Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Stimulus could help the economic recovery ‘trot on’

- Turkey pricing pressure means more to gobble up

- Info tech leading the S&P 500 sector ‘parade’

Whether you’re celebrating in-person or virtually, we’re wishing you and your family a Happy Thanksgiving! Giving thanks may seem difficult to do in a year that’s resulted in the loss of so many lives, jobs, and businesses, but we believe this holiday is the perfect time to reflect on all we are grateful for. From an investor’s perspective, the COVID-induced bear market and the historic levels of volatility at the start of the year will certainly not make the list. But between the ongoing economic recovery and the S&P 500 up over 12% year-to-date, we think investors still have a ‘cornucopia’ of blessings to count!

- #1: US Economic Recovery Continues to Trot | COVID-19 caused the US economy’s shortest, yet steepest recession in the post-World War II era. While the K-shaped recovery path has led to not all industries recovering at the same magnitude, the rebound in real-time activity metrics combined with pent-up consumer demand led to the best quarter of economic growth on record (3Q20: +33.1%) – nearly double the previous record! Improving labor market conditions, vaccine developments, and possible further stimulus lead us to believe the recovery will continue to gain momentum into 2021.

- #2: Feast of Monetary & Fiscal Stimulus | Between interest rate cuts, several facilities to ensure market functionality, and a record setting balance sheet in light of ongoing quantitative easing actions, the Federal Reserve mitigated the downside risk to the US economy in the midst of the outbreak. Congress acted swiftly too, providing more than $3.6 trillion in fiscal relief to individuals and businesses through a series of stimulus deals. While we would be even more grateful if a Phase 4 bill compromise was reached, Congress has already set stimulus records on an absolute, inflation-adjusted, and per capita basis.

- #3: Scientists Bring Effective Vaccines To The Table | COVID-19 has infected more than 11 million Americans, and we are indebted to our frontline workers, who have tirelessly combatted the virus since at least early March, and to our scientists, who have developed effective vaccines at warp speed (less than one year versus the previous record of four years). Ultimately, a safe, widely available vaccine will not only save lives but will also allow us to return to normality.

- #4: Equity Market Harvesting New Post-COVID Highs | The equity market had a strong start to 2020 due to trade resolutions, but even since the ~34% virus-induced decline, the S&P 500 has notched 11 new record highs and the strongest start to a bull market due to an improving macroeconomic backdrop, stronger than expected earnings, and positive vaccine developments. With supportive factors still in place, we maintain a positive outlook for equities over the next 12 months.

- #5: Low Rates the Right Stuff(ing) | Global central bank easing led to a sharp decline in sovereign yields which has resulted in ‘bountiful’ returns for bond investors. The Fed’s intervention has been particularly supportive for investment-grade bonds, which have rallied 8.8% year-to-date! Housing data indicates that lower rates have aided the housing market too, with housing starts and existing home sales up 14.2% and 26.6% year-over-year, respectively.

- #6: Pricing Pressure Means More to Gobble Up | The American Farm Bureau Federation released their annual report for the cost ($46.90) of a Thanksgiving Day dinner for ten people (plus leftovers of course!), which is down $2.01 from the price of last year’s feast. The price for the centerpiece of the dinner, the turkey, has declined to $1.21 per pound, the lowest since 2010.

- #7: Gold Prices the Gravy on Top | Gold prices soared to new record highs this year, reaching a peak level of $2,069/oz in early August. The commodity is up over 22% on a year-to-date basis, and is on pace for its best year since 2010.

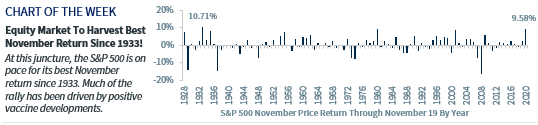

- #8: Seasonality Sweet as Apple Pie | The S&P 500 has rallied nearly 9.7% so far this month, more than 5x the index’s average November return over the last 30 years. In fact, at this juncture, the S&P 500 is having its best November since 1933! Seasonal trends should continue to support the equity market, since the November to April timeframe is historically the best 6-month period, with the S&P 500 posting an average return of 7.7% and being positive 83% of the time.

- #9: Tech Sector Leading The Parade | We’re thankful for the technology that has helped us stay virtually connected with our loved ones. The reliance on tech during this time has led the sector to be one of only three S&P 500 sectors to have both positive earnings and sales growth for the year, and has driven the sector’s more than 70% rally from the COVID-induced lows.

- #10: Friends & Family | Last, but certainly not least, we are thankful for our family and friends! We wish you and your loved ones a very Happy Thanksgiving, and as you sit down to enjoy your turkey, tofurkey, or our personal favorite a turporkin (we always advocate for diversification), we hope you have many reasons to be thankful this year and all the years to come!

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...