Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Here we go again. The perfect recipe for inflation: The Fed is injecting massive amounts of money into the economy and interest rates are near historic lows across the yield curve. The Fed’s balance sheet is expanding. No, this is not 2008, it is 2020. Fears of inflation resounded then much like they are today, but for now, inflation has not posed a threat.

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

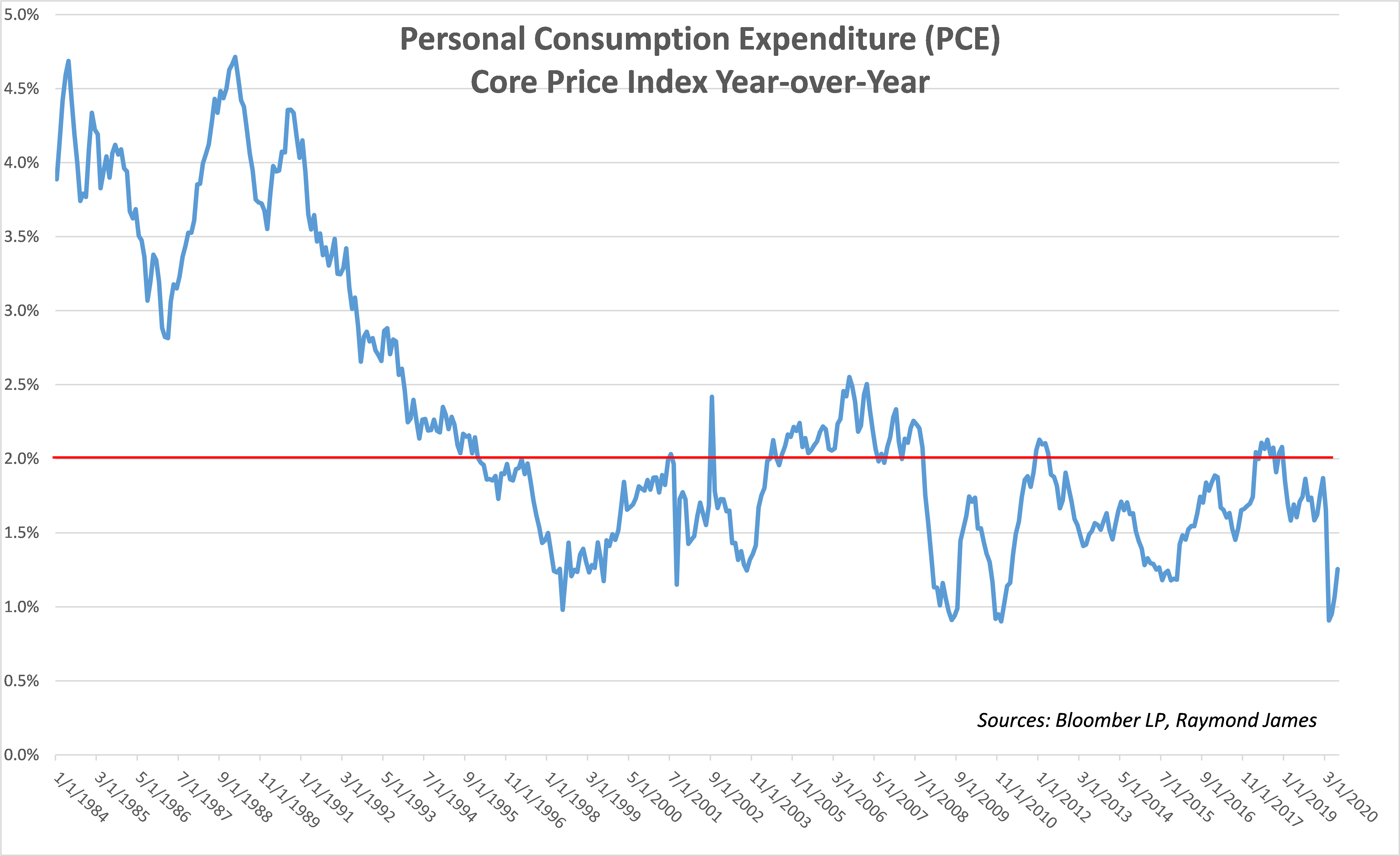

Inflation occurs when there is too much money chasing too little supply of goods and services. The Fed likes to look at Personal Consumption Expenditure (PCE) Core Price Index year-over-year. The red line indicates the Fed’s preferred inflation level of 2.0%. On the surface, we may be inclined to think the setting is right for higher prices (inflation) but let’s take a deeper look into several extenuating economic conditions.

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

The Fed announced a shift in their stance on inflation last Thursday, indicating that their goal of 2.0% inflation will now be a goal to average 2.0%. This provides some wiggle room for an above 2.0% inflation offsetting the prolonged period that inflation has been well below 2.0%.

The Fed’s balance sheet has expanded by a significant amount. Although the supply of money has increased, the velocity at which that money is exchanged for goods and services has not followed suit. There are a lot of moving parts here and we cannot look at just one component for an explantion.

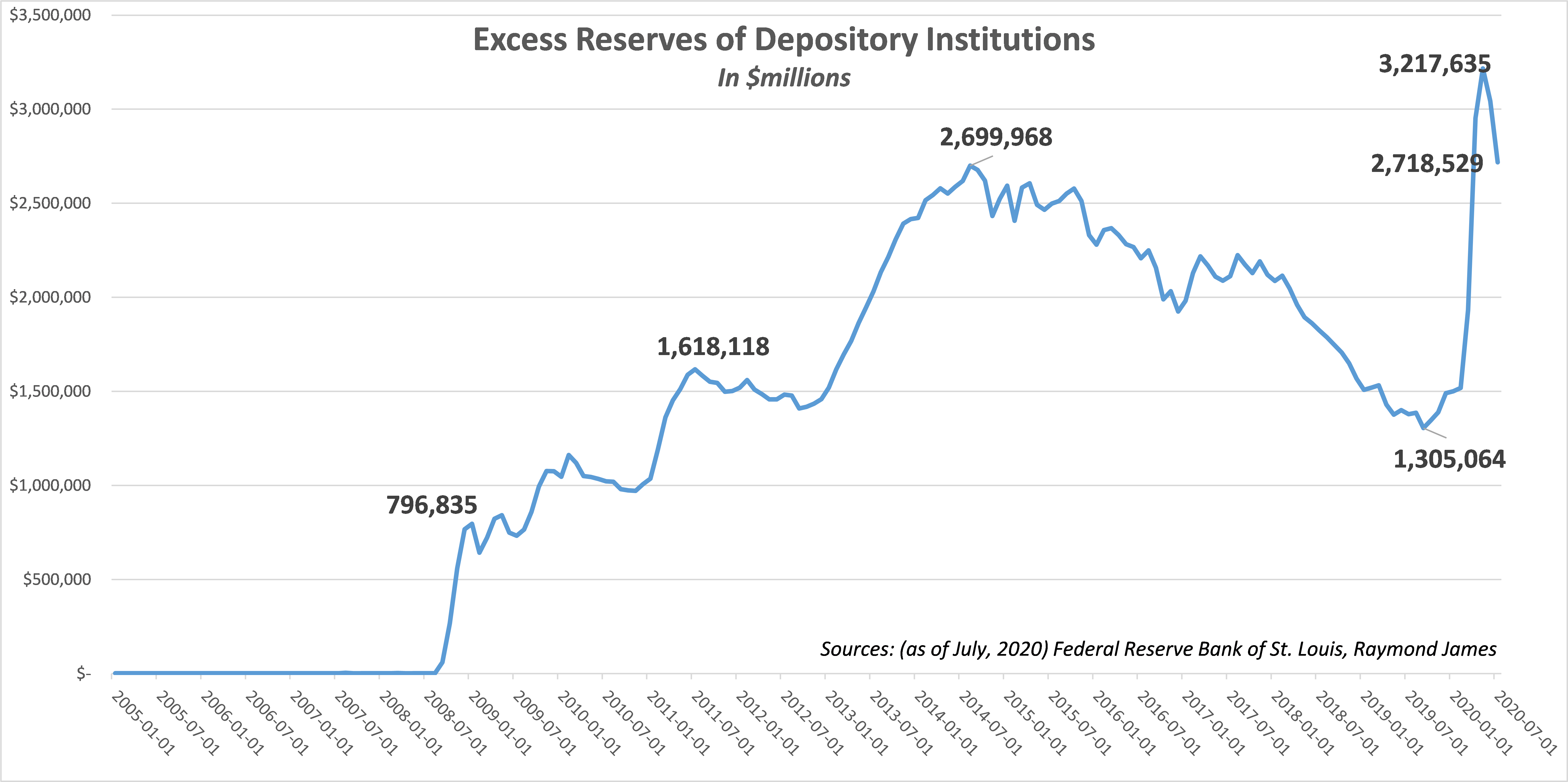

The Excess Reserves for Depository Institutions held at the Federal Reserve have gone up tremendously since the Great Recession of 2008-09. The hope when injecting money into the economy is that as bank’s access to money increases, they in turn loan it out to businesses and individuals who then spend it on new products, new hires, etc. The chain of events promotes economic activity. Throughout the sequence of Quantitative Easing programs implemented from 2008-2014, much of the increased money supply never went to goods and services, an activity that would potentially push inflation higher. It could be argued that although it didn’t create higher PCE, it did inflate stock and bond prices (asset inflation). Banks are holding larger provisions against loan losses while businesses are keeping more liquidity, or in other words not investing/spending on the future.

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

So there’s a stockpile of cash sitting at member banks and that’s not all. U.S. households have shrunk their consumption, partly stemming from the coronavirus but also a longer-term trend perhaps tied to demographics (an aging population). In the next 20 years, over 21% of the U.S. population is expected to be 65 years of age or older according to the government census. Based on Pew Research Center, the wealthiest age group by a significant margin are the +65 year olds. This is an age group that already own their homes and cars and their children are grown. They are more apt to save and live off their wealth than to spend it.

While all this is permeating in the backdrop, unemployment shot up primarily as a result of our pandemic. The Fed has stepped in to replace much of the lost income but we must keep in mind that the Fed’s stimulus programs are temporary and replacement income is not a forever event.

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

Debt levels are on the rise. The government will be less incentivized to see interest rates rise given the amount of debt being added to its balance sheet. Although borrowing money when interest rates are historically low may embody business savvy, corporations are likely to emerge from this recession with much higher debt levels too.

Uncertainty surrounding our current economic state and how we arise from the pandemic overflows. Will health clubs survive? Will people go out and eat as much? Will they get on airplanes and vacation in the same style they did pre-virus? Will students realize the cost savings and simplicity of online degrees? The bottom line: has the way we socialize or spend discretionary income changed forever?

In summary, the economic supply side of the economy has been affected by the pandemic but we cannot ignore the demand side. Consumers and businesses are spending less and saving more while businesses cut employees. Long-term, demographic aging and growing government/business debt will likely pose barriers to higher interest rates.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...