Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Never before has the entire Treasury yield curve been completely under 1.00%. The 10- and 30-year Treasury bonds have reached historical lows. The 10- and 30-year Treasuries achieved record-breaking day-to-day percent closing yield changes on back-to-back business days. Things are different when you use the words never-before, historical or record-breaking. When things are this different, perhaps it’s time to adjust our strategic planning.

Let’s keep in mind that maintaining appropriate allocation is an unwavering constant. The last couple of weeks have accentuated the importance and consequences.

The Markets are Volatile. Should I Be Worried? Should I Think About Jumping Ship?

Worried? Well, that’s human nature. It is prudent to be vigilant about our financial future. Maintaining the value of your principal is paramount during a volatile and perhaps an irrational time. Should you panic sell? NO! The fixed income allocation is staying solid. Monitoring individual credits compared to individual risk parameters may expose select opportunities but a panicked liquidation of the entire portfolio may be adding risk, not eliminating it. Some of the following examples were compiled over that last couple of days. As I write this, the numbers are changing. This fast-moving market requires nearly an hourly update. It is futile to chase pricing which is changing minute-by-minute. During this market instability, values are obsolete within minutes.

Spreads are widening to near 10 year highs. This credit event can predominantly be attributed to the pandemic virus. Volume is low and spreads are gapping creating an inopportune time to liquidate. What is a constant? Your fixed income holding cash flows… are a constant. Income being earned with fixed income… is a constant. The date your fixed income’s face value will be redeemed… is a constant. The point is, now is not the time to divest one of the most stable components of your portfolio. Now is not the time to radically increase your risk profile to find yield. Now is the time to allow appropriate asset allocation to work as intended – and ride it out.

How Have Allocations Held Up?

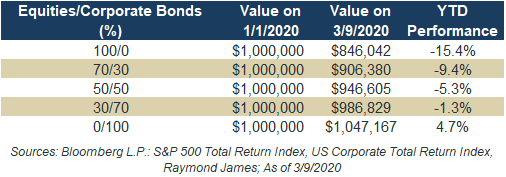

Would you rather lose $53,395, $93,620, or $153,958? The answer is none of the above; however, it is unrealistic to think any portfolio is composed only of safer assets or assets that will never experience losses. The chart below looks at representative portfolio blends of equities/fixed income. For simplicity, the equities are represented by the S&P 500 index and the fixed income by the investment grade corporate index. The various blends provide generic results of investors with different weighted asset allocations. From January through March 9, an equity portfolio lost 15.4% of its value or ($153,958 per million). However, a balanced portfolio cut that loss significantly during this market volatility. In essence, fixed income did the job it was intended to do… preserve capital.

A portfolio of 70/30 blend cut the loss by 39% and a 50/50 blended portfolio cut the loss by 66%. Higher concentrations of equities provide a greater opportunity to grow the portfolio while higher fixed income percentages provide a greater chance to protect principal.

Sell Portfolios Holding Treasuries:

Having just made the case not to liquidate, it is conflicting to now suggest a “sell” opportunity which was created based on current market conditions. Strategically held assets are typically long-term holdings and ignore momentum market swings; however, the extreme Treasury curve moves warrant attention. The 5-, 10- and 30-year Treasuries have rallied to record level low yields. As such, the elevated market prices have limited room for further appreciation assuming for example, that the 5- and 10-year yields bottom somewhere around 0.20% and 0.25% respectively.

The appreciated price is compensating investors to a point where a future upside appears marginal. Simply, the potential future upside on Treasuries appears much more diminutive than the downside. For a $100,000 position, the example demonstrates that even if the 5 year falls to a 0.20% or the 10 year falls to 0.25%, there is a relatively small gain to be achieved. Replacing Treasury yields is obtainable even under our current market conditions.

New Money and Cash Flows:

Move in on the curve. The relatively flat shape and low rates on the Treasury curve provide an argument to position new money or reinvestments toward a more rapid cash flow turnover. A 2-6 year ladder mitigates interest rate risk but in a shorter range and format that turns assets over relatively quick. It provides income but most importantly a protection of principal (via a stated maturity) not afforded in the same manner as with packaged products. Due to the recent market run, net asset values are elevated permitting an opportunity to capture gains and re-position back into fixed income with stated maturities, thus changing the risk metrics associated with your holdings.

Conclusion:

Stay disciplined. Do not panic and maintain the most stable assets in the portfolio. Put new money and/or cash flows into shortened and conservative (high credit quality) positions inside 5-6 years.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...