Chief Economist Scott Brown discusses current economic conditions.

Some very good news on vaccine development, along with expectations of a divided government, helped propel the stock market this week. The economic impact of a vaccine depends on a number of things. We still have a long way to go and there are plenty of logistical issues to be worked out, but there is hope. Yet, while the rollout of one or more vaccines is a key factor, so is the starting point. COVID-19 cases continue to surge and the near-term economic outlook is more cautious.

When someone has to warm up a crowd, such as a live studio audience, they often employ something called Yay-Boo. It goes like this. “There’s a party tonight” (the crown goes “yay!”) — “But you only get one drink” (boo) – “but it’s this big,” holding one hand three feet above the other (yay) – “but it’s watered down” (boo) – “with 100% vodka” (yay) – and so on. The crowd varies its enthusiasm at each point, but becomes more involved throughout the process and is eventually whipped into a frenzy.

The stock market seems to have experienced its own bout of Yay-Boo in the last couple of weeks. We have good news on a vaccine (yay) – but it’s not a done deal and will take time to roll out (boo) – but preliminary results on efficacy are stellar (yay) – but we have to store the vaccine at -80 degrees (boo) – but the basic strategy suggests that similar vaccines could be just as effective (yay) – but the starting point matters and COVID- cases are surging (boo) – but we have hope (yay). We can do the same exercise with the election results.

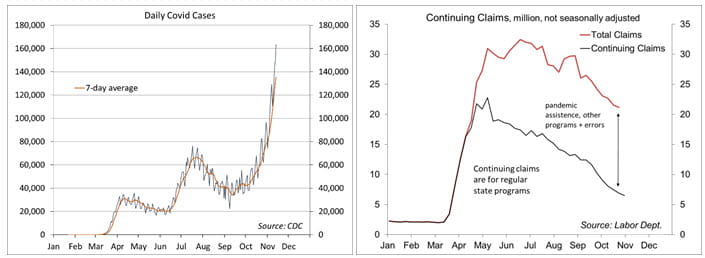

The surge in COVID-19 cases (more than 160,000 on November 12), should set off alarms for investors. The timing, coming just as the holiday season is about to begin and much of the country will move indoors, couldn’t be worse. While some fear a government lockdown similar to March and April, research suggests that self-isolation is a bigger factor. That is, people will refrain from going out whether or not state or local authorities dictate. Partial lockdowns of schools, restaurants, and so on are disruptive, of course, but the problem is compounded by people who don’t take the pandemic seriously. Wearing a facemask is a simple and effective way of slowing the spread of the virus, but we still can’t get everyone on board with that.

The surge is likely to dampen economic activity into early 2021. We should still see improvement overall, but the pace of growth will be weaker than it would be otherwise – and the risks to the near-term growth outlook are to the downside.

Economists are more concerned with hysteresis. At any given time, the economy depends on what came before – and we are looking at longer- term damage as the pandemic goes on. Temporary job losses become permanent. Workers lose skills. Unable to find work, some drop out of the labor force. Those finishing high school or college struggle to find jobs – and the jobs they do get are generally going to pay less than if they hadn’t graduated in a pandemic, and their wages will tend to be lower long after the economy improves. Primary school children are falling behind. Childcare and education needs are straining households and the burden typically falls more heavily on the wife, who may have to quit work to take care of the kids. Strains on working families are likely to get worse before they get better.

For the investor class, things haven’t been so bad. The stock market is up. Small businesses may fail, but large businesses are likely to increase market share. A divided government in Washington is favorable. We’re unlikely to get major tax increases or any new big spending programs. A stimulus package is still likely, but it will be smaller than if we had a Democratic sweep.

The incoming administration will focus on the pandemic and we could see a push for efforts to ease the burden on working families, but the path is unclear and we haven’t seen much of a move toward greater cooperation since the election. The financial markets favor a divided government, but sometimes things have to get done.

Still, while the surge in COVID-19 cases in the U.S. and Europe has generated some concerns for the U.S. and global economies in the near term, the optimism on a vaccine is justified. We can’t get people to agree on much of anything these days. Many will not take the vaccine. Most will have to wait. However, a vaccine is coming.

The overall economic outlook remains uncertain. However, it seems likely that the current surge will slow the pace of progress into the first quarter of 2021. The arrival of a vaccine should begin to boost growth in the second half of next year. We’re unlikely to get back to the previous trend in GDP – as some damage will be permanent – but the gap will probably narrow.

Recent Economic Data

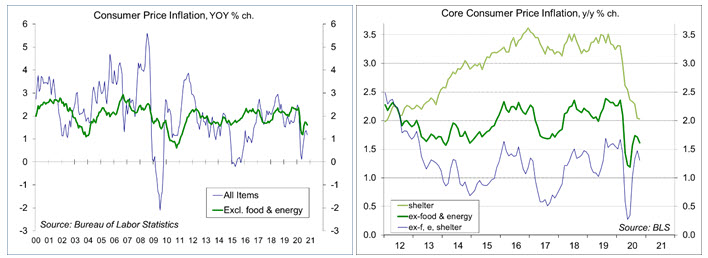

The Consumer Price Index was unchanged in October (+1.2% y/y), restrained by a 1.2% decline in apparel, a 0.8% decline in medical care commodities, and a 3.2% decline in lodging away from home. Gasoline prices fell 0.5% (-0.6% before seasonal adjustment, down 18.0% y/y). Food rose 0.2% (+3.9% y/y). Ex-food and energy, the CPI was also flat (+1.6% y/y). Some prices fell in the March/April lockdown, then rebounded in June, July, and August. However, there doesn’t appear to be a broad-based pickup in inflation more recently.

For homeowners, the Bureau of Labor Statistics seeks to measure the cost of the service that housing provides (the rental equivalent), not the asset value of the home. Homeowners’ equivalent rent rose 2.5% over the last 12 months, vs. +3.3% for the 12 months ending October 2019.

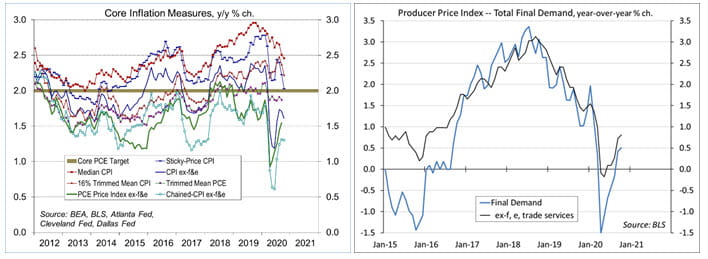

Other measures of core inflation vary, but are generally moderate.

The Producer Price Index rose 0.3% in October (+0.5% y/y). Ex-food, energy, and trade services, the PPI rose 0.2% (+0.8% y/y). Pipeline inflation pressures appear mixed, but generally moderate.

Gauging the Recovery

The number of new daily COVID-19 cases continued to surge, totaling 163,402 on November 12.

Jobless claims, a leading economic indicator, fell to 709,000 in the week ending November 7, down from the previous week’s total of 757,000. Figures tend to be choppy in the final two months of the year. The four- week average was 755,250 – still extremely high. Continuing claims (for regular state unemployment insurance programs) fell by 436,000 (week ending October 31) to 6,786,000. It’s unclear whether the downtrend in continuing claims is due to people finding work or whether they have exhausted their benefits.

The New York Fed’s Weekly Economic Index rose to -2.68% for the week of November 7, up from -3.18% a week earlier (revised from -3.12%) and a low of -11.45% at the end of April, consistent with a moderate pace of growth. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously). Note that the weekly figures are subject to revision.

The University of Michigan’s Consumer Sentiment Index fell to 77.0 in the mid-month assessment for November (the survey covered October 28 to November 10), vs. 81.8 in October and 80.4 in September. Evaluations of current conditions were little changed, but expectations fell from 79.2 to 71.3, reflecting (according to the report) Republican disappointment with the election results and concerns about rising COVID-19 cases.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...