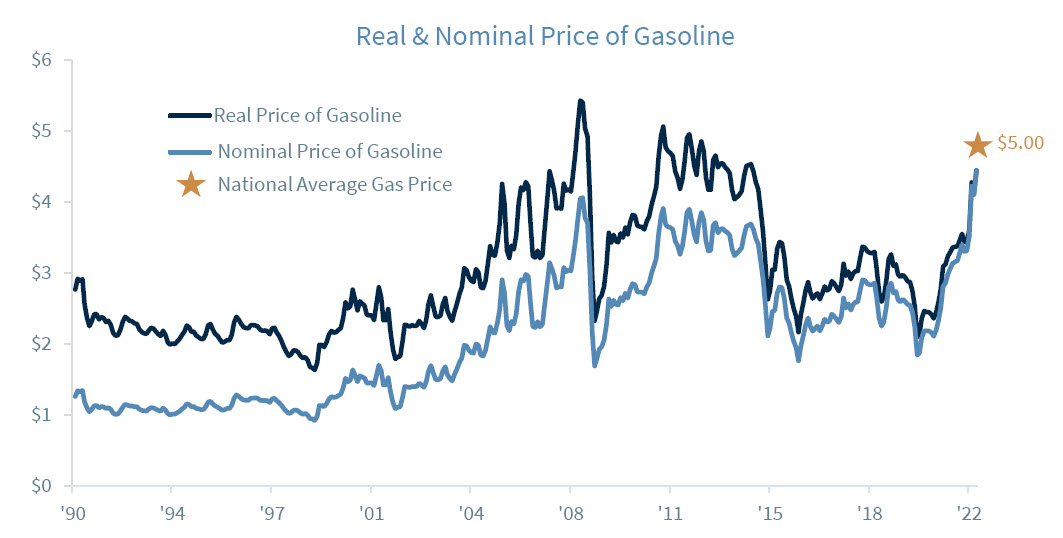

But the Fed is not extremely concerned about the year ahead measure of inflation expectations as higher inflation is already here. What they are most concerned about is future inflation expectations. The Fed is watching the behavior of longer-term inflation expectations and June’s value for the Michigan Inflation Expectations Index five years ahead, which is still preliminary, at 3.3%, loomed large during this week’s FOMC policy meeting discussions. If this 3.3% value stands, it will be the highest reading since a 3.4% print in May 2008. By the way, the price of petroleum in May 2008 was $125.40 per barrel, which looks eerily like today’s price for petroleum. True, the real price of petroleum, that is the price of petroleum adjusted for inflation back in 2008 was still much higher than today’s price of petroleum. However, the real (and nominal) price of gasoline today is fast approaching 2008’s values (see graph on the next page).

This is a clear signal that there are other factors affecting the price of gasoline that were not present in 2008 and whose control fall outside of the Fed’s sphere of influence. The war between Ukraine and Russia plus supply chain issues as well as low inventories, not only for petroleum but also for gasoline, fuel oil, and natural gas, etc. have been pushing prices much higher than they would otherwise be, putting further pressure on inflation.

The similarities with the pre-Great Recession environment are not that many. Yes, we could argue that there is froth in the housing market today but the differences with the pre-2008 period are marked, and we do not expect something like the Great Recession to happen under current conditions.

Thus, we do not see a financial crisis as we saw during the Great Recession, and we also don’t see a deep recession affecting the US economy.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the US Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

The producer price index is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

Industrial production: Industrial and production engineering is a measure of output of the industrial sector of the economy. The industrial sector includes manufacturing, mining, and utilities.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

FHFA house price index is a quarterly index that measures average changes in housing prices based on sales or refinancing’s of single-family homes whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac.

Consumer confidence index is an economic indicator published by various organizations in several countries. In simple terms, increased consumer confidence indicates economic growth in which consumers are spending money, indicating higher consumption.

ISM Manufacturing indexes are economic indicators derived from monthly surveys of private sector companies.

ISM Services Index is an economic index based on surveys of more than 400 non-manufacturing (or services) firms’ purchasing and supply executives.

Non-Manufacturing Business Activity Index is a seasonally adjusted index released by the Institute for Supply Management measuring business activity and conditions in the United States service economy as part of the Non-Manufacturing ISM Report on Business.

New orders index measures the value of the orders received in the course of the month by French companies with over 20 employees in the manufacturing industries working on orders.

Source: FactSet, data as of 6/3/2022

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...