March 26, 2021

Chief Economist Scott Brown discusses current economic conditions.

Economic data rarely follow a smooth path. Weather and external events have effects. Consumer spending can be uneven. New orders tend to come in bunches. One should never place a lot of weight on one particular month’s worth of data. The stories behind the numbers are what’s important. There is a lot of optimism as we look to the remainder of the year, some degree of fear (of inflation, likely unfounded), and more than a fair amount of uncertainty.

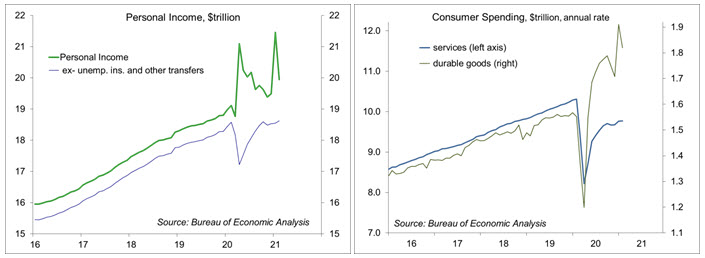

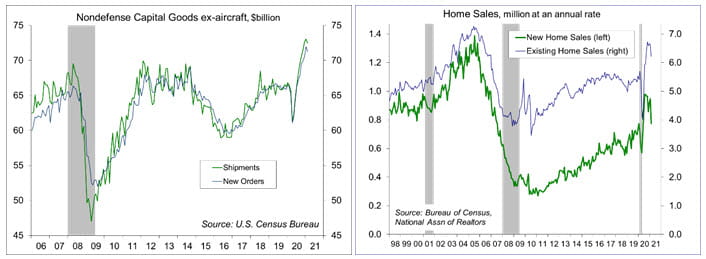

Most of the January and February data reports are in and weather has played a significant role. Weather was unusually mild in January and exceptionally bad in February. Consumer spending, durable goods orders and shipments, construction activity, new and existing home sales, and industrial production all posted declines in February, while still exhibiting strength on a year-over-year basis. For example, orders for nondefense capital goods ex-aircraft, a rough proxy for business investment in equipment, fell 0.8% in February, but the total for the first two months of the year were up 8.5% from the first two months of 2020. Consumer spending on durable goods dropped 4.7% in February, but was still up 17.2% from a year earlier. Existing home sales fell 6.6% in February, but were up 9.1% year-over-year.

Of course, the biggest hit from the pandemic has come in consumer services. Those services where individuals come into close contact with others were especially hard hit – and won’t fully recover until the pandemic is well behind us. For the household sector, spending on services is roughly six times the spending on durables. Consumer spending on services edged up 0.1% in February, as bad weather offset the impact of a general opening in the economy. We can expect sharp improvement in March.

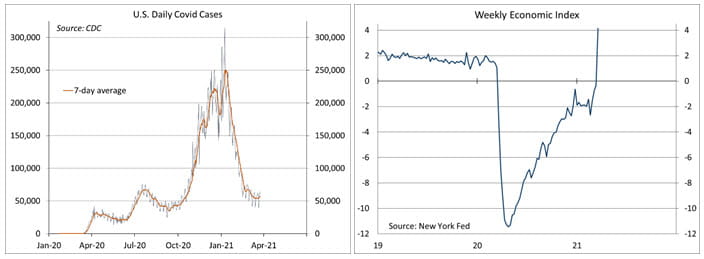

While the rate of new COVID-19 cases has fallen, it’s not zero. Despite the increased availability of vaccines, the number of new cases has been trending above 55,000 per day – much less horrific that in early January (250,000), but still relatively high. Deaths from COVID-19 are running at about 7,000 per week – down from 23,000 in mid-January, but still high. Implicitly, the U.S. has made a trade-off between deaths and economic growth. To keep deaths low, the economy should open gradually, but it appears to be going fast. So now, it’s a question of how many will accept the vaccine. Lockdowns and restrictions will be behind us. Cooped up for a year, many are eager to make up for lost time. Some may still be reluctant to go out in crowds.

In his post-FOMC press conference, Fed Chair Powell said that the recovery could go “more quickly than it has in the past, because it involves reopening the economy, as opposed to stimulating aggregate demand and waiting for that to produce demand for workers.” He admitted that it will still take time for unemployment to go down and for labor force participation to recovery. However, anecdotal evidence suggests that unemployed workers may be unlikely to step into their old jobs. It’s ironic that with 9.5 million unemployed, firms continue to report difficulties finding skilled labor. A cynic would say that simply means difficulty finding people willing to work for what you want to pay them, but there are clearly issues in manufacturing. Many firms are having problems even locating those they had furloughed months ago. Worker shortages have contributed to supply chain issues. Some training will be required, but that takes time. Training should be less of a problem in the lower-skill services industries, but there are likely to be challenges matching millions of unemployed workers to available jobs.

The drop in new COVID-19 cases (relative to the start of this year), the faster arrival of vaccines, and larger-than-expected fiscal stimulus has boosted the outlook for GDP growth this year, and the stimulus should provide ongoing support into 2022. While inflation worries are exaggerated, there is a lively debate among economists about the possible consequences. In the Federal Reserve’s revised monetary policy framework, the central bank will aim for a period of inflation moderately above 2%, but it retains the long-term goal of 2%. If the Fed’s “patiently accommodative” monetary policy stance proves to be a mistake, and inflation rises above 3% for an extended period and inflation expectations become unanchored, then it may have to hit the brakes harder later on, which means potential disruptions to financial conditions and a weaker growth outlook. We won’t know for sure until after the fact, but Fed officials remain confident that everything will work out.

The March Employment Report arrives on April 2, Good Friday. The stock market will be closed, but the bond market will be open for a half session to respond to the numbers. There’s always uncertainty with the nonfarm payroll figures (which are reported accurate to ±110,000). Part of the March payroll gain will reflect a recovery from February’s bad weather. Job growth should remain strong in the months ahead, but job matching difficulties may be a constraint.

Recent Economic Data

Real GDP rose at a 4.3% annual rate in the 3rd estimate for 4Q20 (vs. +4.2% in the second estimate), due partly to an upward revision in inventory growth.

Personal income fell 7.1% in February (+4.3% y/y), reflecting direct deposits that went out in January (and have gone out again in March). Wage and salary income was flat, reflecting an impact from bad weather.

Personal spending fell 1.0% in February, reflecting bad weather, following a 3.4% gain in January (-0.6% y/y). Spending on consumer durables fell 4.7% (+17.2% y/y). Spending on services edged up 0.1% (-5.2% y/y).

The PCE Price Index rose 0.2% (+1.6% y/y), up 0.1% (+1.4% y/y) excluding food and energy.

Durable goods orders fell 1.1% in the initial estimate for February. Ex-transportation, orders fell 0.9%, with the first two months of the year up 7.0% from the same period in 2020.

New home sales fell 18.2% in February, to a 775,000 seasonally adjusted annual rate (still up 8.2% y/y). Existing home sales fell 6.6%, to a 6.22 million seasonally adjusted annual rate, up 9.1% y/y.

The current account deficit, the broadest measure of U.S./foreign trade, rose to $188.5 billion (3.5% of GDP) in 4Q20, up from $104.3 billion (1.9% of GDP) in 4Q19.

The Chicago Fed National Activity Index fell to -1.09 in February, consistent with bad weather, bringing the three-month average to -0.02.

Gauging the Recovery

The trend in COVID-19 cases is much less horrific than at the start of the year (when new cases averaged 250,000 per day), but the level is still pretty high (weekly deaths at about 7,200, vs. over 23,000 in mid- January). Vaccines are arriving a lot sooner than expected, but the virus is still out there. Be careful out there.

The New York Fed’s Weekly Economic Index rose to +4.14% for the week ending March 20, up from -0.33% a week earlier (revised from -0.97%), signifying strength relative to the weak data of a year ago. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

Jobless claims fell by 97,000, to 684,000, in the week ending March 20 (656,789 before seasonal adjustment), the first time below 700,000 in a year. Claims totaled 8.38 million over the first ten weeks of the year. The continued elevated level of claims appears to reflect people repeatedly getting short-term work.

The University of Michigan’s Consumer Sentiment Index rose to 84.9 (a 12-month high) in the full-month assessment for March (the survey covered February 24 to March 10), vs. 83.0 at mid-month and 76.8 in February. The report noted gains from disbursement of relief checks and better than anticipated vaccination progress. The data point toward “robust increases in consumer spending,” the report said, but much will depend on the draw-down in savings.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...