Rob Tayloe discusses fixed income market conditions and offers insight for bond investors.

Many questions should be addressed when figuring out what bonds to purchase for your portfolio, including:

- What is the risk tolerance?

- What is the time horizon?

- What are the federal and state (local) tax brackets?

- Are the bonds being purchased in a qualified (IRA…) or taxable account?

Answering these questions and other questions (this is just a small list) will provide the answers you need to figure out what bonds are most appropriate for that account.

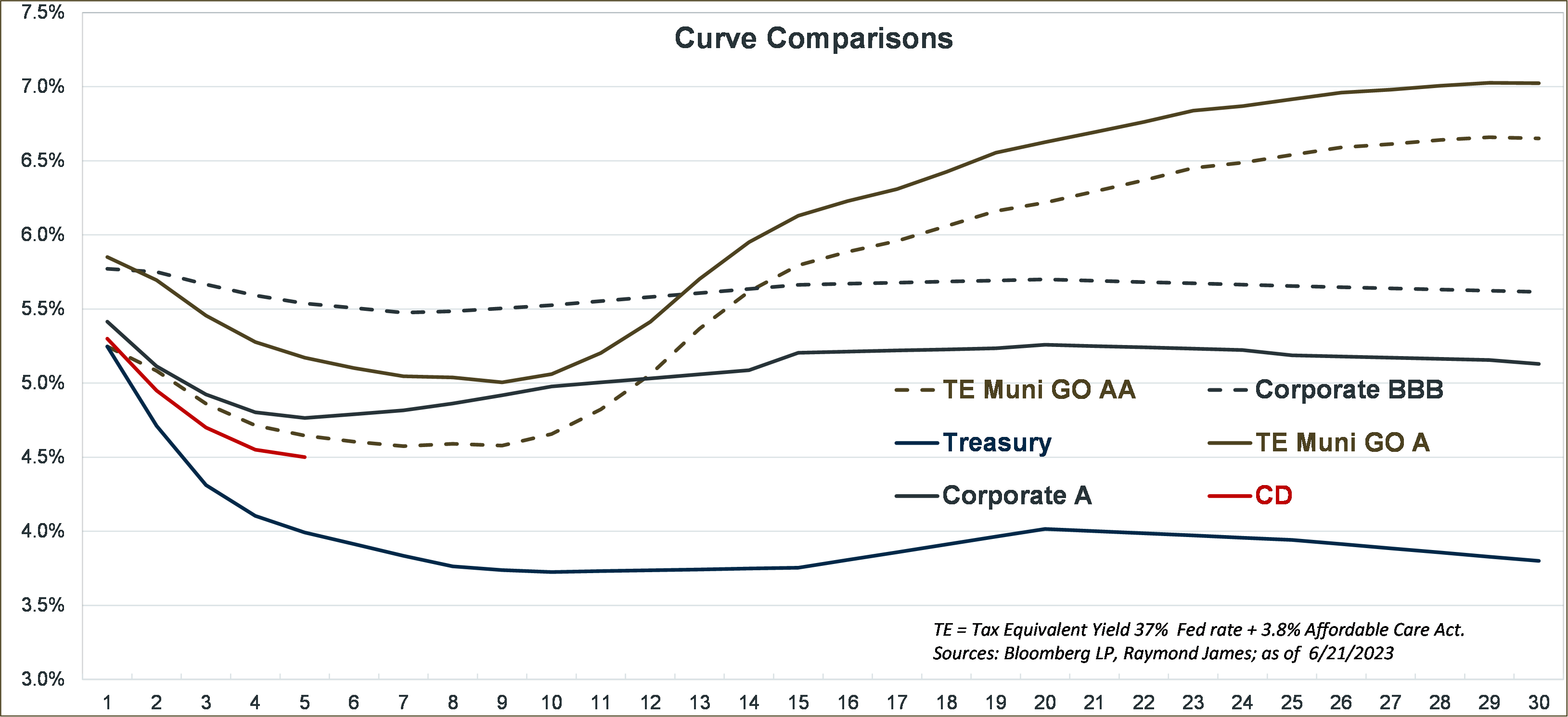

The Fixed Income Solutions associates work closely with financial advisors to use these questions and other questions to identify the best opportunities to meet clients’ personal goals and cash flow needs. Plus, Raymond James has tools to show what securities make sense in various situations. The “Curve Comparison” graph illustrates that different bond types have diverse yields (with tax rates considered) at different points on the curve. Within 12 years, BBB-rated corporate bonds currently maximize income regardless of tax bracket. For clients in high tax brackets, tax-free municipal bonds may make the most sense in bonds with maturities greater than 12 years. Clients in the highest federal tax brackets can achieve greater than 7.0% taxable-equivalent yields on the long-end of the curve. The tax-free benefits can sometimes be amplified for clients residing in states with a high state income tax when in-state bonds are purchased, thus avoiding state tax too. The process of identifying optimum yield pockets through curve comparisons may help meet the objective to maximize return within personal investing parameters.

Some investors have an affinity for certain bond types (like municipal or Treasury bonds) because that is “what they have always done.” At the end of the day, it is usually important to maximize after-tax income while staying within the investor’s risk tolerance regardless of biases. Digest as much information at your disposal in order to make the best possible decision for you. For instance, Treasuries or CDs can make sense for conservative investors who are parking money short term. Treasuries are exempt from state income tax, so they can enhance after-tax yield for investors residing in a state with an income tax. The benefit increases proportionally for clients living in states with higher income-tax rates.

There are many tools and resources at your disposal to help make investment decisions. Leveraging these tools with the help of your financial advisor will help to maximize after-tax income. The Fixed Income Solutions team is here to help navigate various market conditions.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...