Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Stocks and bonds perform well after the last rate hike

- The bar for cutting rates is higher than it has been in the past

- First-quarter earnings results have been better than feared

Derby Day is almost here – the fastest two minutes in sports! This weekend, 20 of the best three-year old horses will get the opportunity to win the 149th Run for the Roses. Forte is the favorite to win with 3-1 odds. However, some fans will be cheering for the underdog, hoping another longshot, like Rich Strike in 2022, will pull off another stunning upset. Picking the winner makes for interesting conversation. Some fans randomly select their choice based on a lucky number, the jockey’s silk colors, or a casual connection with the horse’s name. Others hope to gain an edge scouring the racing program for insights on the horse’s pedigree, speed ratings, race results, and performance under different track conditions. In many ways, the rigors of analyzing a horse race is comparable to investment research, where analysts and strategists meticulously review corporate reports, historical earnings, revenue trends, competition, and the macro environment (just to name a few) for insights on where the market is heading. Below we discuss the Federal Reserve, regional banks, and the key themes emerging from 1Q23 earnings season.

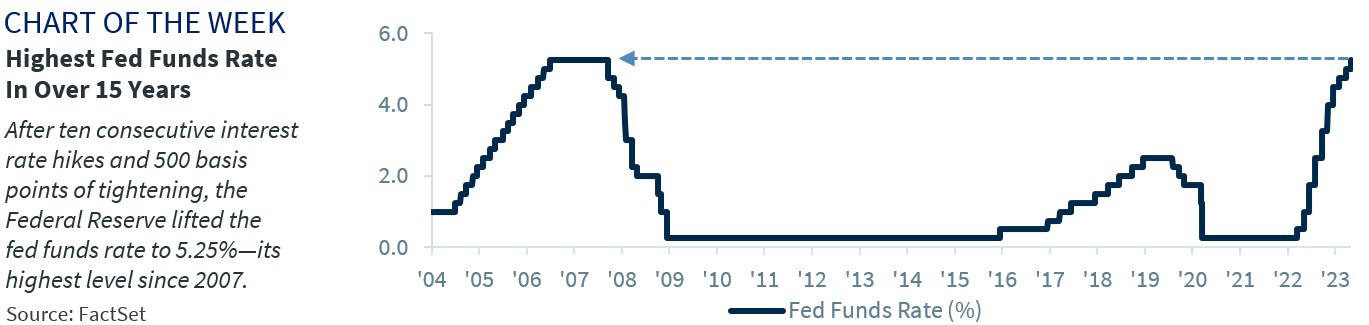

- The Fed no longer has its blinkers on | The Federal Reserve’s (Fed) unwavering commitment to curb inflationary pressures led to the fastest tightening cycle in over four decades. Cracks were bound to appear at some point as the Fed often tightens until something in the economy cracks. And an important crack emerged in early March when a trifecta of regional banks collapsed. As we have written in the past, this was a potential game changer for the Fed as it meant that it needed to tread carefully as the cumulative rate hikes were starting to cause stress in the financial system. Policymakers need to strike a delicate balance between restoring price stability while not sending the economy into a deeper than necessary contraction. While Fed officials voted to lift the fed funds rate to a target range of 5.0% to 5.25% this week, its highest level in more than 15 years, their willingness to take rate hikes off auto-pilot, albeit with a conditional disclaimer that rates could increase again if the data warrants, suggests that the end of the tightening cycle is near. And the historical record shows that both stocks and bonds perform well following the Fed’s last rate hike.

- Regional banks stocks remain off the pace | The FDIC takeover of First Republic, the second biggest bank failure ever, is a reminder that tensions in the banking system have not fully subsided. While the overall banking system remains sound and regulators have learned from past crises that swift action is needed when challenges arise, the market still can’t decide whether we’re in the backstretch or the homestretch when it comes to the recent tremors. However, the ongoing disruptions will likely influence the Fed’s decisions as it calibrates policy going forward. One dynamic the Fed will be focused on is the extent of credit tightening that is yet to be realized from the recent banking disruptions. In fact, just last month Fed Chair Jerome Powell estimated that the expected tightening would be roughly equivalent to an additional 25 basis point rate hike. The market has already concluded that the Fed will hike less than perhaps it wanted to, but the bar for cutting rates remains much higher than it has been in the past given that inflation remains well above the Fed’s 2.0% target and unemployment is still hovering near historic lows. And, with the Fed’s credibility on the line after its delayed reaction to rising price pressures after the pandemic, Powell does not want to encourage the market to price in cuts too soon and potentially risk another reacceleration in inflation down the road.

- 1Q23 earnings season is coming down the homestretch | Over 80% of S&P 500 companies have reported earnings and thus far, the results have been better than feared. Earnings growth is on pace to decline ~2% year-over-year, better than the consensus forecast of a 6% decline heading into the reporting period. While the bar may have been set low and the backdrop remains challenging, we’re optimistic about what we’re hearing from company managements. Below are some of the highlights:

- The consumer is still ‘in the money’ | Despite concerns of an impending slowdown, the consumer remains in good shape. Banks and credit card companies, such as Wells Fargo and Visa, have reported strong spending across travel and entertainment. Another bright spot came from the home builders, where D.R. Horton and Pulte highlighted improving homebuyer demand and reduced cancellations now that mortgage rates have stabilized and sticker shock from last year’s rapid increases has worn off.

- ‘Odds-on’ cost-cuts/efficiency initiatives | After last year’s dismal performance, companies like Amazon, Alphabet and Meta switched into cost-cutting (i.e., layoffs) and efficiency mode to protect their margins. Out of the gate, their stocks have been rewarded with double-digit gains YTD. The cost-cutting trend is spreading to others, like 3M, Disney, and Morgan Stanley.

- Some ‘front-runners’ have maintained pricing power | Starbucks, PepsiCo, McDonald’s and Proctor and Gamble have delivered strong earnings results this quarter. Strong brand loyalty and price inelasticity has allowed these firms to maintain pricing power in this elevated inflationary environment. Good for the company’s bottom line, but not so great news for the Fed.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...

Markets & Investing April 01, 2024 Doug Drabik discusses fixed income market conditions and offers...

Markets & Investing April 01, 2024 Market rally driven by a broadening of the market and optimism that...