Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Markets can present challenges for investors as volatility, direction, supply, outside influences and future expectations are continuously changing. In addition, investors present a myriad of needs and goals. What should remain constant is that investors seek to optimize their return within their own risk profile regardless of what current market conditions are present when investing.

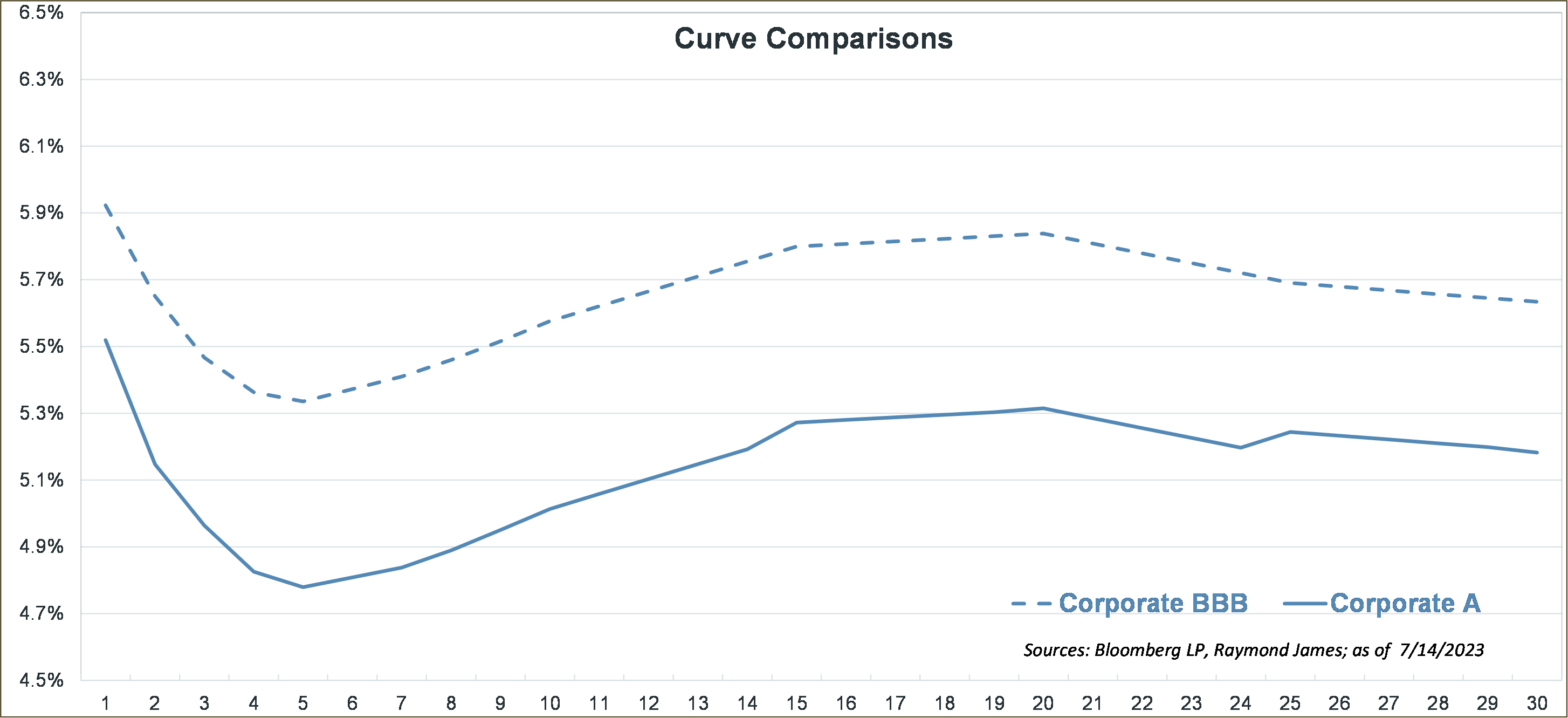

What is capturing investor attention is that yields are at levels not seen in well over a decade. The investment-grade corporate yield curve, albeit fairly flat, is elevated to all other high quality curves in the short to intermediate maturity range appealing to investors in all tax brackets. The municipal curve displays the greatest upward slope providing a better risk-reward payoff on the long end of the curve (12-30 year maturities). These two curves provide plenty of opportunity for investors with varying maturity needs. In order to present more bite-size portions of data, this week’s commentary focus is on the corporate sector. Stay tuned next week for the municipal sector focus.

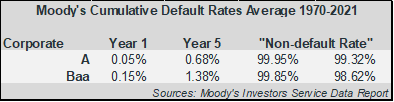

Many investors seek opportunities within the investment-grade corporate space in part because of the available yields in the short and intermediate maturities. Where to focus may be simplified with the help of two sets of data. First and foremost is credit security. The investment-grade space (both A and Baa) boasts high credit merit as displayed in the chart. It is important to note that this excellent quality is mutual for both A-rated and Baa-rated corporate bonds. However, recognizing the moderate differences matters when considering the following second set of data. (Note that past performance is not a guarantee of future results.)

Note the current superior yields associated with Baa-rated (dotted curve) versus A-rated (solid line) corporate bonds. It’s that simple. There is a marginal difference between the credit values yet a significant difference in attainable yields. If your risk profile calls for investment-grade quality, consider the notable income advantage offered in the Baa corporate space.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Markets & Investing April 01, 2024 Market rally driven by a broadening of the market and optimism that...

Markets & Investing April 01, 2024 Doug Drabik discusses fixed income market conditions and offers...

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...