The fall from bull to bear market has been fast and frustrating but here are three dynamics to watch, says Raymond James Chief Investment Officer Larry Adam.

Sadly, what was once the strongest bull market on record—a more than doubling of the S&P 500 from the March 2020 pandemic lows—has officially ended today as the shortest on record (since 1950). Monday’s decline of ~3.9% has brought the S&P 500 21.8% below its January 3 record high, which exceeds the 20% threshold or generally accepted demarcation line to determine a bear market. It has not only been fast, but it has also been very frustrating as many of the forces of the decline(e.g., war, China COVID zero-tolerance policy, supply chain- disruptions, droughts, etc.) are beyond policymakers and investors control. But as fears grow, there are three dynamics to help put them into perspective.

1. We are not in a recession

News from colleagues and clients is reinforcing our view that while select goods-oriented companies have noted slowing sales and rising inventories, overall spending trends remain positive as the consumer shifts preferences from goods to services. We’ve heard of the worst traffic in years and miles of backups to vacation destinations despite the high gasoline prices. We’ve heard of restaurants at full capacity and struggles to obtain reservations that aren’t made well in advance. And we’ve heard of car rental companies cancelling requests on the day of travel due to no cars being available. With the consumer being the biggest driver of economic growth (~70% of GDP) and services representing a larger portion of spend than goods, it is difficult to envision a recession in this environment. We are not saying that this type of spending will last indefinitely, but the willingness and ability to spend by consumers suggests that we are not in a recession now. However, we will need to keep a close eye on these spending patterns as we go into the fall and the ever-important back-to-school and start of the holiday shopping seasons.

2. Nothing will be solved overnight

Investors are continually searching for answers on the questions of whether the economy will enter a recession, whether inflation is on a descent, and whether or not the U.S. Federal Reserve (Fed) can achieve a soft landing. This nervous energy has led to volatile swings in the financial markets as investors recalibrate expectations after each and every data point or headline. To echo our Chief Economist Eugenio J. Alemán, in regard to last Friday’s inflation report “nothing has changed in the U.S. economy between Thursday and today, other than goods and services prices are higher than what the market had expected.” While we realize it is hard to be patient when you’re watching your investments fluctuate in value, this is unfortunately a situation that will require time. As a result, volatility is likely to remain elevated throughout the summer.

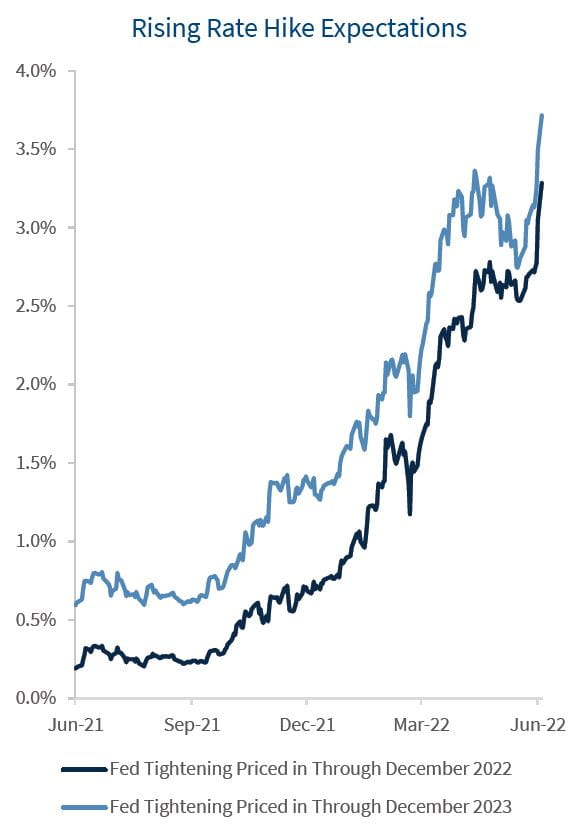

The weakness in the equity market over the last two days was driven by the May inflation report, which was not what we (or anyone else) was hoping for. The fact that inflation did not peak in April further fueled fears of the need for the Fed to raise interest rates more and ultimately cause the economy to go into a recession. The problem is that while we expect inflation to gradually recede by year end, it will take time. The next reading for personal consumption expenditures (PCE) is not until June 30, and the next consumer price index (CPI) release is not until July 13. More important, one data point will not suffice as a trend as we will have to see multiple reports showing a firming in the trend. As Senior Investment Strategist Tracey Manzi explains below, the Fed is unlikely to shift course over one data point. Fed Chairman Jerome Powell may express that the Fed is not close to the idea of 75 basis point (0.75%) hikes in this week’s conference, but we anticipate that it will proceed with a 50 basis point (0.50%) interest rate hike as planned. The data-dependent Fed needs time to evaluate the economic conditions and any shift to its outlook, just as investors need time, or consecutive declines in inflation, to be convinced that pricing pressures are easing and that a recession can be avoided. Therefore, investors are closely and anxiously monitoring the headlines for precise answers on inflation and the Fed’s policy path should prepare for elevated volatility over the upcoming weeks.

Source: FactSet, as of 6/13/2022

3. Markets are in need of a mood shift

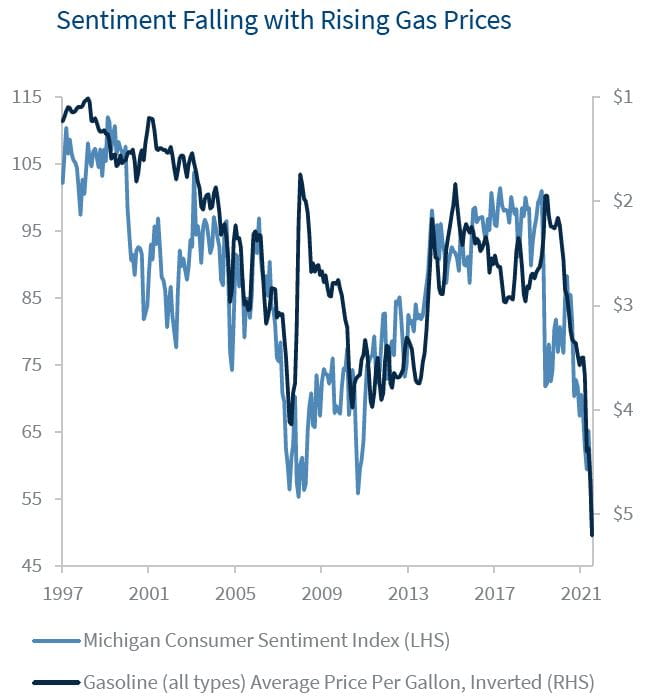

It is plausible we could talk ourselves into a recession due to all of the festering negativism. Consumer sentiment is at the lowest level on record, CEO confidence is at the lowest level since April 2020, small business optimism is at the lowest level since May 2020, and the percentage of bullish investors is at the lowest level since 1990. This widespread pessimism will be the challenge at this week’s Federal Open Market Committee meeting that will bring about the updated economic projections and dot plot, and Chairman Powell’s press conference. To date, he has been up to this challenge, effectively ‘threading the needle’ as he expresses the need to have less accommodative monetary policy while simultaneously assuaging fears that the economy is headed for a recession. This very well could be his most important press conference given that the 10-year Treasury yield has soared to 3.4% (the highest level since April 2011) and is clearly impacting the interest rate sensitive parts of the economy, particularly the housing market. Honestly, confidence remains the biggest risk to our more optimistic outlook. The largest driver of sentiment is gasoline prices as the higher gasoline prices go, the lower confidence goes. That is why oil prices remain squarely in our sights—the longer they stay elevated, the higher the probability of a recession.

Source: FactSet, AAA Gas Prices, as of 6/13/2022

The bottom line: We won’t be stuck here forever

During times of elevated volatility and overall uncertainty, it can be hard to visualize reaching the other side to more favorable market conditions. For example, just two years ago, investors, as well as many economists, financial market pundits, and healthcare experts, thought that we’d be stuck in the world of COVID lockdowns forever. Many thought that stay-at-home winners would continue to prosper at the same pace – which they did not. In short, investors tend to extrapolate the current environment indefinitely and miss the pivot in sentiment, trends and economic conditions. And that is why it is so important to take a step back and look at where these dynamics are likely to go.

Today, for as many negatives as there seem to be, there remain positives that could change the trajectory to a more positive course. For example, some of the forces that sparked the surge in inflation (e.g., depleted inventories, transportation costs, record demand for goods) have started to ease and should lead to a deceleration in pricing pressures, and healthy job creation and wage growth have helped defend against this inflationary environment. We agree with our economist that while recessionary risks are growing, a recession is not our base case over the next twelve months.

However, if we are wrong and a recession occurs, we expect it would be short-lived and mild in nature (an economic decline of less than 2.5%). Currently, consumer and business finances remain in good shape and the economy does not appear to have any imbalances (e.g., housing or technology bubble). Typically, a mild recession has corresponded to an equity market decline of ~24% on average. This suggests that even if we are in the midst of a mild recession, the equity market (S&P 500 down ~22%) has already priced in ~90% of the decline from a historical perspective. With the S&P 500 NTM P/E (currently 15.8x) at the lowest level since January 2019 excluding COVID, the equity market has already priced in much of this negative news. With our base case for positive economic growth in 2022 still intact and a moderation in inflation over the next six to twelve months, Mike Gibbs, Managing Director, Equity Portfolio & Technical Strategy, believes that while equities may continue to be challenged in the near term, the recent selloff is an opportunity for long-term investors.

All expressions of opinion are those of Investment Strategy and does not reflect the judgment of Raymond James and are subject to change. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed. Past performance is not indicative of future results. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital. The Standard & Poor’s 500 Index (S&P 500) is an index of 500 stocks issued by 500 large companies with market capitalizations of at least $6.1 billion. It is not possible to invest directly in an index. Material is provided for informational purposes only and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The Bloomberg US Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate-term investment grade bonds traded in the United States. Diversification does not guarantee a profit nor protects against a loss. Fixed-income securities (or “bonds”) are exposed to various risks including but not limited to credit (risk of default or principal and interest payments), market and liquidity, interest rate, reinvestment, legislative (changes to the tax code), and call risks. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices generally rise. U.S. Treasury securities are guaranteed by the U.S. government and, if held to maturity, generally offer a fixed rate of return and guaranteed principal value.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...