Chief Economist Eugenio J. Alemán discusses current economic conditions.

Today’s consumer price index report was not a good one for Americans, for the stock market, and for the Federal Reserve (Fed). This report will increase the pressure on the Fed to do what is needed to bring inflation down at (any?) cost. However, the increase in the consumer price index (CPI) on a year-over- year basis was also accompanied by a decline in the year-over-year number for the core CPI number, that is, the number that excludes items like food and energy, which are very volatile. The core CPI number is the one that the Fed looks at closely to gauge what is happening to overall inflation and that number was just a bit better than in April.

Having said this, there is no denying that inflation has become the most pressing subject for Americans, as was shown today by the release of the June preliminary University of Michigan Consumer Sentiment number. It has also become the most pressing issue for policymakers and for the Fed.

The US has enjoyed low and relatively stable inflation for so many years that we seem to take low inflation for granted. In fact, many economists argued for many years that, because of our aging population and the slowdown in population growth, the US economy would follow the path of the Japanese economy with very low inflation and very low rates of economic growth. Many even argued that high inflation was something we would never see again.

Others argued that our rate of inflation was too low for comfort, approaching zero or even negative rates, i.e., deflation, during some periods. In fact, monetary policy over the last several decades had to be retooled for the new normal of very low inflation and very low interest rates with what has been called the ‘zero-lower-bound.’ As ex-chairman of the Federal Reserve Ben Bernanke indicated in a 2017 Brookings Institution article “…the scope for rate cuts is limited by the fact that interest rates cannot fall (much) below zero, as people always have the option of holding cash, which pays zero interest, rather than negative-yielding assets. When short-term interest rates reach zero, further monetary easing becomes difficult and may require unconventional monetary policy, such as large-scale asset purchases (quantitative easing).”

If high inflation is bad for the economy, deflation is not much better. Our policy toolbox is very apt for fighting inflation, but we are still trying to figure out what policy tools may help us from experiencing deflation. If inflation is bad for those that live on a fix income, deflation is bad for those that hold debt.

What About Stagflation?

We have also heard a lot about stagflation lately. We even heard a presumed ‘expert investor’ saying that we are in a ‘hyperinflationary’ scenario, something that is ludicrous. Talking about hyperinflation makes no sense, not only because inflation today is ‘just’ 8% but also because hyperinflation is a very particular event and the conditions for it to become a reality are such that it is almost impossible for it to happen in the US.

But what about stagflation? Stagflation is what happened during the 1970s and early 1980s. The US economy beat stagflation during the tenure of Fed Chairman Paul Volcker by raising interest rates very high and sending the US economy into a severe recession. Stagflation is the combination of stagnant economic growth plus high inflation, thus the term ‘stagflation.’ How close are we to stagflation today? Not close at all.

On this call we politely disagree with the ex-Chairman of the Federal Reserve, Ben Bernanke, who has been doing the ‘new book’ selling round and has been saying that a stagflation environment is possible. For stagflation to be an alternative, inflation needs to become entrenched.

That is, future or long-term inflationary expectations need to become unanchored. And this is not happening today. We are not saying that this may not happen in the future, but it is not true today. What we are saying is that under current conditions, stagflation is not a feasible outcome today.

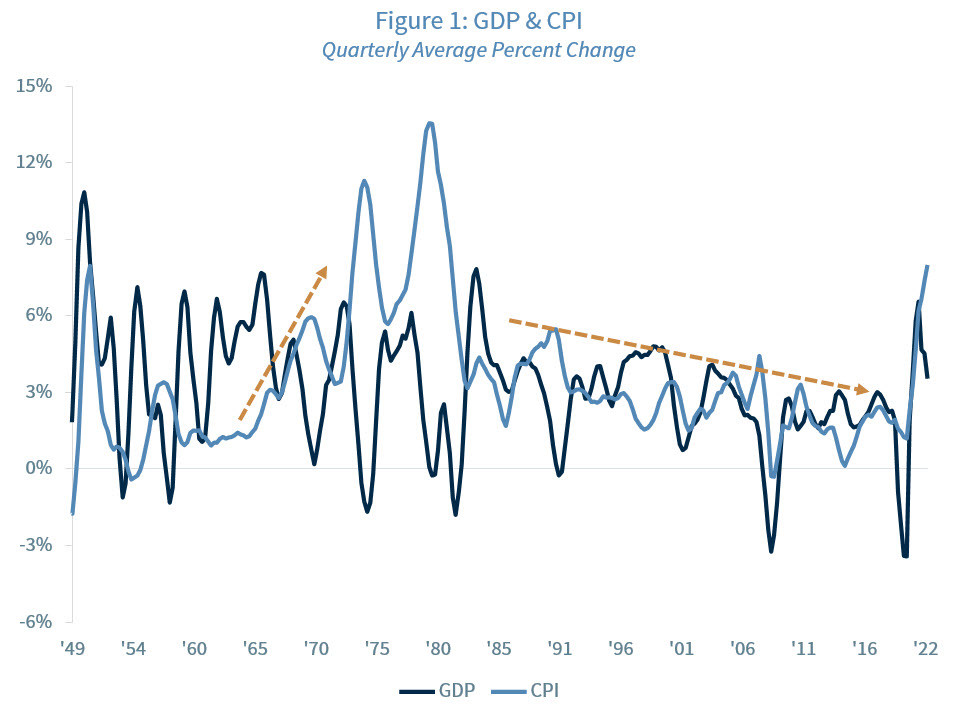

The graph above shows that before we got to stagflation in the mid-1970s, inflation had been increasing for almost ten years. This recent bout of inflation started in the second quarter of 2021, so it has only one year and change. For those that suffer inflation the most, that is, those in the lower echelons of income, (and for those of us that don’t have an electric car), it feels like an eternity. However, in economic terms, it is not that long of a period. But there are other issues at play today. First, potential economic growth back in the 1970s and 1980s was close to 4.0%. Thus, growing 1.5% to 2.0% was considered stagnant economic growth. Today’s potential output is closer to 1.5% to 2.0%, so out of the gate, the definition of stagnant economic growth becomes an issue. Today, stagnant economic growth should probably be close to 0%, that is, no growth or negative real, per capita economic growth.

Looking at the graph above, inflation is very high today because economic growth is also very high, much higher than what potential output is estimated to be today, which is closer to 1.5% to 2.0%. That wasn’t the case in the 1970s and 1980s. Inflation was rampant even though economic growth was very weak and much lower than potential output at the time. That is, for stagflation to be true we have to have high inflation with very low economic growth for a long period of time.

And, by the way, you noticed that I have not even talked about the Ukraine/Russia war and the price of food, petroleum, and gasoline, etc., yet. But yes, these issues have added to uncertainty and to the upward pressure on prices. This is clear from looking at what is happening in the rest of the world. Even Japan is experiencing accelerating inflation. The Bank of Japan has been trying to get inflation higher since the 1990s to no avail and this war has given them a triumph they seem to be trying to disown!

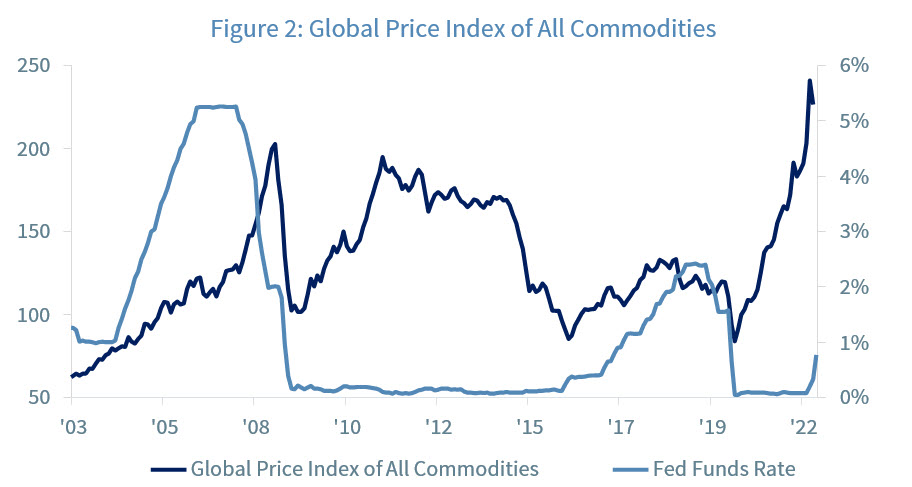

The graph above shows the evolution of commodity prices over the years, and we can see that the current increase in commodity prices is not related to US monetary policy but to overall world supply-demand imbalances, something neither the US Federal Reserve nor the US political administration has control over. Of course, we could argue that if the central banks of the world increase interest rates at the same time and to very high levels they could generate a global recession. Then, global commodity prices would certainly come down to earth. But such an event requires conditions that are even more difficult to attain than the conditions needed for the US economy to enter into stagflation.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the US Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Consumer Sentiment is a consumer confidence index published monthly by the University of Michigan. The index is normalized to have a value of 100 in the first quarter of 1966. Each month at least 500 telephone interviews are conducted of a contiguous United States sample.

The producer price index is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

Industrial production: Industrial and production engineering is a measure of output of the industrial sector of the economy. The industrial sector includes manufacturing, mining, and utilities.

Personal Consumption Expenditures Price Index (PCE): The PCE is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

FHFA house price index is a quarterly index that measures average changes in housing prices based on sales or refinancing’s of single-family homes whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac.

Consumer confidence index is an economic indicator published by various organizations in several countries. In simple terms, increased consumer confidence indicates economic growth in which consumers are spending money, indicating higher consumption.

ISM Manufacturing indexes are economic indicators derived from monthly surveys of private sector companies.

ISM Services Index is an economic index based on surveys of more than 400 non-manufacturing (or services) firms’ purchasing and supply executives.

Non-Manufacturing Business Activity Index is a seasonally adjusted index released by the Institute for Supply Management measuring business activity and conditions in the United States service economy as part of the Non-Manufacturing ISM Report on Business.

New orders index measures the value of the orders received in the course of the month by French companies with over 20 employees in the manufacturing industries working on orders.

Source: FactSet, data as of 6/3/2022

Markets & Investing April 01, 2024 Market rally driven by a broadening of the market and optimism that...

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...

Markets & Investing April 01, 2024 Doug Drabik discusses fixed income market conditions and offers...