Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- A U.S. recession will likely be the mildest in history

- Fed rate cuts are on the horizon in 2024

- Small caps are a ‘dive’ worth considering

Want to know what’s ‘cooking’ in the financial markets in 2024? Please join us on Monday, January 8 at 4 p.m. ET | 3 p.m. CT | 2 p.m. MT | 1 p.m. PT, as we present our Ten Themes for 2024. Our Ten Themes presentation is a collection of what we deem to be the most critical economic and financial market insights for investors for the upcoming year. After a few surprises (e.g., no recession, 25%+ equity returns, Tech super rally, positive fixed income returns) from last year that ended up being beneficial for investors, we have rolled up our sleeves and whipped up what we believe will be on the financial markets’ menu in 2024. This year, we selected popular television cooking shows and kitchen references as an overriding theme to articulate our views. Here is a quick preview to whet your appetite:

- The ‘rotisserie’ economy | The long-awaited recession never materialized in 2023 as the sectors of the economy rotated from hot (i.e., travel and leisure) to cold (i.e., housing) over the last few years. Just like a rotisserie oven turns constantly to keep food cooking at just the right temperature, the economy has been able to avoid getting too chilled all at once – often a recipe for a severe recession. We still expect a recession in 2024, but it will likely be the mildest in history.

- Powell is the ‘top chef’ | Powell has served up a restrictive diet of interest rate hikes to bring inflation back under control. But with growth concerns mounting and inflation pressures easing, the Federal Reserve (Fed) can add a little more spice to the menu. Rate cuts are on the horizon, with the Fed likely to deliver three or four cuts in 2024.

- Fixed income had a ‘makeover’ | The sharp reset in bond yields has given the fixed income markets the ‘makeover’ it needed. Despite the massive rally in the final months of the year, yields remain near their highest levels in over a decade. With a mild recession on the horizon, the 10-year Treasury yield should settle near 3.5% in 2024. We favor quality over lower rated credits.

- U.S. equities require a more discerning eye | After a 25% return for the equity market last year, investors will need to have a discerning eye, like Gordon Ramsay in ‘Hell’s Kitchen’, and be more selective in 2024. With a lot of good news priced into the market (slowing inflation, Fed cuts), earnings will need to grow to propel the markets higher from here. Given our expectation of a mild recession, current consensus EPS estimates of $245 are likely too high. Instead, we think 2% EPS growth to $225 is more likely. History (election year, Fed easing) suggests there is upside to the market, albeit more muted to 4,850 by year-end 2024.

- ‘Richer flavors’ among favored U.S. equity sectors | In a slowing economic environment, earnings growth will be a decisive factor in determining sector performance. That’s why our 2024 ‘Michelin Star’ sectors are like America’s Test Kitchen: familiar spaces being improved by experimenting with new gadgets and ingredients. Three sectors that are likely to benefit are Info Tech (AI), Health Care (innovative drugs) and Industrials (reshoring).

- Small caps are a ‘dive’ worth considering | While some ‘dive’ restaurants look ugly on the outside, the food and atmosphere make up for it. Underperforming small-cap equities may appear unappealing at first glance, but fundamentals (i.e., attractive valuations, outperformance following recession/Fed cutting cycle, higher weighting to our favorite sectors) under the surface make them a ‘dive’ worth visiting in 2024.

- Still favor U.S. equities over international | While international equities are attractively priced relative to U.S. equities, the U.S. is still our ‘prime’ choice. However, we continue to see opportunities in emerging markets, particularly in India and Mexico.

- Discipline still driving energy | Discipline is a key characteristic in both the kitchen and in energy markets. OPEC has shown discipline in curtailing oil supply, just as private U.S. companies have been restrained in drilling new wells. This discipline, combined with a recovery in demand, should push oil prices higher toward $85/barrel by year-end 2024. This supports our contrarian call on the Energy sector over the next 12 months.

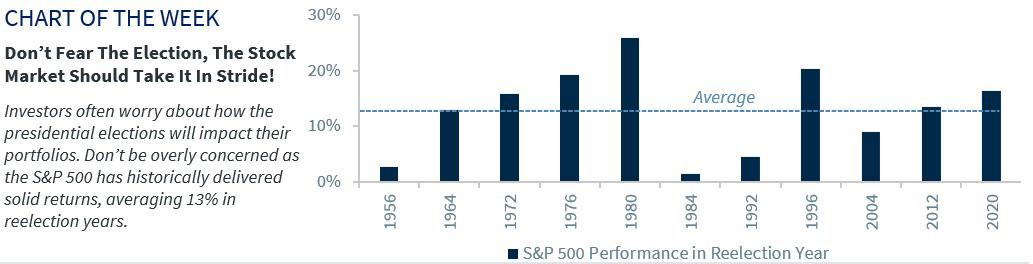

- Turning up the ‘heat’ on volatility | 2023 was the year of positive surprises. While the market expected a recession, elevated inflation, and a sharp decline in earnings this did not come to fruition. That led to the S&P 500 being up over 25% for the year. However, with the market and investors optimistic, it could be setting up for disappointment in 2024. This, combined with elevated geopolitical risks and a US presidential election should lead to increased volatility in 2024.

- Asset allocation is like a ‘balanced’ meal | While it’s easy to eat too much of one thing at the ‘buffet’, a balanced approach is the healthier option. The same concept applies to asset allocation. Stay true to your asset allocation and do not gorge yourself by over investing in last year’s ‘hot’ investments.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...