Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Easing pricing pressures to end the Fed tightening cycle

- Wishing for nine dovish voters on the Fed

- Equity investors would cheer if the NASDAQ reached 12,000

Annually, we release our 12 wishes for the new year that we hope come to fruition in 2023. Sadly, as many of our wishes this year did not come true, markets reacted accordingly and provided disappointing performance. But with a little extra cheer, we hope that many on this year’s list come true and return us to more thriving investment markets. These desired gifts should not be confused with our Ten Themes for 2023 that will be released next week. Our wishes are high level, macro dynamics that in our opinion have over 50% probability of occurring whereas the Ten Themes for 2023 are more detailed and provide specific views and actionable investment ideas for the upcoming year. So, until we release them next week, let’s start the new year with some optimism and lay out in our wishes what could serve as the backdrop for a more positive year for investors. They include:

- One Year Of Peace & Harmony | Between the Russia-Ukraine war and the midterm elections, we’re hoping for a year of peace at home and abroad. Reduced tensions in D.C. and progress towards peace talks between Russia and Ukraine would provide stability for the markets and uplift the depressed investor sentiment levels that we’ve witnessed for the majority of this year.

- Two Million Job Gains | As the labor market normalizes, job gains at the rate of ~165k per month would support, or at the very least mitigate, the potential downturn in the economy. Given that the consumer accounts for ~70% of the U.S. economy, a continued streak of healthy job gains would keep balance sheets healthy and the ability to spend robust.

- Three Percent Core Inflation | The easing of pricing pressures would diminish the severity of the anticipated recession. With the Fed pleased but not completely convinced by the recent cooler-than-expected reports, a more consistent decline in the inflation readings would encourage the Fed to end the tightening cycle – which would be beneficial to equities and bonds alike!

- Gas Prices Below Four Dollars Per Gallon | The $4 per gallon threshold is a key psychological level that tends to dampen both consumer sentiment and spending. As of late, consumers have already received an early gift as both oil and gas prices are lower than they were one year ago. It’s almost hard to believe that the national average gas prices has fallen ~$1.90 from the peak!

- Five Golden Rings | Who doesn’t want to receive this gift? And with the price of gold down ~12% from its March peak, the price of this present is much more realistic than it was just a few months ago.

- A Comeback For The 60/40 Portfolio | After the most volatile year for the 60/40 portfolio since 1987, we are hoping that positive returns for both equities and bonds provide a much better year for the standard investment portfolio.

- Mortgage Rates Below Seven Percent | Mortgage rates below 7% would keep home buyers from quickly heading for the exit sign amid drastically higher costs. It would also free up spending capacity for new furniture, decor, and other makings for a new home.

- Dividend Growth Of Eight Percent | Above-average dividend growth of 8% would be welcomed by income-seeking investors, especially if bond yields recede further from the recent peaks.

- Nine Doves On The Fed | If nine voters on the Fed became more dovish, we’d be looking at the end of the tightening cycle and possible Fed pivot (e.g., interest rate cuts) much sooner—something the equity market desperately wants.

- A Lower, Less Volatile 10-Year Yield | With higher yields leading to the worst annual bond performance since at least 1975, we’re looking for a less volatile 10-year yield in 2023. A move lower would benefit both the housing market and bond investors.

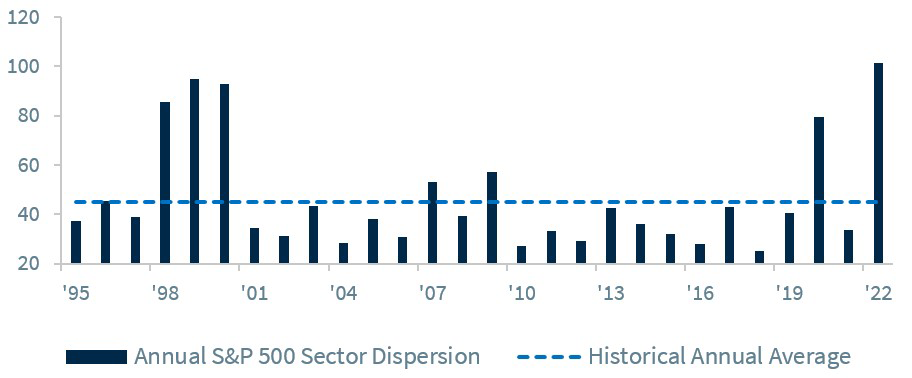

- All Eleven Sectors In Positive Territory | All eleven sectors with positive performance would confirm a broad-based rally and help the S&P 500 avoid the infrequent, unusual occurrence of two back-to-back negative years of performance.

- The NASDAQ Reaching 12 Thousand | After a challenging year for the tech sector, the NASDAQ reaching the 12,000 threshold would equate to a ~17% rally from current levels and suggest a resurgence in tech-related industry performance.

While we would love for investors to receive all the gifts on our New Year holiday wish list, even a few could result in 2023 being a better, brighter year. But in addition to our hopes for the U.S. economy and financial markets, we want to send you and your family our best wishes for a new year of health, happiness and prosperity!

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing Members of the Raymond James Investment Strategy Committee share their views on...

Markets & Investing Review the latest Weekly Headings by CIO Larry Adam. Key Takeaways ...

Technology & Innovation Learn about a few simple things you can do to protect your personal information...