Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

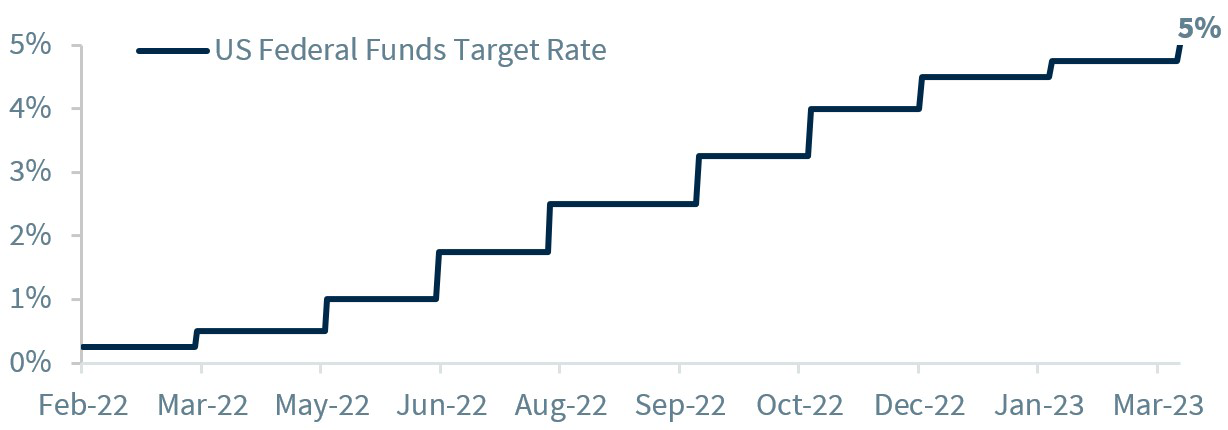

- Fed eases pace of rate hikes with 25 basis point move

- Job cuts broadening to industries beyond tech

- Full effects of tightening yet to be felt

Punxsutawney Phil – the world’s most famous groundhog – saw his shadow. So, for those of us braving colder temperatures, if tradition holds true, we may have six more weeks of winter to go. Fortunately, historic weather data doesn’t give this furry forecaster much predictive power. But if there is one thing investors can count on over the next six weeks, it is that the Fed will be underground assessing the economic outlook ahead of the critical March Federal Open Market Committee meeting (March 21-22). Chair Powell was clear at this week’s press conference that the Fed is not ready for rate hikes to go into hibernation, but the upcoming data releases and Fed member speeches will be more critical in discerning how the Fed’s economic forecasts will be adjusted and when the tightening cycle may come to an end.

With spring comes hope – of the end of the tightening cycle | On Wednesday, the Fed announced its eighth consecutive interest rate hike. The committee slowed the pace as expected, as the 25 basis point increase brought the target range (4.5-4.75%) to the highest level since 2008. Given the strong employment report, our economist now anticipates two additional 25 basis point hikes at the March and May meetings before the Fed ends this tightening cycle and pauses for the remainder of the year, contrary to market expectations that the Fed will cut interest rates twice by the end of the year. Admittedly, we (and the markets) seemed to bypass Powell’s confirmation that rate hikes would be “ongoing.” Why? Because the Fed needs to be uber cautious “declaring victory” on inflation, especially when it was misguided by the extent of the ramp up in inflation last year. Below are a list of economic developments that will be on the Fed’s (and our) radar without a shadow of a doubt, which we believe will likely confirm the end of the tightening cycle this spring – which should be a positive catalyst for both the equity and fixed income markets.

- The season of easing inflation | Powell acknowledged that there is “welcome” evidence of disinflation beginning but cautioned that substantially more progress—particularly in the services component is needed before ending tightening. And although PCE (Personal Consumption Expenditures) is the Fed’s preferred inflation metric, the committee will benefit from receiving two CPI (Consumer Price Index) prints (February 14 & March 14) before its next rate decision. Note that the year-over-year pace of inflation has quickly descended from 9.1% to 6.5% over the last six months. Our ‘boots on the ground’ or real-time data (e.g., Zillow rental rates, memory chip and used car prices) confirm that the trajectory for inflation is indeed still lower. Yes, it is a process that takes time. But ultimately, an easing of lagging shelter costs, weakness in goods prices (which will be in focus with upcoming major retailer earnings results) and moving past the anniversary of the Russia-Ukraine war (and related commodity price surge) should guide headline inflation to our forecast of 2.2% – closer to the Fed’s target – by year end.

- A shadow to be cast on the labor market | The resilience of the labor market has been remarkable to this point, evidenced by 517k jobs added in January, the unemployment rate matching a record low (3.4%), job openings above 11 million, and initial claims at the lowest level since April. However, as economic growth eases, the pace of job gains and wage growth should moderate. And signs of cracks are beginning to form with layoffs and reduced hiring plans. Most of the job cuts to date have been within the tech space, but layoffs are broadening to companies in other industries such as 3M, Hasbro, Goldman and FedEx. A slowing in hiring and easing wage growth, combined with evaporating excess consumer savings, will hamper consumer spending in the second half of the year. Already, core retail sales have declined two straight months. The next employment report (March 10), weekly jobless claims (which may soon reflect layoffs) and retail sales (February 15 & March 15) will be closely watched.

- Impact of higher rates | The U.S. economy is interest rate sensitive and higher interest rates are having an impact. Chairman Powell acknowledged the lagged effects of higher rates as he said that over the last year the Fed has taken “forceful action” to tighten and that while it has “covered a lot of ground… the full effects of our rapid tightening so far are yet to be felt.” Just look at the struggling housing market with existing home sales down an astounding 35% YOY and price increases softening. While auto sales remain healthy, the delinquencies on sub-prime auto loans are nearing record levels. The same is occurring with credit card delinquencies. The Fed will need to keep watch to assure it does not ‘overtighten’ and induce more credit concerns.

- Fed speak in focus | At the FOMC meeting six weeks away, monitoring Fed speak will be critical to gauge how incoming economic data is impacting individual Fed member’s economic outlooks. Of note, Chair Powell is slated to speak next Tuesday at the Economic Club of Washington. In light of the strong January employment report and ISM Services Index, investors will watch how he balances a resilient labor market with a slowing in other leading economic indicators (e.g., ISM Manufacturing, housing).

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...