Chief Economist Scott Brown discusses current economic conditions.

Amid extreme social distancing, economic activity took a major hit in March and April. The initial rebound in May, June, and July was strong, but partial, and the pace of improvement appears to have slowed in August. The easy part of the recovery is done. It gets harder from here. A few sectors of the economy are stronger than in February (grocery stores, retail auto sales, housing), most are still lower, and some (hotels, air travel, live entertainment) are far from their pre-pandemic levels and are likely to take years to recover.

Consumer spending accounts for 70% of Gross Domestic Product and employment is the key driver of spending. Nonfarm payrolls fell by 22 million in March and April. About half of those jobs were recovered by August. The Labor Department’s recent shift to additive seasonal adjustment makes the jobless claims figures of the last couple of weeks incomparable to previous data (which were under a multiplicative seasonal adjustment, exaggerating the August numbers). However, the unadjusted claims figures have remained relatively high, consistent with prolonged weakness in overall labor market conditions. Proprietary labor market indicators suggest a slower pace of job growth since the August payroll survey. Sales of motor vehicles have improved. Recovery rebate checks and the inability to spend in some areas (restaurants, entertainment, travel) likely helped consumers (those still employed) to pull together down payments for cars, boats, and other big-ticket purchases.

The housing market has strengthened. The shift to working from home has led to a shift in demand. If you’re going to spend more time at home, it makes sense to want more room and a better location. Mortgage rates are low, but prices have risen. Sales of existing homes are constrained by a limited number of homes for sale and elderly residents are generally less willing to relocate because of the pandemic. Sales of new homes are limited by the ability to build them. Lumber prices have risen sharply. There is typically an increase in furniture sales as existing home sales rise, but new residential fixed investment is still a relatively small part (about 3.3%) of GDP. While remote working has fueled housing strength, the pandemic has also put us on the brink of a foreclosure crisis.

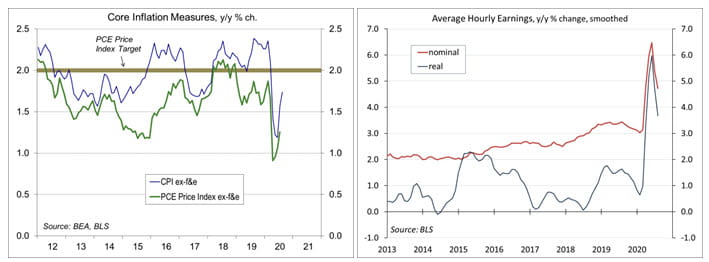

The Fed’s revised monetary policy framework was more evolutionary than revolutionary. It simply formalized what had already been underway. The Fed had adopted a symmetric inflation goal (meaning inflation could be too low as well as too high). The difference between a symmetric inflation goal and a flexible average inflation target is subtle, but it’s not a major break from the recent past. There has been less faith in a tradeoff between unemployment and inflation over the last several years and the Fed now recognizes that low unemployment significantly benefits low- and mid-income communities, leaving an employment goal that is broader and more inclusive. The Fed did as much as it could in the early part of the pandemic, ensuring adequate liquidity to the financial system, but monetary policy cannot do anything about the virus itself.

Fiscal support was critical in preventing the March/April downturn from becoming more severe. Aid was massive, but in line with the magnitude of the economic impact of the pandemic. Lawmakers have struggled to reach agreement on further action. Some support, such as enhanced unemployment benefits, expired at the end of July, but we didn’t see evidence of a cliff effect on spending. Some may see that as reducing the need for further fiscal support. However, we still have millions of Americans without work and pressures on state and local government budgets are building.

Fiscal support has added to the budget deficit. With less than one month remaining in the current fiscal year, the FY20 shortfall is expected to exceed $3 trillion (it was tracking at a little over $1 trillion before the pandemic). How do we pay for this? If we decide to pay down debt, we can do that over a long period (either through higher taxes or spending cuts). However, we don’t have to pay down federal debt. The Congressional Budget Office’s recent update on the outlook showed that while the deficit is significantly higher near term, the projections are now lower for later in the forecast horizon. Lower interest rates reduce the government’s interest payments even as the debt rises. With fiscal support the danger is not doing enough to aid the economy currently and taking that aid away too soon. Austerity may seem like a virtue, but is a sin in a weak economy or struggling recovery.

The economy is likely to improve further as households and businesses get used to working through the pandemic, but it won’t fully recover until the pandemic is well behind us. A vaccine is unlikely to be 100% effective and, distribution issues aside, many will refuse it. While the recovery could be stronger than expected, the risks are weighted primarily to the downside. In particular, job losses may remain elevated or increase in the months ahead.

Recent Economic Data

The Index of Small Business Optimism edged up to 100.2 in August (roughly the long-term average), vs. 98.8 in July and 100.6 in June (the index hit a low of 90.9 in April).

Job openings rose to 6.62 million in July (vs. 6.60 million in July), up sharply from the April low of 5.00 million, but still below February. Hiring rates and quit rates have moved closer to pre-pandemic levels.

The Producer Price Index rose 0.3% in August (-0.2% y/y), up 0.3% excluding food, energy, and trade services (+0.3% y/y). There were mixed signs of pipeline inflation pressures at the earlier stages of production. Ex- food & energy, the index for processed intermediate goods rose 0.5% (-1.1% y/y) and the index for unprocessed intermediate goods rose 1.7% (+5.7% y/y). Lumber rose 10.5% (+27.6% y/y, mostly in the last three months).

The Consumer Price Index rose 0.4% in August (+1.3% y/y). Food prices (+0.1% in August) were mixed and gasoline prices (+2.0%) were boosted somewhat by the seasonal adjustment. Ex-food and energy, the CPI rose 0.4% (+1.7% y/y), boosted by a 5.4% gain in prices of used cars and trucks. Apparel prices rose 0.6%, continuing to recover ground lost in the early stages of the pandemic (now -5.9% y/y).

Real hourly earnings were unchanged in August, as the increase in prices offset a 0.4% gain in nominal earnings. For production workers, real hourly earnings advanced 0.2%. The year-over-year percentage changes are still significantly distorted by the earlier massive loss of low-wage jobs (which are far from fully recovered).

Gauging the Recovery

Jobless claims, a leading economic indicator, totaled 885,000 in the week ending September 5, the second week under the revised seasonal adjustment – still extremely high by historical standards (although less horrific than in March and April). Unadjusted claims totaled 857,148. Continuing claims (for regular state unemployment insurance programs), a coincident economic indicator, rose by 93,000 (week ending August 29) to 13.385 million. However, total persons claiming UI benefits (all programs) rose by 380,000 in the week ending August 22 to 29.605 million (not seasonally adjusted) – in comparison, the monthly employment report showed 13.6 million unemployed in August.

The New York Fed’s Weekly Economic Index rose to -4.26% for the week of September 5, up from -4.80% in the previous week and a low of -11.45% at the end of April. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

The University of Michigan’s Consumer Sentiment Index edged up to 74.1 in the full-month assessment for August (the survey covered July 29 to August 24), vs. 72.8 at mid-month and 72.5 in July. The report noted that “half of all consumers anticipated the economy would improve in the year ahead, but 62% judged that the overall conditions in the economy could be best described as unfavorable.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...