February 1, 2021

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Growth assets are allocated to growth oriented products in order to provide growth.

Principal preservation assets are allocated to products that preserve principal in order to preserve principal.

Yes, I am aware that those two statements likely did not provide you with any new information, but when it seems like so much recent market commentary is trying to pull us off track, sometimes it helps to remind ourselves of the fundamentals of investing, including asset allocation. Yes, yields are low right now. Yes, equities might offer more potential upside. No, that isn’t a good justification to abandoned fixed income in search of higher returns. Equities have almost always offered more potential upside but they also offer more potential downside. More risk = more reward… this isn’t anything new but unfortunately, many investors are allowing low interest rates to push them into taking on more risk.

Never lose sight of why each dollar that you have invested has been allocated to a specific product and remember why certain products fall into each respective category (principal growth or principal preservation). It is becoming all too common of a theme for investors to shift money that is intended to preserve their hard-earned capital into growth-oriented products. This is usually justified because “rates are too low” and “I need to earn more.” Both of these justifications lose sight of what you need out of your wealth-preservation assets and set you up for a potentially very painful wake-up call.

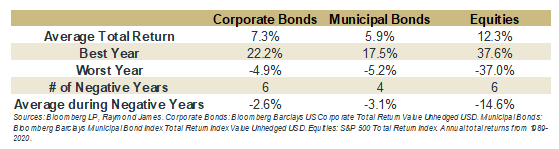

As a reminder as to why fixed income is typically the go-to asset class for capital preservation, take a look at the statistics below, which summarizes the annual total returns for equities, corporate bonds, and municipal bonds since 1989 (as far back as data is available for all three indexes).

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

The moral of the story over the past 30 years has been that when equities have a bad year, they can have a very bad year (an average return of -14.6% in down years), while when bonds have a bad year, things haven’t been nearly as bad (-2.6% and -3.1% on average for corporate bonds and municipal bonds, respectively). Historical performance is not a guarantee of future performance, but fixed income has historically preserved principal in tough times more effectively than equities. This is why assets intended to preserve principal are generally allocated into fixed income. Don’t let the market push you into taking on more risk and potentially derailing long-term wealth accumulation. Pouring “fixed income dollars” into dividend paying stocks, REITs, or other income producing products works until it doesn’t. In doing this, you are potentially sacrificing your primary goal of preserving principal in an attempt to chase a secondary goal of total returns. Stick with your long term asset allocation plan, it’s there for a reason.

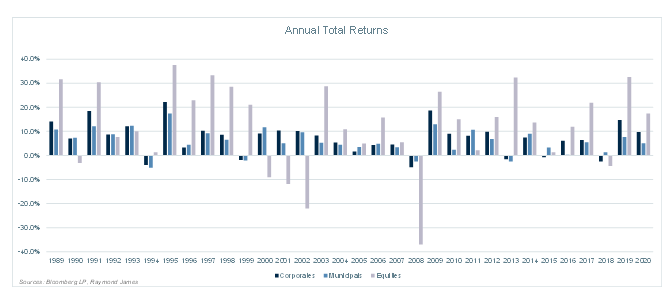

For a visual representation, here is a year-by-year breakdown of total returns for each asset class.

Click here to enlarge

Sources: TradeWeb Direct, Raymond James.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Markets & Investing April 01, 2024 Raymond James CIO Larry Adam reminds investors they need to be well...

Markets & Investing April 01, 2024 Market rally driven by a broadening of the market and optimism that...

Markets & Investing April 01, 2024 Doug Drabik discusses fixed income market conditions and offers...