Chief Economist Scott Brown discusses current economic conditions.

Efforts to contain the coronavirus have had a major impact on the global economy. There is still a lot of uncertainty in the outlook, which has three elements. First, there was a sharp decline U.S. Gross Domestic Product in 2Q20. Second, there was a sharp-but-partial rebound off the lows in May. Third, improvement after the initial rebound will slow, barring a vaccine or effective treatment for COVID-19, leaving a long-lasting gap between the level of aggregate economic activity and the pre-pandemic trend. There are significant challenges in the second half of the year and the risks remain weighted predominately to the downside.

Economists are often criticized for being slow on the draw during crises. Few saw the calamity ahead of the 2007-2009 financial crisis. Economic data tend to be lagging and it often takes time to see developing strains clearly. That’s not entirely the case this time. For example, the Brookings Institution had an online conference on “COVID-19 and the Economy” on June 25 (papers here and a 7.5-hour video here). Researchers used a range of real-time indicators to look into the dynamics of the labor market and consumer spending. Many of the conclusions have been discussed in the press already and they illustrate the unusual and uneven impact of the pandemic.

About 20% of the labor force lost jobs by the end of April. Job losses were concentrated among low-wage workers: 37% of workers in the bottom 20% of the wage distribution, compared to 9% in the top 20%. In May, overall employment was about 15% below the pre-pandemic level, but 30% below for low-wage workers. In the BLS data, the drop in low-wage jobs dramatically boosted average hourly earnings. Many of the laid-off workers expected to be rehired and firms did rehire workers in May (but not fully). Lower-educated and non-white workers were more likely to be laid off – and the least likely to be rehired

Consumer spending sank sharply in March and April, but has rebounded fastest for those at the bottom of the income scale. Government programs have played a significant part. “Recovery rebate” checks and deposits went out to all workers (with individual income below $75,000 or joint income below $150,000) whether unemployed or not (also, reportedly, to a million dead people). Expanded unemployment benefits, which allowed claims for the self-employed, part-time workers, and those who had previously exhausted their regular benefits, helped to offset lost wages. Figures through early June show that about 10 million people were receiving benefits beyond the 20 million or so receiving regular state unemployment benefits. In some cases, workers are taking more per week than they did working. However, there’s no evidence that this is preventing individuals from returning to work.

It’s also clear that there are holes in the social safety net. Many at the low-end of the income scale are unbanked and missed out on the recovery rebate. Others may be unable to receive unemployment benefits or have seen delays in receiving support. Food insecurity is a significant issue. Many low-income families had relied on school lunches, which are no longer available. Food prices also rose (partly reflecting difficulties in adjusting supply chains away from restaurants and toward grocery stores). Demand at food banks is high.

Spending fell more at the upper end of the income scale, largely because these households were unable to spend. Upper-income household have more discretionary spending. Social distancing reduced their ability to travel or eat at fancy restaurants. Forced savings ought to support improvement in spending, but that depends on the degree of social distancing ahead.

In its revised World Economic Outlook, the IMF lowered its projection of global growth for 2020 to -4.7% (vs. a -3.0% projection made three months ago). The IMF expects growth to rebound in 2021, but “this would leave 2021 GDP some 6½ percentage points lower than in the pre-COVID-19 projections of January 2020.” Many economists had expected COVID-19 to be a more significant problem for developing nations, which tend to have lower capacity in healthcare and the fiscal scope to respond to an economic hit. Yet, the developed economies have fared worse. Developing countries have younger populations (17.5% of Italians are older than 70, but only 2.2% of Ethiopians), and obesity rates are lower in developing countries (36.2% of adults in the United States are obese, but only 2.1% in Vietnam). Still, emerging economies, as well as the world as a whole, will face enormous challenges in the quarters ahead.

The rise in COVID-19 cases in a number of states has renewed fears of a second wave. For the most part, states have paused their re-openings rather than locked down again. That may change. However, there is likely to be an increase in self-imposed isolation regardless of state directives. That means a more gradual pace of economic improvement – and perhaps a further decline in GDP – in the quarters ahead. Extending support for the unemployed and increasing aid for state and local government will be key.

Recent Economic Data

Real GDP fell at a 5.0% annual rate in the 3rd estimate for 1Q20, same as in the 2nd estimate, with little change in the component data. Most revisions now come in the annual benchmark adjustments, due July 30 (along with the advance estimate for 2Q20). Advance economic indicators for May, suggest that net exports and the change in inventories will both subtract from 2Q20 GDP growth.

Personal income fell 4.2% in the initial estimate for May (7.0% y/y), as transfer payments fell 17.2% (still up 67.5% y/y). Wage and salary income rose 2.7% (-5.7% y/y). Spending rose 8.2% (-9.3% y/y), up 8.1% adjusting for inflation (tracking at a 30-35% annual rate of decline in 2Q20).

Durable goods orders rose 15.8% in May, partly reflecting elevated levels of aircraft orders cancellations in March and April. Ex-transportation, orders rose 2.3%. Order for nondefense capital goods ex-aircraft rose 2.3%, suggesting that business fixed investment contracted at a much more moderate pace than consumer spending.

Existing home sales (which measure closings) fell 9.7% in May (-26.6% y/y). New home sales (which measure initial transaction and are reported with a gigantic degree of statistical uncertainty) rose 16.6% (+12.7% y/y, but down 5.6% from February).

The Chicago Fed National Activity Index, a composite of 85 economic indicators, improved to +2.61 in May. The three-month average, at -6.65, is consistent with a major recession.

Gauging the Recovery

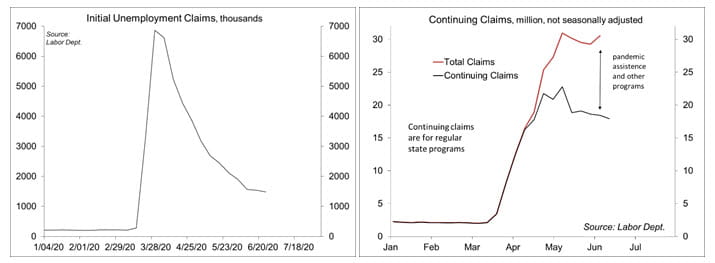

Jobless Claims fell to 1.480 million in the week ending June 20, trending down, but still very high. Continuing Claims fell by 767,000 in the week ending June 13, to 19.522 million (seasonally adjusted). The figures are for regular state unemployment insurance programs and do not include pandemic assistance and other programs. Total recipients, including all programs, were 30.554 million (not seasonally adjusted) for the week ending June 6 (up from 29.260 million in the week ending May 30). Pandemic assistance includes self-employed and part-time workers (who normally wouldn’t qualify for benefits), as well as individuals who had previously exhausted their unemployment benefits.

The New York Fed’s Weekly Economic Index rose to -7.69% for the week of June 20, down from -8.57% in the previous week and a low of -11.48% at the end of April. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

The University of Michigan’s Consumer Sentiment Index rose to 78.1 in the full-month assessment for June (the survey covered May 27 to June 22), up from 72.3 in May, but down from 78.9 at mid-month. Expectations remained weak. The report noted that “While most consumers believe that economic conditions could hardly worsen from the recent shutdown of the national economy, prospective growth in the economy is more closely tied to progress against the coronavirus.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...

Markets & Investing April 01, 2024 Market rally driven by a broadening of the market and optimism that...

Markets & Investing April 01, 2024 Doug Drabik discusses fixed income market conditions and offers...