Chief Economist Scott Brown discusses current economic conditions.

In his May 13 webcast on the economic outlook, Federal Reserve Chairman Jerome Powell struck a cautious tone. That mood was reinforced by the economic data reports that followed. The economic outlook depends on the virus and efforts to contain it. There’s hope that monetary and fiscal support will carry us through and the virus will be checked. However, economic improvement may take time and fall short of a full recovery. Many will fall through the cracks and deep recessions create long-lasting damage.

Powell noted the unprecedented speed and scope of the current downturn, “significantly worse than any recession since World War II.” The Fed’s policy response was quick and forceful. The Fed slashed short-term interest rates, restarted asset purchases, restarted credit and liquidity facilities that it used during the financial crisis, and launched some new ones. However, according to Powell, these efforts “may not be the final chapter, given that the path ahead is both highly uncertain and subject to significant downside risks.” He cautioned that “the recovery may take some time to gather momentum, and the passage of time can turn liquidity problems into solvency problems.” Powell indicated that further fiscal support will be needed, noting that while this could be costly, “it will be worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery.”

“While we are all affected” by the economic effects of the pandemic, Powell noted, “the burden has fallen most heavily on those least able to bear it.” The Fed conducts a survey of consumer finances every year. The results for 2019, posted last week, showed that 16% of adults were unable to pay all of their monthly bills at the time of the survey and 25% skipped medical care (a visit to a doctor or dentist) because they couldn’t afford the cost. To gauge the effects of the COVID-19, the Fed conducted a supplemental survey in early April, which showed that 19% reported either losing a job or experiencing a reduction in work hours in March. Nearly 40% of people working in February with a household income below $45,000 reported a job loss in March.

While the loss of labor income has been partly offset by “recovery rebate” checks and unemployment benefits, personal income slipped 2.0% in March and is expected to have fallen further in April (personal income and spending figures are set to be released on May 29). The index of (private- sector) aggregate weekly payrolls (from the employment report) fell 11.0% in April.

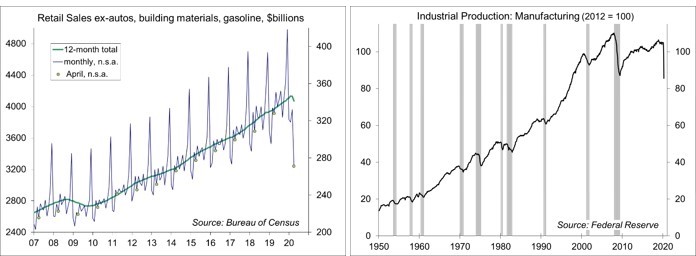

Retail sales fell more than expected in April, down 23.4% since February. The two-month decline was especially pronounced in clothing stores (-89.3%), home furnishings (-67.4%) electronics and appliances (-64.9%), restaurants (-50.5%), sporting goods (-49.0%), department stores (-44.7%), and auto dealerships (-36.5%). Sales at non-store retailers, which include online shopping, rose 13.7% between February and April (+21.6% y/y). Sales at grocery stores were mixed (up 28.6% in March, down 13.2% in April). Gasoline sales fell 40.5% in the last two months, although much of that reflected a 29.0% decline in gasoline prices.

Industrial production fell 11.2% in April (-15.0% y/y), the largest monthly decline in the 101-year history of the index. Manufacturing output fell 13.8% (-18.0% y/y). Production of motor vehicles and parts has declined 80.2% in the last two months. Heavy and medium truck assemblies have fallen 66.2% since February, while autos and light truck assemblies fell 99.0%.

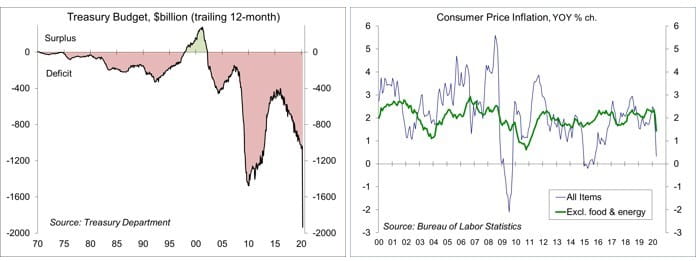

Treasury reported a $737.9 billion budget deficit for April, vs. a $160.3 billion surplus in April 2019. Revenues fell 54.8% y/y, reflecting the postponement of Tax Day (to July 15). Outlays rose 161.1%, reflecting increased spending on Health, Medicare, Income Security, and other pandemic-related related areas. The 12-month deficit totaled $1.941 trillion (about 9.2% of GDP). While tax receipts that would have arrived in April will eventually show up in July, spending will continue to rise. Congress has provided roughly $2.9 trillion (about 14% of GDP) in fiscal support for health-care providers, households, and businesses, and state and local governments. More fiscal support will be needed, especially in aid to state and local governments, which are facing growing budget constraints.

Will monetary and fiscal support boost inflation? Not likely. Excess capacity should put downward pressure on prices for the time being. There may be some bottleneck pressures as the economy rebounds, reflecting disruptions to supply chains. However, given the large increase in unemployment, wage pressures are expected to remain muted.

How will we pay off the debt? We don’t have to. The government is nothing like a household. The U.S. only has to make interest payments and be able to roll over the debt. The government’s borrowing costs are low and are expected to remain relatively low by historical standards even after the pandemic has passed. Demand for safe assets has surged and the Fed has stepped up its purchases of Treasury securities, so government borrowing is not crowding out private borrowing. At some point, beyond the pandemic, the U.S. will have to get its financial situation in order. That means getting government borrowing roughly in line with the growth in the overall economy. However, there are two dangers. One is not doing enough in the near term, worsening the economic damage. The other is tightening the budget too soon and dampening the pace of recovery.

As Powell warned:

“The overall policy response to date has provided a measure of relief and stability, and will provide some support to the recovery when it comes. But the coronavirus crisis raises longer-term concerns as well. The record shows that deeper and longer recessions can leave behind lasting damage to the productive capacity of the economy. of unemployment can damage or end workers’ careers as their skills lose value and professional networks dry up, and leave families in greater debt. The loss of thousands of small- and medium-sized businesses across the country would destroy the life’s work and family legacy of many business and community leaders and limit the strength of the recovery when it comes. These businesses are a principal source of job creation — something we will sorely need as people seek to return to work. expansion, further limiting the resurgence of jobs as well as the growth of capital stock and the pace of technological advancement. The result could be an extended period of low productivity growth and stagnant incomes.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...