Chief Economist Eugenio J. Alemán discusses current economic conditions.

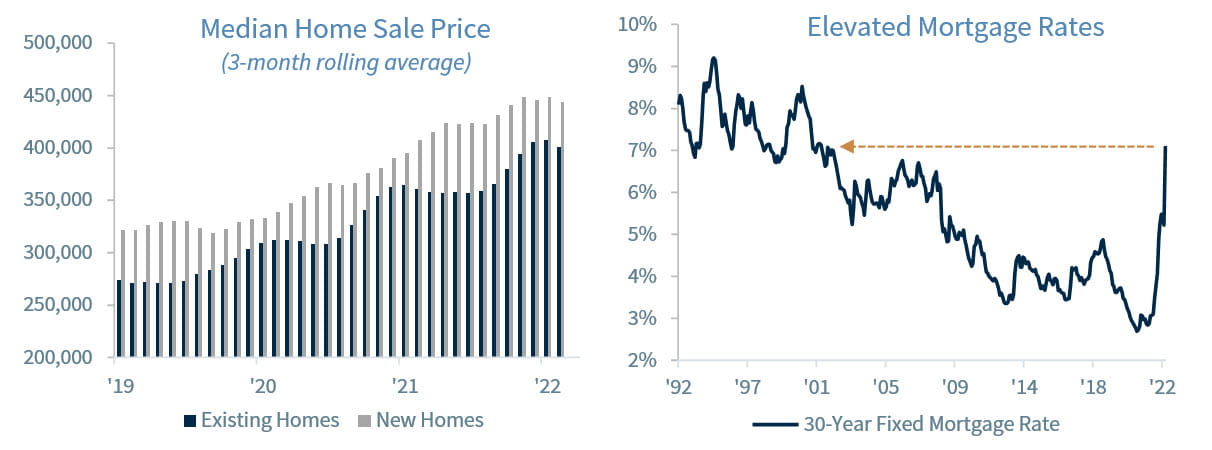

With mortgage rates more than doubling from ~3% to over 7% today the difference in cost between buying a home twelve months ago compared to today is very big. Not only are existing home prices up 8.4% year-over-year, but the same $400,000 mortgage costs ~$1,000 more per month than it did back then. The combination of higher mortgage rates and higher home prices has slowed the housing market significantly, with the number of existing home sales falling for ten consecutive months to the lowest number in eight years if we exclude the short-lived collapse in home sales in 2020.

Median home prices for both existing and new home sales are likely to continue to decline as mortgage rates remain elevated and the economy continues to slow down. The NAHB/Wells Fargo Housing Market Index continued its downward trend in October, as it recorded a value of 38, the weakest reading since a reading of 37 at the outset of the COVID pandemic. If we exclude the pandemic period, this is the lowest reading since August of 2012 when the U.S. housing market was recovering from the 2008-2009 Great Recession. What’s even more concerning about this release is the large decline in both the Traffic of Prospective Buyers Index and the expectations of Single-Family Sales over the next six months. These two Indexes are more forward looking, and this month’s declines projects a grim outlook for home sales.

From an economic perspective, ‘residential investment’ has historically made up 3-5% of GDP according to the National Association of Home Builders, and it includes construction, remodeling, and brokers’ fees. However, the largest impact on GDP comes from what’s called ‘consumption spending on housing services’, which averages 12-13% of GDP. This item includes gross rents, owners’ imputed rents, and utilities paid by renters and owners. Therefore, the direct and indirect effects of housing for the US economy represent about 15-18% of GDP. Thus, the decline that we are starting to witness in the housing market will likely have a large impact on the overall economy.

There are many additional costs associated with buying a home, such as closing fees, appraisals, and inspection costs. However, once the home is purchased, there are many ongoing expenses beyond the mortgage that include insurance, taxes, and maintenance, just to mention a few. However, from an economic standpoint, the housing market has ramifications well beyond the items listed above. For instance, homeowners tend to personalize their new homes with new pieces of furniture or freshly painted walls, which ultimately have an indirect impact on local businesses.

Since the pandemic, we have witnessed strong demand for housing and, consequently we saw a surge in home improvements. Homeowners tend to feel wealthier as their home values appreciate, but as home prices decline further into year end and in 2023, they might think twice before spending large amounts on their new dream home. Additionally, many homeowners have likely been impacted by this year’s stock market declines, and with inflationary pressures lingering many of them will start to feel the pressure from this environment. So, what could be the overall impact on the economy due to these knock-on effects? The National Association of Realtors estimates that the economic impact of each home sale besides the cost of construction is ~$54,000. The contribution mostly comes from income generated by real estate industries and from housing-related expenditures. However, it is hard to provide an economic impact estimate because these expenses affect sectors differently across the economy.

The housing market is a key component of the U.S. economy as we witnessed in 2008 during the housing crisis, and most importantly it has ramifications that spread across many industries that based on the estimates above have a potential spillover impact of more than $3 trillion. While the U.S. housing market is already in recession, we currently do not see or expect a collapse, but we do expect it to continue to weaken until interest rates start to decline, which is not expected to happen until 2024, according to the latest Federal Reserve (Fed) forecast. Therefore, while it is a priority for the Fed to bring down inflation by raising rates, it is imperative to consider that the repercussions of a declining housing market extend well beyond home prices.

The slow down in the housing market is good news for the Fed as it’s a sign that its strategy of targeting long-term interest rates (mortgage rates) to slow down the overall economy is working. Our expectation continues to be that the Fed will raise rates by another 125 bps over the next two FOMC meetings to a terminal federal funds rate of ~4.5%. This will bring rates further into restrictive territory and will put additional pressure on mortgage rates and further slow the housing market. The bottom line is that while home prices do not enter the Consumer Price Index (CPI) calculation, the services provided by housing do, either in terms of rent or owners’ equivalent rent, and they account for almost one-third of the inflation indicator. As mortgage rates go up, home prices start to decline, putting pressure on rental rates to go lower. This process takes time, as it has historically taken six to twelve months for changes in monetary policy to have a measurable impact on the economy. However, once rental prices start to decline, the shelter component of CPI should feel some relief, ultimately contributing to lower headline inflation.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the U.S. Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

Consumer confidence index is an economic indicator published by various organizations in several countries. In simple terms, increased consumer confidence indicates economic growth in which consumers are spending money, indicating higher consumption.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation.

Leading Economic Indicators: The Conference Board Leading Economic Index is an American economic leading indicator intended to forecast future economic activity. It is calculated by The Conference Board, a non-governmental organization, which determines the value of the index from the values of ten key variables

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Geographical Revenues: Overall country-specific revenues as a percentage of total revenues from a specific index such as the S&P 500 or the STOXX Europe 600.

Source: FactSet, data as of 9/30/2022

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...