Chief Economist Eugenio J. Alemán discusses current economic conditions.

This Weekly Economics report will be very short, only covering today’s nonfarm employment release and implications for the economy and the Federal Reserve (Fed). We understand that the college football season is starting so we don’t want to disrupt tailgating preparations and wish that your bar-b-que is one to remember!

As we said in the title: Happy Labor Day!

We know that markets are pricing (and bracing for) another 75 basis point (bp) increase in the federal funds rate in September while we were expecting them to go for a more conservative, 50 bp increase. Furthermore, markets are expecting the Fed to also move in November as well as in December. We still believe that they will not move in November because it normally doesn’t like to make a policy decision in November in an election year. However, this time around, anything is possible, especially if inflation numbers do not continue to behave.

Thus, it is probably a good time to conclude that a terminal rate of 3.50% may not be the end point for the federal funds rate in this cycle and that it will probably be closer to 4.0%. However, we will wait until the September FOMC meeting to make a change to our forecast because the Fed will come up with its forecast and dot plot, which will provide some more information about the future path of monetary policy.

What’s Not to Like with August’s Employment Report?

The August employment report came out better than expected… but for reasons that may be counter intuitive. Normally, more jobs are better than less jobs: we are not in those ‘normal’ times today. Fewer jobs (up 315,000 in August) than those reported in July, up 526,000, is good news for the US economy today. Normally, a higher rate of unemployment is bad for the economy: today, an increase in the rate of unemployment is ‘good’ for the economy. Normally, an increase in the labor force participation rate is good for the economy: today, an increase in the labor force participation rate is ‘great’ for the economy.

Let’s take each one individually. First, as we said before, the labor market was growing too fast for our economy’s health. The US economy created an average of 456,000 jobs during the first seven months of the year when the average growth of employment between 1980 and February of 2020, just before the start of the COVID-19 pandemic has been at 128,000. That is, employment grew 3.6 times higher during the first seven months of this year compared to the average growth in employment since 1980. This is the reason we think it is unlikely that the NBER, the official body that calls for the beginning and end of recessions, calls for a recession during the first half of this year. Of course, benchmark revisions to employment numbers could lower the number of jobs created but we think even with revisions, the conclusion will be no recession during the first half of 2022.

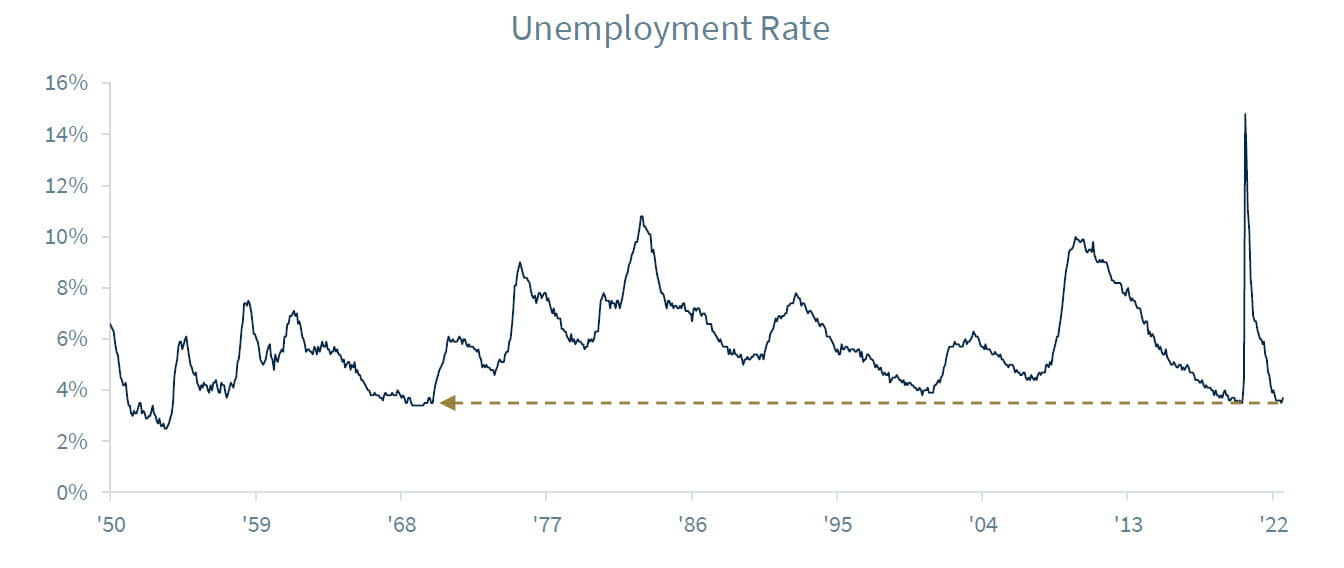

Second, July’s employment number reported the lowest rate of unemployment, at 3.5%, in more than 50 years. We have had a 3.5% rate of unemployment, more recently in January and February of 2020, just before the COVID-19 pandemic, but we must go back to May of 1969, at 3.4%, to see a lower rate of unemployment than the one recorded in July.

This means that the labor market is very tight and tight labor markets, while good in terms of full employment, i.e., all those who want a job have a job, are not so good for inflation and Fed policymakers, as tight labor markets tend to push wages higher and higher wages could keep inflation higher than what the Fed would like to see. A higher rate of unemployment is great news for the economy because it will mean that the Fed will probably not have to increase interest rates so much. However, this is just a month’s worth of data, and we cannot say that this is the start of a trend, although we hope it is.

Which brings us to the third part of this discussion. An increase in the labor force participation rate, which is what pushed the rate of unemployment higher in August, is always good news for an economy. This is true in normal times as well as in not so normal times. The fact that more Americans are reengaging in the economy is great news for firms looking for workers — job openings at 11.2 million, or twice the available workers in July. It is also great news for Americans, as having a job is always better than not having a job, perhaps with few caveats.

Thus, as you prepare your car/truck/SUV for tailgating and start your bar-b-que, please remember to be happy to have a job and have a great Labor Day weekend!

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the US Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

The producer price index is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

Industrial production: Industrial and production engineering is a measure of output of the industrial sector of the economy. The industrial sector includes manufacturing, mining, and utilities.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

FHFA house price index is a quarterly index that measures average changes in housing prices based on sales or refinancing’s of single-family homes whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac.

Consumer confidence index is an economic indicator published by various organizations in several countries. In simple terms, increased consumer confidence indicates economic growth in which consumers are spending money, indicating higher consumption.

ISM Manufacturing indexes are economic indicators derived from monthly surveys of private sector companies.

ISM Services Index is an economic index based on surveys of more than 400 non-manufacturing (or services) firms’ purchasing and supply executives.

Non-Manufacturing Business Activity Index is a seasonally adjusted index released by the Institute for Supply Management measuring business activity and conditions in the United States service economy as part of the Non-Manufacturing ISM Report on Business.

New orders index measures the value of the orders received in the course of the month by French companies with over 20 employees in the manufacturing industries working on orders.

Source: FactSet, data as of 6/3/2022

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...