March 1, 2021

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Our opinions are often acquired by our personal life experiences. If you are unfortunate and purchase a car that turns out to be a lemon, and you spend countless hours and money on repairs, you will quite likely swear off the make and model of that car in the future. Statistics may show that was a fluke. Only one in tens of thousands of this particular make and model car meet this fate, but your bias has been formulated.

The financial world may parallel this sort of bias behavior. If you are in your 40s, building a house, putting a child through college and taking care of a sickly parent, you may scoff at discussions of whether there is inflation or not. Of course there is inflation… well at least in your reality. Lumber prices are excessive, college tuition is soaring and medical expenses have gone up. Everything in your world is being met with higher prices (inflation).

Now suppose you are 60, nearing retirement, in the same house for 30 years, have grown children, concentrating on saving money and your splurge is an occasional tech gadget or extravagant vacation. Nearly nothing in your world is being impacted by inflation. As a matter of fact, much of your world is more affordable on a relative basis than it was years ago.

This portrays two distinctly different experiences creating two distinctly different biases in the same real world and singular financial market. This illustrates how personal experiences are bifurcated and may cloud your assessment of the economy. In this example, certain sectors of the economy are experiencing inflation while other sectors are more affordable. Split scenarios are appearing in other arenas too.

This virus initiated crisis, turned into a recession. Businesses were literally shut down. However, outcomes have been divided. While airlines, hotels, small businesses, movie theaters, health clubs, entertainment venues and restaurants have been financially devastated, online retailers, takeout services, home exercise equipment providers, video conference firms, streaming services, game makers and grocery stores have all boomed. Again, segmented sectors experiencing very different consequences to the same crisis.

The effects on employment have likewise, diverse consequences. Many of us now work provisionally from home due to the pandemic. We are less likely to: purchase work apparel, make trips to the dry cleaner and burn gas. Although your job output may have remained consistent, your new temporary lifestyle has greatly affected the dry cleaner operator, gas attendant and retail employee. Your personal bias may not be reflective of your neighbor’s experience.

The stock market has benefitted with a tremendous run, yet 31% of the S&P Index stocks were priced lower on February 24, 2021, versus where they were January 3, 2020. The S&P Index is up 21% over that period yet only 282 (56%) of the stocks match that percentage rise. Stocks returns are varied.

The disparities rouse a myriad of discussions, articles and debates which due to the divergent data, can confusingly authenticate opposing viewpoints.

The economy as a whole, is arguably not in a better position than it was pre-COVID. Predictions of rates, inflation and where our economy may end the year should be viewed with caution.

It has been suggested that it may be reasonable for rates to settle near pre-COVID levels. One noteworthy statistic to consider is that the Federal Reserve’s balance sheet ($4.1 trillion January, 2020 and $7.3 trillion January, 2021) is projected to grow another $2-$4 trillion by year’s end, an enormous potential pre-COVID difference. Getting the economy back to previous levels further assumes that companies somehow get to their pre-COVID performance levels and vaccination distribution actually meets expectations.

In January of last year, the 10-year Treasury was at 1.78%. The current 10-year Treasury rate is ~1.45%, close to where it is was one year ago. Every 10 basis point move seems to be absorbed with dramatic contemplation. Whether this part of the curve settles at 1.78% or 1.37% or 1.20% or 0.90% may not have a meaningful impact to our economy or overall productivity. All of these instances reflect a continued low interest rate environment.

Imagine the economy being as complex as a human body. Each part works independently yet collectively work simultaneously as one homogenous unit. Similarly, there are a lot of economic variables in the air which converge as our economic state. There are two meaningful variables with significant economic impact which are headwinds to higher interest rates, anything but inconsequential and merit meaningful valuation.

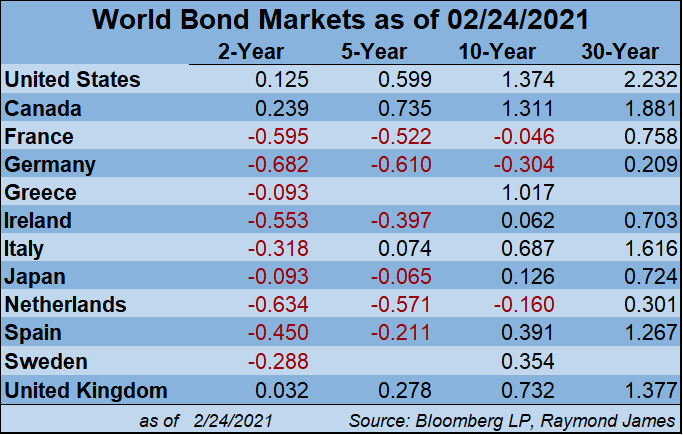

First, world interest rate disparity exists and is widespread. Nearly all economically sound nations outside of the United States share one thing in common: lower interest rates. I would challenge anyone to make fundamental sense explaining why countries, like Spain and Greece, hold lower interest rates than here in the U.S. Most of these world countries carry a higher percentage of debt, produce a fraction of gross domestic production (GDP), maintain smaller markets and have diminutive projected future means to future earnings.

Interest rate disparity can diverge only so much. In other words, this global economy dictates that it will require changes and growth beyond the United States to see significant rate changes.

Second, the distribution of age and wealth in the U.S. meaningfully can influence future growth. Consumer spending drives and represents 70% of our economy. The population of 60+ year olds account for roughly 18% of the population yet control nearly 50% of the wealth. Why is this so meaningful? Pandemic or not, this age group has accumulated their most meaningful assets and have already consumed life’s biggest expenditures. They in large part, own their homes and cars and have raised their children and paid their tuitions. They are predominantly savers or in the saving stage of life and not spenders. As the population continues to age, these older, wealthier individuals may dampen lofty consumer spending.

The ten year Treasury at 0.90% or 1.90% may have little effect on fixed income long term allocation planning. We easily can be drawn to biases dictated by our current experiences. We see things through our eyes rather than as they may be universally. Your situation may not be in sync with the realities of the world, which is why each investor’s portfolio is unique to their circumstances and their personal goals.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...