Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

The start of a new year always seems like a time to hit the reset button and undo any wrongs the world threw at us last year. I happen to be quite adept at the process of channeling new positive thoughts and forgetting the negative as I am a lifelong Cubs fan with years of practicing this art. The truth is, for income investors, fixed income recorded a very fruitful year pushing yields to levels not obtainable in recent history. Fixed income is typically a long-term investment strategy. 2022 allowed an opportunity for all income investors to better position their portfolio allocation dedicated to protecting principal and providing income and cash flow. I thought I’d provide some background statistics to put in perspective how the market developed last year so that next week we can talk about where we foresee going forward this year and what strategies might be used in 2023.

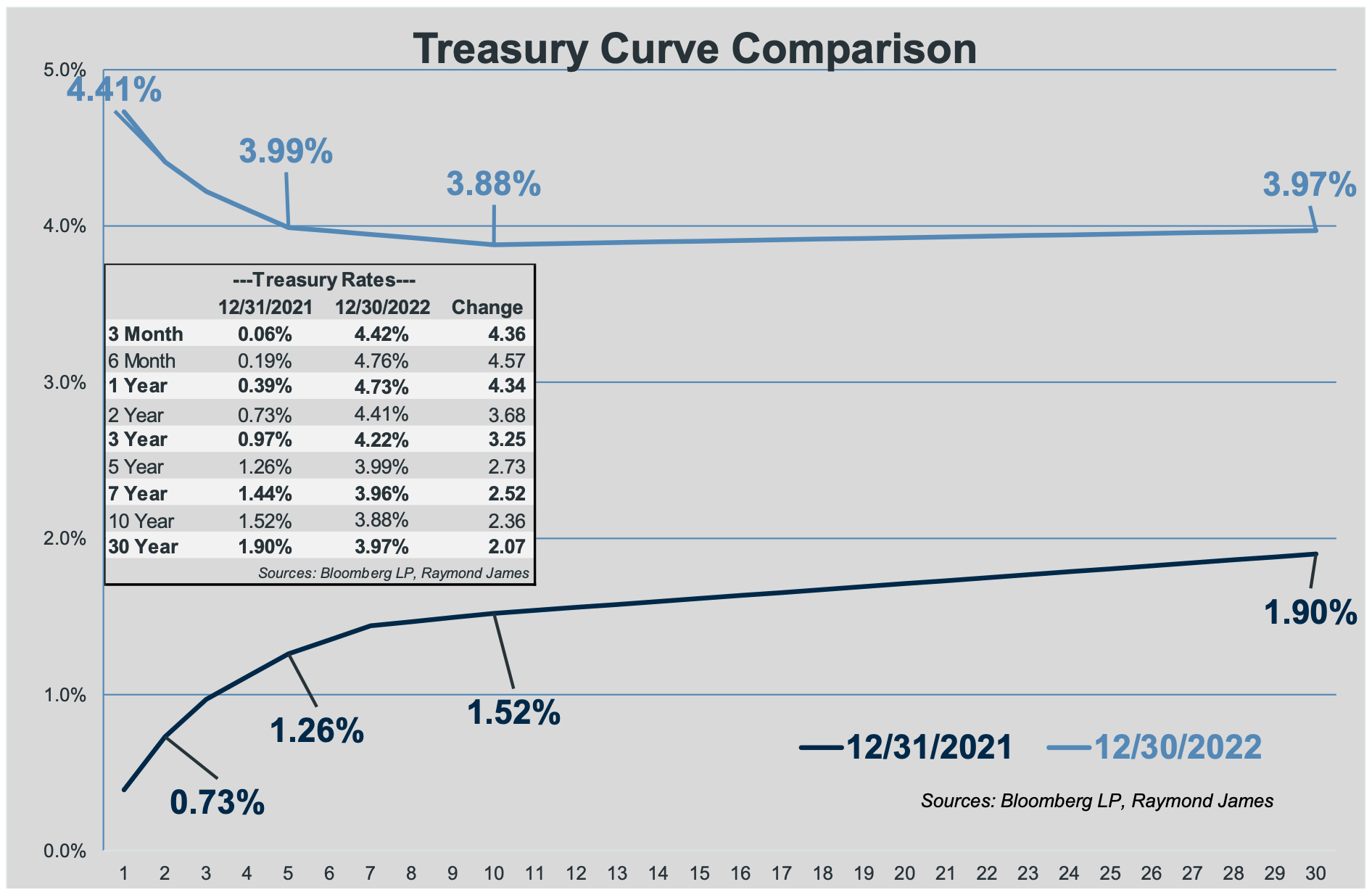

Treasury prices took a pretty big blow in 2022, thus yields rose significantly. As you can see in the graph, the overall changes were disproportionate as the shorter end of the Treasury curve experienced the greatest yield increases. The 3 month T-bill underwent a 436 basis point (bp) increase, more than double the 207bp yield upturn of the 30 year Treasury bond. It is also noted that the Treasury yield curve ended the year inverted: short term yields are greater than long term yields. Historically speaking, this often occurs preceding a recession. We will talk more about that possibility next week.

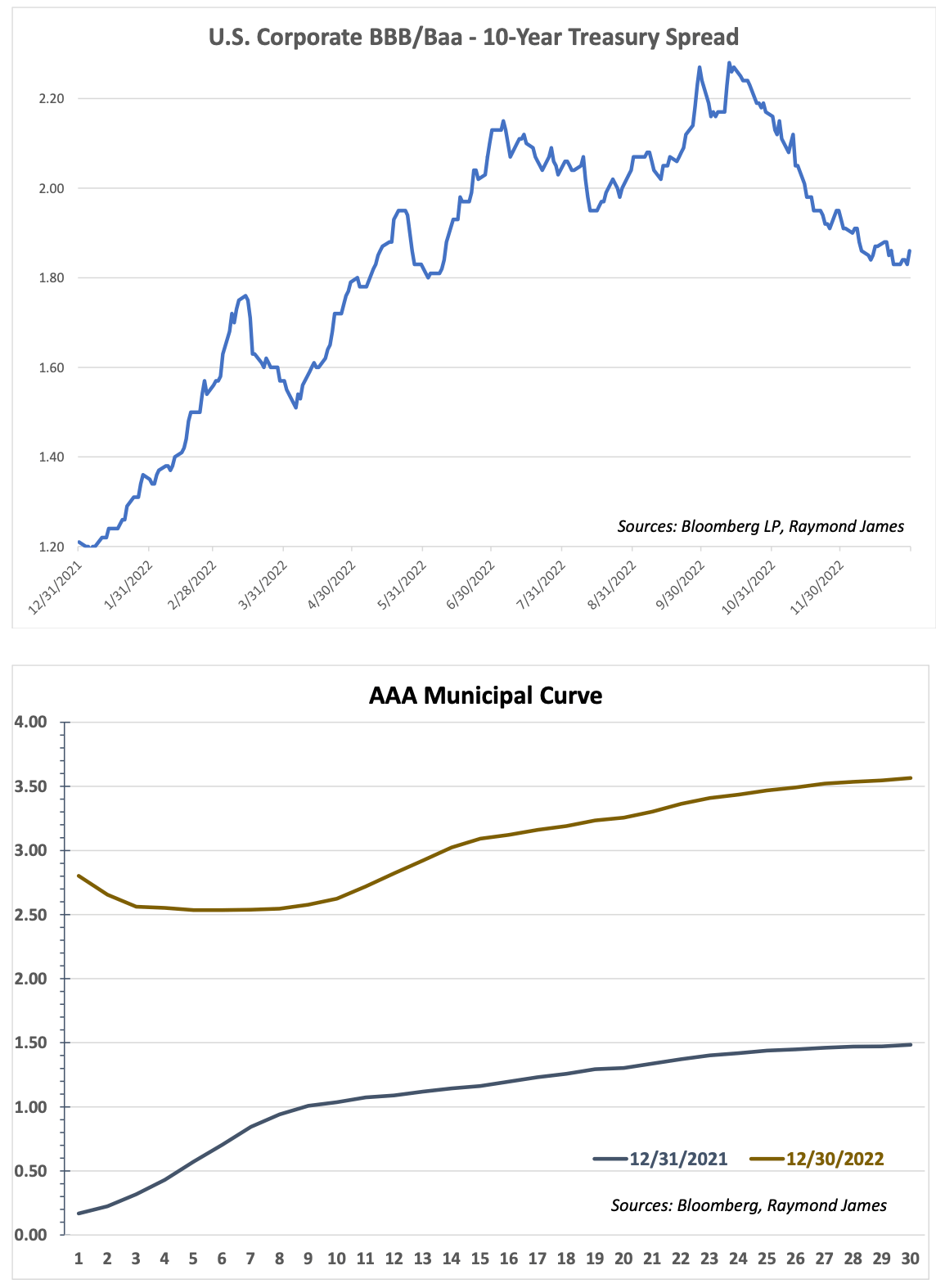

In general, spreads also increased in 2022 helping to boost yields in various fixed income products including: corporate bonds, certificates of deposits (CDs) and municipal bonds. By example, the following graph depicts the spread change that occurred in 10 year U.S. corporate bonds that have an investment-grade rating of BBB/Baa versus the Treasury 10 year bond. The net comparison shows how the spread between the two widened. When combining the increase in Treasury yields with the increase in the spread, the consequence is higher yields.

Municipal bond yields also faired well in 2022 reversing the trend from the previous year. Municipal yields increased across the maturity spectrum. Robust demand for short maturities has pushed the cost for short term versus longer term maturities high but the municipal curve ten years and out maintains a rewarding upward slope the further out one goes.

We often remind investors that the primary goal of fixed income is often to protect principal. That reminder was in light of how low interest rates had fallen. Now that interest rates have increased, that primary goal does not change. Instead, it offers investors a dual benefit of continuing to offer principal protection but also providing more income and healthy cash flows to investors.

The last chart compares the net yields available in different investment grade product types providing the net changes from the beginning to end of the year. Please look forward to next week’s Bond Market Commentary for views on what strategies to employ in 2023.

We appreciate all your attention and allowing us to provide fixed income support to you throughout the year. We look forward to another year of partnership. Happy New Year!

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...