Chief Economist Eugenio J. Alemán discusses current economic conditions.

Extreme criticism of the Federal Reserve (Fed) over the last year and a half has put Fed officials on the defensive, which means that it went from a highly benign view of inflation (i.e., it is transitory, and we can wait) to a very risk averse stance, which is where we find it today.

This is what we got from the Fed’s statement after the Federal Open Market Committee (FOMC) meeting on Wednesday as well as from the press conference given by the Fed Chairman, Jerome Powell. The pendulum has shifted so much that it is purposefully disregarding the better news on inflation we have gotten over the last several months and seems to be willing to overdo its play in terms of monetary policy today. And markets have reacted accordingly after becoming more upbeat in the last couple of months with what they thought was good news and advances on the inflation front.

This section from the Fed’s statement gives a clear view of its current extreme risk aversion stance:

This year the Fed had one such event: Russia’s invasion of Ukraine and the ensuing war, which sent oil and food prices through the roof and pushed it into the current risk aversion stance. And since almost all petroleum forecasts we have seen lately call for prices of petroleum to go back to $100 or higher, it is clear that the Fed is trying to be ahead of the curve in case this forecast comes to fruition and pushes inflation higher once again.

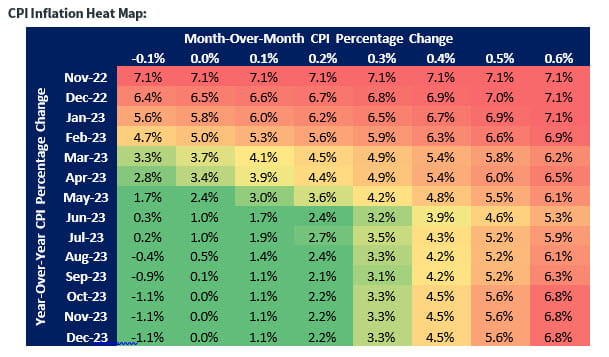

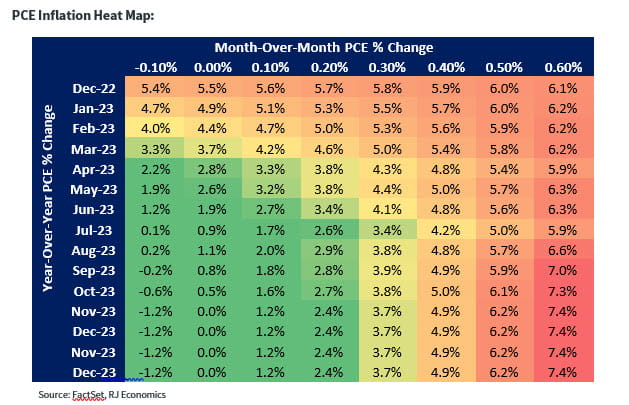

For this reason, we are including our ‘inflation heatmap’ in this report so we can see the different inflation paths and the time we will need for the Fed to attain the 2.0% inflation target going forward. Remember that these are very simple scenarios that assume that inflation changes at a constant rate per month in order to observe what would happen to the year-over-year rate of inflation for both the consumer price index (CPI) and the personal consumption expenditures (PCE) price index, which is the favored inflation number targeted by the Fed.

By looking at this ‘inflation heatmap’ it is clear that what markets are expecting – for the Fed to pivot before the end of 2023 – is akin to expecting several monthly deflationary (i.e., negative rates of inflation) readings for both the CPI as well as the PCE price index. Although this is not impossible, it is very unlikely as things stand today. And the reason has to do with, as we indicated above, the possibility for oil prices to, once again, cross the $100 dollar per barrel threshold.

The Federal Reserve’s Drive to Affect ‘Animal Spirits’

Being at the Fed is probably a very rewarding job in good times, i.e., low inflation and low unemployment, but it is probably very stressful when those two measures are not where everyone expects them to be because the Fed’s mandate states that it is responsible for both of these measures to be low at the same time, which is a very difficult feat in normal times, let along during and after a pandemic such as we experienced in 2020.

As we have said on many occasions, the Fed has a very blunt instrument to weaken economic activity, that is, interest rates. As interest rates increase, investment and those sectors that are more sensitive to interest rates, i.e., the housing market, take the lead in weakening. However, there are other sectors that are not that sensitive to interest rates but are much more sensitive to high inflation. That is the case with consumer demand, which is about 70% of the total economy.

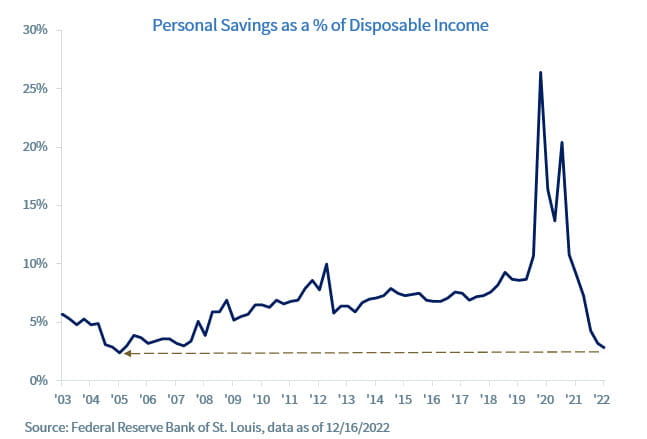

Consumer demand is very sensitive to high inflation and less sensitive to interest rates, but that doesn’t mean that it is completely immune to higher interest rates. Consumer demand depends on income and income is affected by inflation, i.e., high inflation reduces real income. That is, inflation affects the amount of goods and services we can buy with our income. But consumer demand is also affected by interest rates because, in the end, individuals decide to consume today or to consume tomorrow (i.e., save today) depending on interest rates. If interest rates on savings accounts are too low today, individuals prefer to consume today because the alternative of increasing savings is not an enticing one. However, if interest rates are high today, then they would prefer to save today and increase consumption in the future.

But just by looking at the savings rate today, it is clear that interest rates on savings are still not creating the incentives for Americans to save more today. So, what is the alternative to not saving? To continue to consume. Thus, Americans have continued to consume, even if they have to go into debt to do so.

This means that the Fed is between a rock and a hard place. It wants to slow down the economy, but the economy is not responding. The goods producing sector is weak, and that is the result of higher interest rates as well as the appreciation of the U.S. dollar. Higher interest rates have slowed the housing market while the appreciation of the U.S. dollar has started to affect exports to the rest of the world. But the goods sector is not tanking, it is, so far, slowing down. However, the service sector is still booming, and it seems it does not care about higher interest rates, at least not yet.

Today, only 16.3% of total nonfarm employment is in the goods-producing sector. This sector of employment is still not weakening even though the industrial sector has weakened over the last several months. Furthermore, the rest, that is 87.7% of nonfarm employment, is in the service sector which is still booming.

So, the only recourse the Fed has today is to ‘scare’ companies that a recession is coming so they start to dial back in terms of employment today as well as employment projections for the coming months. In ‘Fed speak’ this is what it calls ‘guidance.’ Since the Fed has no other way of pushing companies to slowdown or even shred employment, it is letting them know that it is going to be even tougher than it has been in the past in order to make companies change their expectations about the future. That is, they are trying to change expectations in order to affect what John Maynard Keynes called ‘animal spirits’

According to investopedia.com: “Animal spirits represent the emotions of confidence, hope, fear, and pessimism that can affect financial decision-making, which in turn can fuel or hamper economic growth. If spirits are low, then confidence levels will be low, which will drive down a promising market—even if the market or economy fundamentals are strong. Likewise, if spirits are high, confidence among participants in the economy will be high, and market prices will soar.”

So, this is where we are today. The Fed is trying to ‘scare the bejesus’ out of the financial markets as well as other economic actors like firms and consumers, so the economy goes into recession. However, firms, but particularly small firms, are saying: why would we not keep increasing employment if we are still understaffed for the amount of business we have today? Meanwhile, consumers argue that since interest rates on savings are so low, they will continue to consume even if they have to continue to borrow because, so far, employment is very strong, and we expect to pay back these debts in the future.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the U.S. Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

Consumer confidence index is an economic indicator published by various organizations in several countries. In simple terms, increased consumer confidence indicates economic growth in which consumers are spending money, indicating higher consumption.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation.

Leading Economic Indicators: The Conference Board Leading Economic Index is an American economic leading indicator intended to forecast future economic activity. It is calculated by The Conference Board, a non-governmental organization, which determines the value of the index from the values of ten key variables

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Geographical Revenues: Overall country-specific revenues as a percentage of total revenues from a specific index such as the S&P 500 or the STOXX Europe 600.

Source: FactSet, data as of 9/30/2022

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...

Markets & Investing April 01, 2024 Market rally driven by a broadening of the market and optimism that...

Markets & Investing April 01, 2024 Doug Drabik discusses fixed income market conditions and offers...