Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The economy ended the streak of negative growth

- Fed expected to hike rates by 0.75% for the fourth time

- Strong market reaction for missed earnings estimates

Play ball! It’s primetime for baseball fans as the Fall Classic is the culmination of a 162-game regular season. Houston’s run at redemption and Philadelphia’s hopeful return to glory will all begin with Game One of the World Series tonight! While we believe the series will provide plenty of action and excitement for the crowd, we hope that the curveballs stay on the field as investors have surely faced enough of them this year. Instead, we’re focusing on the plenty of other connections between the markets and America’s pastime, such as the U.S. economy stepping up to the plate in the third quarter, the Fed being on deck for next week’s FOMC meeting, and this week and next providing earnings results for some of the S&P 500’s heavy hitters. Here’s our insights on the recent and potential market moving events:

- U.S. Economy Avoids Strike Three | The U.S. economy avoided three consecutive quarters of negative growth and exceeded consensus expectations by growing at an annualized rate of 2.6% during the third quarter, but the report in its entirety was not a grand slam. The biggest contributor to growth was net exports, driven by a surge in energy-related exports. The biggest detractor was residential fixed investment which declined over 26% (the worst since 2Q20). The true bright spot remains personal consumption, which while slowing, still provided a boost of +1.4% due to strength in services spending (+2.8%). Some real-time, high frequency data also suggests that the consumer should continue to be a positive catalyst for the economy moving forward. First, consumers still have a healthy ~$1.7 trillion in excess cash savings. Second, forward guidance from many service industry leaders such as airlines (i.e., United), hotels (i.e., Hilton) and rental car agencies (i.e., Hertz) suggest that demand is not fading as we approach the holiday season. In addition, retail and food services card transactions remain ~12% above pre-pandemic levels. So, while the Fed-induced economic slowdown is progressing as expected, fairly resilient consumer spending supports our notion that the economy will experience a mild, not severe, recession in 2023.

- The Tightening Cycle Is Nearing The 7th Inning Stretch | Due to hotter than expected September inflation reports, the Fed is expected to increase interest rates by 0.75% (to 3.75% – 4.00%) for the fourth consecutive time at next week’s November FOMC Meeting (November 1-2). However, following this meeting, the Fed will be able to ‘stretch’ and take a breather to see how impactful their aggressive rate hikes have been thus far. Important point: there will be six weeks between the November and December meetings which means the Fed will receive not one but two releases for both inflation and jobs. At that point, we expect the Fed to ‘close’ the year with only a 0.50% interest hike in December with an outside chance that it could be ‘game over’ in this tightening cycle. Why? First, there have been several Fed members who have expressed concerns of taking too much action too quickly—particularly given the six to nine month lagged impact of interest rate hikes. Second, some areas of the economy have materially weakened, evidenced by mortgage applications down +40% on a year-over-year basis. Third, real-time data indicates easing pricing pressures (e.g., Manheim Used Vehicle Index declined for the fifth consecutive month, falling freight rates, increased retail discounting, etc.). And fourth, labor market conditions are slowly starting to tighten as reflected by multiple companies either slowing (e.g., Microsoft, Alphabet), freezing (e.g., Amazon, FedEx) or cutting (e.g., Meta, Intel) jobs.

- Earnings Not Batting A Thousand | Earnings season is far from over as there are still nearly 240 companies representing ~35% of the S&P 500’s market capitalization left to report. On a positive note, the percentage of companies beating sales estimates is trending back near the historical average (65% versus the previous 20-quarter average of 69%), and the percentage of companies beating earnings estimates has been steadily improving (70% versus the previous 20-quarter average of 77%). It is important to note that these averages were inflated by the record-setting earnings seasons experienced coming out of the pandemic. Overall, earnings season has not been stellar, but better than feared. However, the market has gotten more discerning reacting to the results. Companies beating on both the top and bottom line are outperforming the S&P 500 by 1.2%, on average, in the three days after reporting as companies missing both are underperforming the index by 6.8%, on average, over the same period.

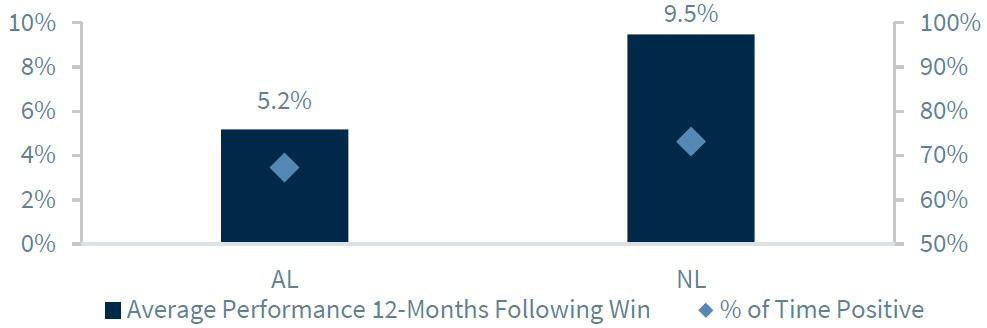

- Who Is The Market Rooting For? | Unquestionably, our outlook for the U.S. equity market is based upon the macroeconomic fundamentals, earnings growth, valuations, etc. While not statistically significant, sometimes investors want to ride the wave of interesting historical trends. So, if you have not decided which team to root for, history suggests that the best equity market performance has occurred when Philadelphia’s league (NL) defeats Houston’s (AL) (see below). However, for our friends and followers in Houston who are rooting for their team to notch its second victory in six years, you can contend that the U.S. economy has been in or entered a recession the two previous times the trophy went to Philadelphia (1980 & 2008).

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...