Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The ‘speed & precision’ of the Fed will help the U.S. economy

- Sizable stimulus moves congress into ‘the lineup’

- A vaccine is slow to develop but has ‘MVP’ potential

Despite major sports leagues canceling their seasons, there is still a buzz as the National Football League prepares to host its 85th draft next week. It will be the first to occur virtually, with commissioner Roger Goodell announcing each pick from the basement of his New York home! When it comes to providing reliable, consistent, properly finessed investment views, we hope to be your ‘first round pick,’ particularly as we navigate this time period of unprecedented uncertainty. But as for the US economy combating the COVID-19 outbreak, there’s a lot of ‘top notch talent’ that has helped set the stage for an eventual recovery. We believe firmly that we’re all in this together, and that many key ‘players’ will remain instrumental in helping the economy embark on another ‘championship’ run. Below is our mock draft of who we believe demonstrates the skills to turn this economy around. And with that, with the first pick of the 2020 Draft, the Investment Strategy Team selects…

- #1) Chairman Powell Is Our Quarterback | When it comes to speed, precision, and crafting creative plays, we immediately think of the Federal Reserve, quarterbacked by Chairman Jerome Powell. The Fed faced the difficult challenge of addressing the detrimental economic and credit market impacts of the COVID-19 outbreak, but it never ceased to display leadership and versatility as it sought to provide relief. Implementing two emergency interest rate cuts was a clutch maneuver, but what truly ‘moved the chains’ were the steps to expand the size and scope of quantitative easing, to establish trillion dollar facilities to keep a credit crisis at bay, and to launch a $2.3 trillion lending program to alleviate the stresses on small businesses and most impacted states. We have an unwavering belief that Chairman Powell and the Fed have ‘untapped’ skills to use should economic conditions deteriorate and that Chairman Powell has a few more ‘touchdown’ runs up his sleeve.

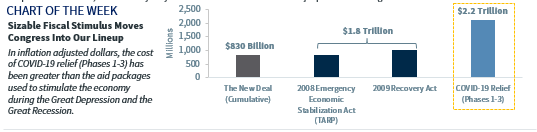

- #2) Congress Is Our Offensive Line | Not only do lineman protect the quarterback’s efforts but they ‘plug’ the holes (by blocking) to allow the plays to develop. That is exactly what Congress has done with the $2.2 trillion dollars in stimulus that they have given to individuals, businesses, municipalities and hospitals to prevent the economy from being ‘sacked.’ They are plugging the hole that was created by the ‘shutdown’ of most parts of the economy while simultaneously complementing the Fed’s aggressive actions. From a historical perspective, the cumulative stimulus efforts undertaken by the government thus far surmount those of both the Great Depression and Great Recession in terms of both inflation-adjusted cost and cost per capita. Congressional discussions are increasing the likelihood of another supplemental round of spending ($250 billion to $750 billion), which leads us to believe the COVID-19 relief efforts will soon hold the record for cost as a percentage of GDP as well.

- #3) Dr. Fauci Is Our Linebacker | Dr. Fauci has led our nation’s defense against the COVID-19 outbreak. While he understands the importance of reopening the US economy, he has the protection and safety of all citizens at the forefront of his decisions. As President Trump, the governors, and other medical experts begin to weigh in on plans for reopening, he will utilize his expertise to defend against a second wave of cases or, at a minimum, provide guidance on the benefits and consequences of the ultimate ‘game plan’ so they are fully understood. Despite any criticism surrounding his decisions thus far, he remains high on our prospect board as he is best suited to closely monitor the playbook of countries in Asia and Europe and assist our key decision makers in accomplishing the feat of safely leading our economy to a victorious rebound.

- #4) Pharmaceutical/Biotech Companies Are Our Cornerbacks | The Fed and Congress are undoubtedly impressive, but ultimately nothing could match the ‘game changing’ abilities of the development of a vaccine. The fruition of such an advancement would ‘intercept’ the root cause of this economic and financial market harm – the COVID-19 outbreak. Due to the nature of testing protocols, we realize the development of a vaccine will take some time, but given the amount of investment and the severity of the issue, we have faith pharmaceutical companies will maximize efforts and exhaust all options to ensure this occurs as soon as possible (hopefully within 12 months or so). In the interim, our Healthcare Policy Analyst Chris Meekins** believes that more widespread, expedited testing capabilities or a therapeutic are critical in helping the US ‘turn the corner’ by July 4 (75% probability), therefore these companies have the biggest upside potential to become the ‘Most Valuable Player.’

- #5) We Are The Wide Receivers | When it comes to mitigating the number of US deaths, the responsibility lies with all of us! With over 90% of US citizens sheltering at home under state mandates, there is no doubt that social distancing practices have been crucial to flattening the curve and to helping the US reach its peak in cases sooner rather than later. In the times ahead, adherence to the ‘routes’ determined by our government and the CDC will be critical in helping our economy return to normal operations in a safe, effective way. Any ‘fumble’ in our actions now could jeopardize reaching the other side of this health crisis.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...