Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

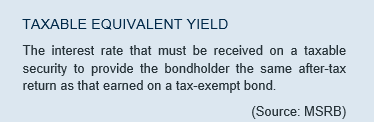

One of the major benefits of municipal bonds is that the interest earned is exempt from federal income taxes. The appeal of earning money that you do not have to pay taxes on understandably piques the interest of many investors. That being said, it doesn’t mean that every investor should seek out tax-free bonds for their portfolio. In many situations and for many investors, it makes sense to invest in a taxable product when the “take-home pay” on a bond after paying taxes exceeds what could be earned with a tax-free investment.

Generally, tax-free bonds are going to offer a lower nominal yield than comparable taxable bonds as the tax-free nature “compensates” investors, making the lower nominal yield relatively attractive on a taxable-equivalent yield basis. Deciding whether tax-free bonds or taxable bonds make the most sense depends on a range of factors including current market conditions and an investor’s personal situation (goals, risk tolerance, tax bracket, etc.). An investor’s tax bracket is a major determining factor in choosing between municipal bonds and taxable bonds. The higher the tax bracket, the more beneficial a tax-free investment. Conversely, lower tax-bracket investors receive less benefit from a tax-free investment and therefore are generally better served purchasing a higher yielding taxable product and paying their relatively low tax rate on the income earned.

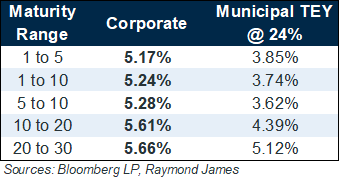

This chart shows a range of hypothetical portfolios comparing corporate bond yields versus municipal taxable equivalent yields assuming a 24% federal tax bracket. What’s shown generally would be expected: a lower tax bracket investor’s “take-home pay” will be higher with a corporate bond portfolio than it would be with a municipal bond portfolio. While these numbers show the reality of the market, sometimes investors make choices based more on emotion than math. It is fairly common for investors to seek out a tax-exempt municipal portfolio even though they are in a lower tax bracket, simply because they do not want to pay any taxes. At the end of the day, this is generally not in their best interest from a return perspective. To put it another way: would you rather make $500,000 a year and pay no taxes or make $1,000,000 a year and pay $400,000 in taxes?

Raymond James is not a tax professional and does not provide tax advice. Always consult a tax professional prior to making any investment decisions. Illustrative portfolios are hypothetical and based on index yields, not actual offerings. Index breakdown is as follows using Bloomberg BVAL index yields: Corporate Portfolio – 20% ‘A’ rated, 80% ‘BBB’ rated; Municipal Portfolio – 80% ‘AA’ rated, 20% ‘A’ rated.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing April 01, 2024 Market rally driven by a broadening of the market and optimism that...

Markets & Investing April 01, 2024 Doug Drabik discusses fixed income market conditions and offers...

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...