Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- U.S. economic growth has defied the odds

- The labor market is off to a strong start to the year

- The road to 2% inflation may be bumpy, but is still intact

Happy Saint Patrick’s Day and the first day of spring – two celebrations to look forward to in the coming days. What’s not to like about good luck charms, all things green, leprechauns and the arrival of warmer weather? And just like the seasons change, the economy goes through its own variations – moving from cold to hot, with the Federal Reserve (Fed) behind the scenes trying to guide the economy somewhere in between. Whether it was luck or skill (or maybe both) the Fed has done a good job navigating this economy, despite the great challenges it has faced over the last four years. The Fed’s Tuesday/Wednesday meeting next week will include its updated economic forecasts, the potential path of interest rate cuts (the ‘dot plot’) and the Chairman’s press conference. Here’s what has changed since its December 2023 projections:

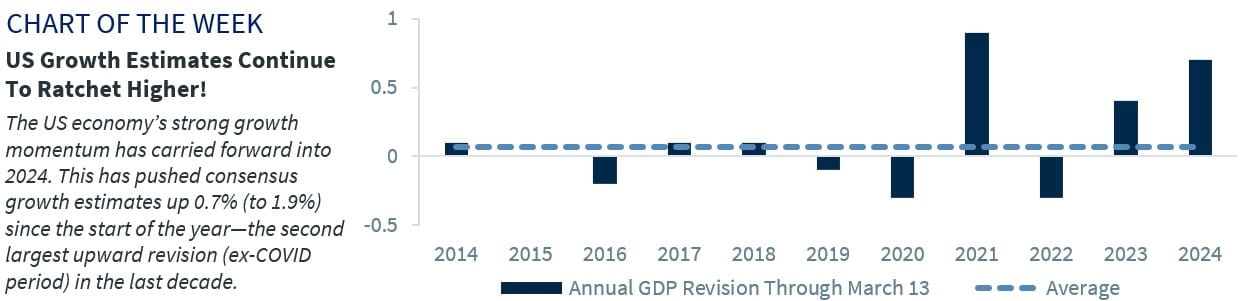

- Economic growth has defied the odds | With the U.S. economy posting two consecutive quarters of 3%+ GDP growth, recession calls have quieted down. In fact, Google searches for the term ‘recession’ have declined to the lowest level since 2004. While seasonal factors and cold weather have muddied the data to start the year, the U.S. economy remains on solid footing due to healthy consumer fundamentals (i.e., household net worth hitting a record high and personal incomes climbing at their fastest pace since July 2021 in January) and solid residential fixed investment. This has pushed consensus growth estimates up 0.7% (to 1.9%) since the start of the year, marking the second largest upward revision at this juncture of the year over the last ten years (trailing only the 2021 COVID recovery). While economic data remains strong, there have been some warning signs over the last few months that suggest growth could slow. For example, credit card debt is soaring, borrowing rates are at record high levels, credit card delinquencies, particularly those 90 days or more past due, rose to the highest level since 1Q21, and both consumer and business confidence have ticked lower since the start of the year. The upside growth surprises should see the Fed modestly increase its +1.5% 2024 GDP forecast; however, Chair Powell should reiterate the messaging in his semi-annual testimony before Congress last week – the economy is on the path for a soft landing, but it’s too soon to declare mission accomplished.

- Labor market remains solid | Driving the economy has been the resilience of the labor market, especially the strong job growth to start to the year. Over the last two months, the U.S. economy has added over 500k new jobs (the best two months of gains since last April), with jobless claims remaining near cyclical lows. While the labor market is on solid footing, cracks are forming. First, announced job cuts rose to the highest level since March of last year, with cost cutting and automation being the two biggest culprits. Second, the number of job openings has declined to the lowest level since 2021, with the quits rate (a sign of consumer confidence in the labor market) easing to a 2.5 year low. Third, the percentage of small businesses planning to increase employment declined for the third consecutive month to the lowest level since 2020. More important, the same survey stated that the percentage of small businesses having difficulty attracting qualified talent fell sharply. The Fed’s updated forecasts will likely reflect a gently higher unemployment rate from the current 3.9% rate (a two-year high), but not much changed from the 4.1% year-end 2024 forecast last December. While the unemployment rate is likely to remain historically low, Chair Powell will likely stress that a healthy, but normalizing labor market should ease wage pressures, thereby giving the Fed the confidence it needs to cut rates in 2024.

- Disinflationary trend hits a snag | Inflation fell notably throughout 2023, declining from a cyclical peak of 9.1% to 3.2%. However, in the first two months of the year, inflation has ticked higher—with core consumer prices and the Fed’s preferred measure of inflation, core PCE, showing healthy month-on-month gains. No doubt, the hotter than expected prints will keep policymakers on guard in the near term given their reticence to declare victory after the progress made last year. The key culprit for the recent uptick has been elevated shelter costs but given the well-telegraphed measurement issues with this sub-component of the inflation index, Fed officials are more likely to hit the pause button rather than panic. Case in point: inflation, excluding shelter costs, came in at 1.8% in February – well below the Fed’s 2.0% target. While the road to 2.0% may hit some bumps, a sustained reacceleration appears unlikely given that global commodity prices (ex-energy) are trending lower, supply chains have normalized, and consumers are pushing back on price increases. The last two inflation prints are unlikely to materially change the Fed’s inflation forecasts, which show the core PCE measure on track to hit 2.0% by 2026.

Bottom line for the Fed | The recent economic news will likely reinforce the Fed’s near-term caution. However, with the economy expected to lose momentum, the labor market slowing, and disinflationary trends still intact, a Fed easing cycle still appears on the horizon given the Fed’s restrictive policy stance. While the Fed will want to wait for more data, the ‘dot plot’ is likely to maintain the three rate cuts penciled in for 2024, which aligns with our economist’s view of three to four rate cuts this year. In addition, the Fed is expected to detail the plans to temper the pace of its recent balance sheet reduction strategy.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...